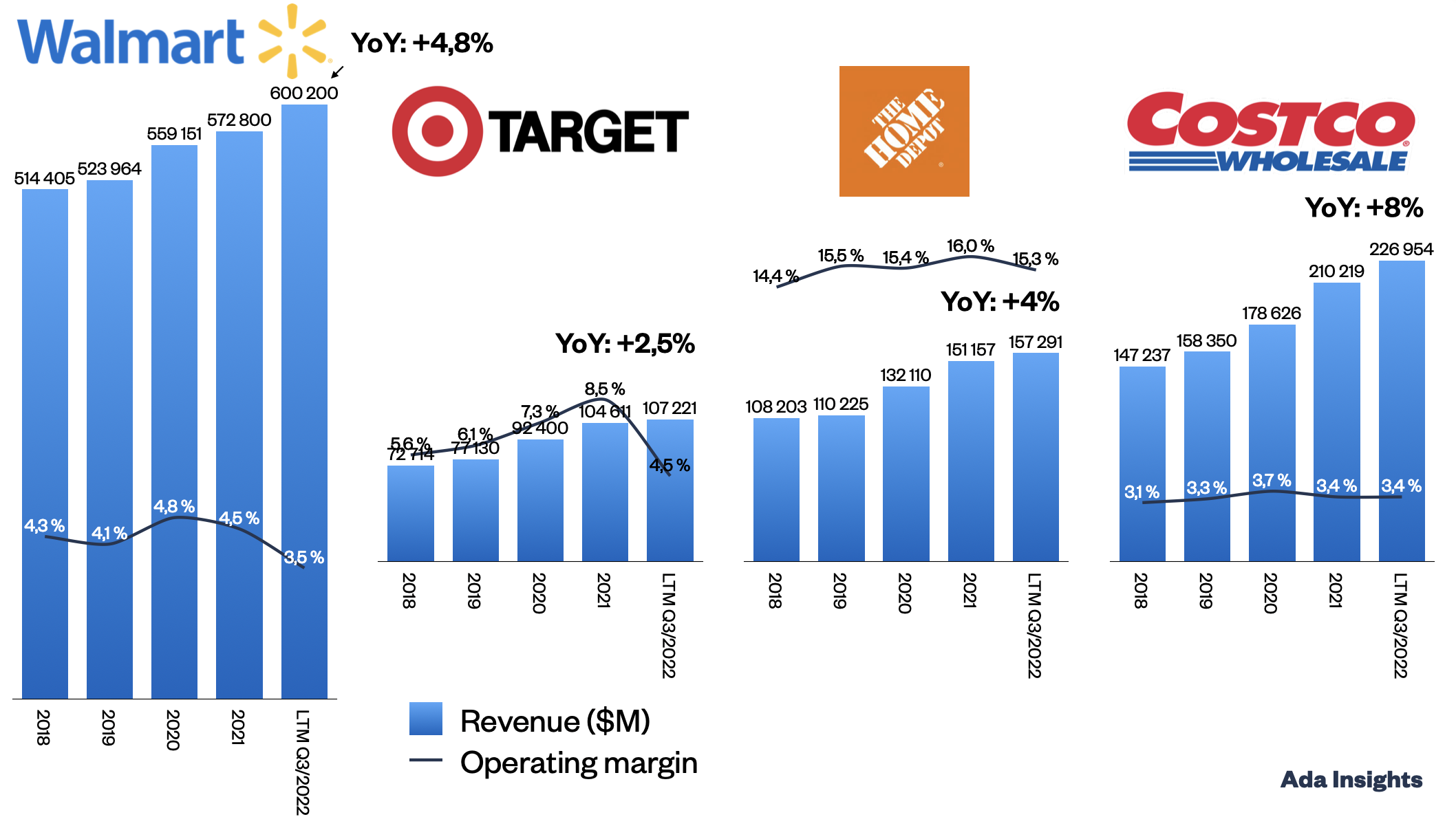

US giants growing with mixed results

During the last few days, Walmart, Target & Home Depot have reported Q3/2022 results. All the companies could report robust results after some unprecedented times. However, the giants had some differences in their reporting.

Walmart reported the strongest quarterly growth figures with 8,8% growth. The growth can be put into perspective when looking at Walmart’s pure size. In the third quarter alone, Walmart added a whopping $12 billion in new revenue into the business! That would be a decently sized grocer in Europe. An interesting detail in the Walmart report was the acceleration of e-commerce growth, which was +16%. Online constituted 12% of the total of total revenue for Walmart US.

Target, on the other hand, grew only slightly: +3,3%. The company was one of the biggest winners of the pandemic but had struggled to match that growth for the last four quarters. Target’s Operating margin for the Last Twelve Months (LTM) has declined rapidly from the 2021 numbers. The decline in profitability is mainly due to the high inventories the company has been struggling. Target decided to get rid of the inventory quickly, which pushed the company's profitability down for Q2/2022. For the third quarter, the profitability started to improve as the Operating margin tripled from 1,3% to 3,9%.

Like Target, Home Depot was one of the biggest benefactors of the pandemic. However, after the 20-30% growth quarters in 2020 & 2021, Home Depot has been by single digits for the last four quarters. Despite that (and growing inventories), the company has maintained healthy profitability of 15+% operating margins.

The last of the big four, Costco, has not yet reported results for this third quarter of the year. However, until Q2/2022, Costco had been performing robustly. It remains to be seen whether the company can maintain that. According to the monthly sales reports, Costco has also maintained its sales momentum during the third quarter.