Are impulse purchases dead online?

As online grocery retailing has grown over the years, there has been a constant discussion about the future of the impulse purchases. The traditional grocery store has been argued to be a superior place to drive impulse purchases, ie. purchases that the customer might not buy otherwise. Impulse purchases refer especially to candies and snacks.

Online share of sales for these products has traditionally thought to have been lower than in the stores.

Why are impulse purchases smaller online?

Copyright: K-Supermarket Lasihytti

Impulse products have best in-store placements

Firstly, part of the reason why the store is such a great way to drive impulse purchases is the fact that the impulse products have been given so much space in the stores. And not just any space, but the prime space of end caps and other valuable locations inside the store.

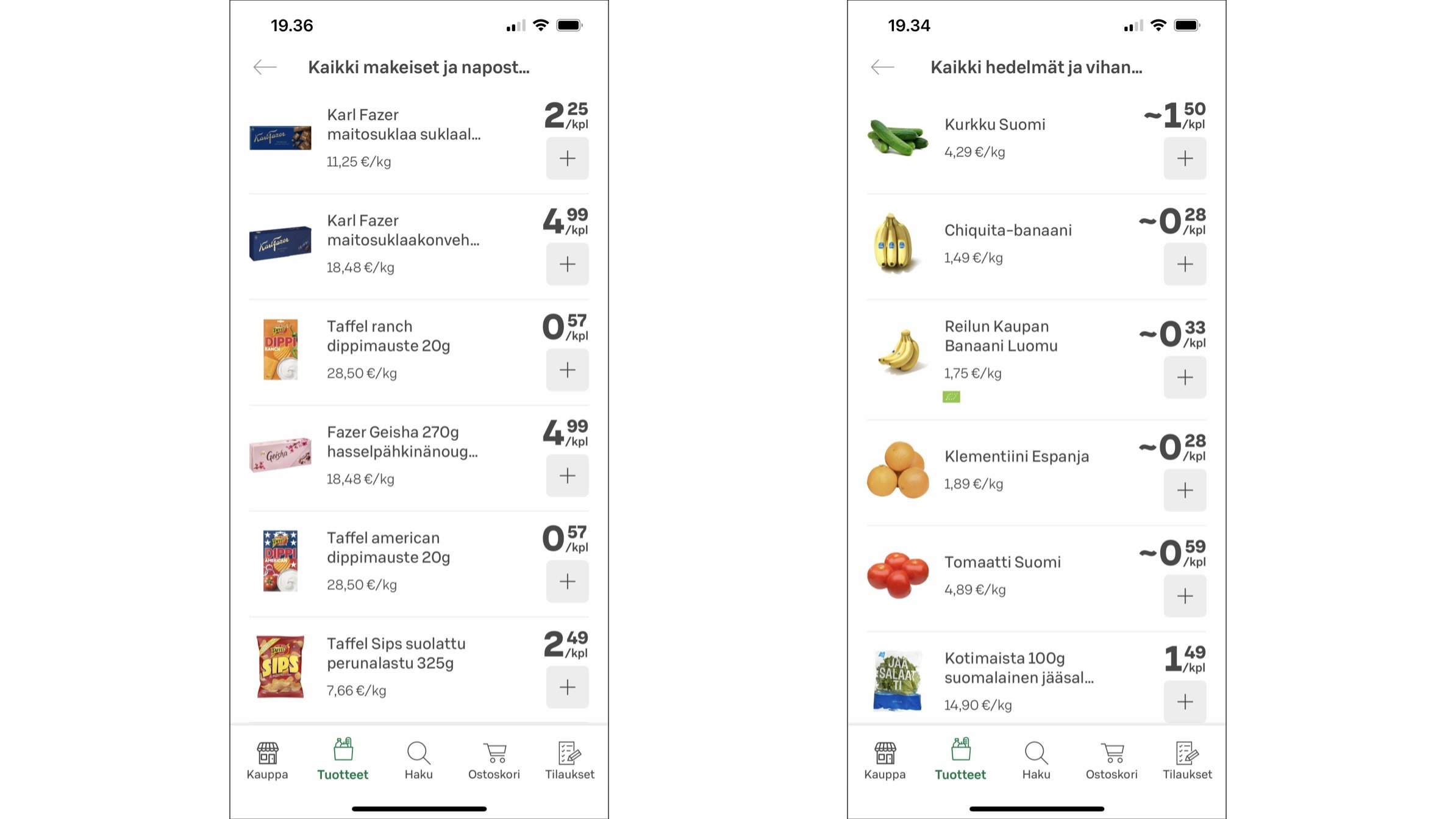

For online the impulse products are normally somewhere in the middle or bottom of the category tree. No wonder people are not buying them.

According to the book “Inside the Mind of the Shopper” by Herb Sorensen, about 30% of the offline grocery purchase decisions are made inside the stores. Rather often customers are hungry and in a hurry. That lends itself nicely to fall for the temptation of the snacks and candies. The more the retailers push for these impulse products in the best locations, the more they will be sold. By its nature online buying seems to be a bit different.

Online impulse products are at the bottom of the category hierarchy

If the impulse products would get similarly prime locations in the online store as they get in the physical stores, the sales would probably look rather different. Additionally, online seems to be more functional channel than the stores. As the name of the category, impulse, implies, they are not bought as planned purchases. Online seems to have more planned purchases than the stores.

The differences of the online channel

Firstly, the space that the retailer has to showcase the assortment is a small screen on a laptop, let alone on a smartphone. Customer can see only a handful of products at a time.

As online is very much about saving time, the sessions for online grocery are probably rather short. Thus, the customer does not have a lot of options when they choose what to buy. Also the search bar makes finding the right product a lot easier. In the stores customers need to walk from one product to the other and are thus exposed to numerous impulse products along the way.

For online customer behaviour, customers don’t need to go around the store (and get exposed to all products) to get milk.

There is hope

Is online so bad after all?

There is more talk than data about the real difference between the in-store purchases and online purchases of impulse products. However, we have received some data about the role of impulse products online and offline. Two sources have been kind enough to provide us with data. We are truly grateful for retailer Hannu Aaltonen in K-Citymarket Kupittaa as well as Oda Norway for providing the numbers.

In the second biggest hypermarket in Finland (Kupittaa) candy & snacks products do have higher share of sales in the store than in online (5,5% vs 4,1%). However, the difference is smaller than one might have expected. On the other hand, pure play online grocer Oda has a surprisingly high share of sales coming from candies & snacks. For ice-cream the share is almost same for online and offline.

Sources: K-Citymarket Kupittaa & Oda

These are naturally only two cases, which might not represent the industry in general. However, they are showing some kind of indication that impulse products are not necessarily performing as poorly as one might expect from the media discussions around the topic.

Quick commerce is a channel for impulses

Quick commerce has risen quickly as an additional channel of online grocery retailing. With the fast deliveries and small, convince store typed, assortments, quick commerce sector has been seen as having great potential for the sale of the impulse products.

Some studies have shown that customers would be ordering more impulse products from these retailers. In the Netherlands one survey found that snacks, soft drinks, juices, coffee & tea as well as fruits and vegetables were the best selling categories.

Quick commerce company GoPuff has also published their best selling products in some cities. The lists include a lot of snacks as well as alcohol drinks. Rather traditional convenience store products.

European quick commerce and restaurant delivery company Foodora published their top 10 products in their Foodora markets in Finland. The list includes traditional top-selling grocery store products like cucumber, banana, soft drink, milk…

How about Quick commerce assortments?

Another approach is to look at the assortments of different kinds of retailers. Do the Quick commerce retailers focus more in the impulse categories in their assortment?

For this very interesting question data was kindly provided by Nousua Oy (www.nousua.fi).

Source: Nousua Oy & Oda

As one can see from the figure above, impulse products do play a significantly bigger role in the assortment of a quick commerce company. K-Citymarket Kupittaa seems to have a very big portion of its huge assortment dedicated to impulse products. One could imagine that Prisma Kannelmäki would represent a more normal share of assortment for a hypermarket.

Online changes the context of buying groceries

We all have impulses that arise throughout the day. One big source of impulses are ads we see in the internet and the physical world around us.

For physical stores, the impulses are materialised only in the store.

As the name of the category, impulse, implies, social media or print ads are not very effective in driving behaviour hours or days later in the grocery store.

However, for online the impulses generated by ads could be caught immediately as they arise. Therefore, the nature of impulses change when customers start buying online.

For online, impulses are not only something that arise and are caught while customer is “in the store”. They can be added to basket anywhere and anytime.

The best online grocers are available to catch the impulses immediately as they arise.

Buying groceries, online or offline, is normally seen as a one-off event, which is done in one go (online session or visit to a store).

One needs to start thinking differently about online grocery buying. Instead of the one session phenomenon to a more holistic buying experience that ideally starts when the previous order is placed and ends when the next order is placed. Throughout this time customers can fill in the baskets with all manner of products.

One retailer who clearly has figured this out is Oda from Norway. Their “Sånn” (“just like that”) ad campaign emphasised this aspect. The ads feature every day occasions where customers add products to their online baskets throughout the week. This makes the buying experience very easy and effortless.

The impulses initiated by physical or social media ads can de added to the online basket immediately.

This changes the way impulse purchasing should be viewed.

What kinds of actions are you doing to get hold of all occasions where impulses arise?