How Finnish retailers managed 2021?

For big Finnish retailers year 2021 had two distinct parts. First part of the year was characterised by the pandemic lockdowns, whereas the second part was characterised by less restrictions and tougher comparison numbers from extraordinary 2020.

On a yearly level many pandemic winners did perform well in 2021. This was a result of the unprecedented nature of the pandemic ridden first quarter of 2021. However, the second part of the year was marked by slowing growth.

On the other hand, the image gets a bit different when one looks at the smaller retailers.

The flourishing categories

One could say that the biggest winners of the pandemic era retailing in Finland were the big retailers who sold big variety of products. Especially food, home and pet categories were flying off the shelves. They have also been surprisingly resilient to declines in the face of severe comparison numbers during the second part of the year.

All of the big retailers had a good year in 2021.

However, especially good 2021 was for the DIY retailer K-Rauta, which had strong growth during all of the four quarters of the year.

Electronics and general merchandise retailer Verkkokauppa.com had a solid first three quarters of the year, but surprisingly it plunged into decline during the last quarter.

The two big success stories of the early pandemic times, food and discounting (Tokmanni), had a strong start to the year. However, both saw decreasing growth figures during the second half of 2021.

One has to note that K-Citymarket, Prisma and Tokmanni were growing on top of exceptionally high growth figures from 2020.

Food as a unique category

One should also keep in mind that food is a different kind of category to any other retail category. Firstly, food is a massive category with roughly 40% of all retail sales in Finland. The massive size leads to generally low growth percentages.

Single digit percentages in grocery mean tens of millions in absolute growth.

Thus, it is fair to say that the 10-15% jumps in grocery revenues during the pandemic are a huge outlier in the normal behaviour of grocery retailing.

During the second part of 2021 grocery retailing returned back to more normal levels of revenue.

It is important to note that the big grocery retailers have been able to maintain the very hightened sales levels.

Same applies to Tokmanni, which has also been hugely successful during the most severe times of the pandemic. It can be seen as a great result that the company has been able to maintain the new level of sales.

Price becoming more important in grocery?

As the grocery industry’s growth has normalised, the competitive dynamics of the market seems to be changing. As the K-Citymarkets were the clear market winners during the early pandemics during 2020, they have been losing to the market after the Q1/2021.

That seems to indicate that the price leadership of Prisma have become more important. An additional reason for the changing success of Prisma is the new and improved online service launched during the latter part of 2021.

It will be very interesting to see how these giants can sustain the "new normal" levels after the pandemic during 2022.

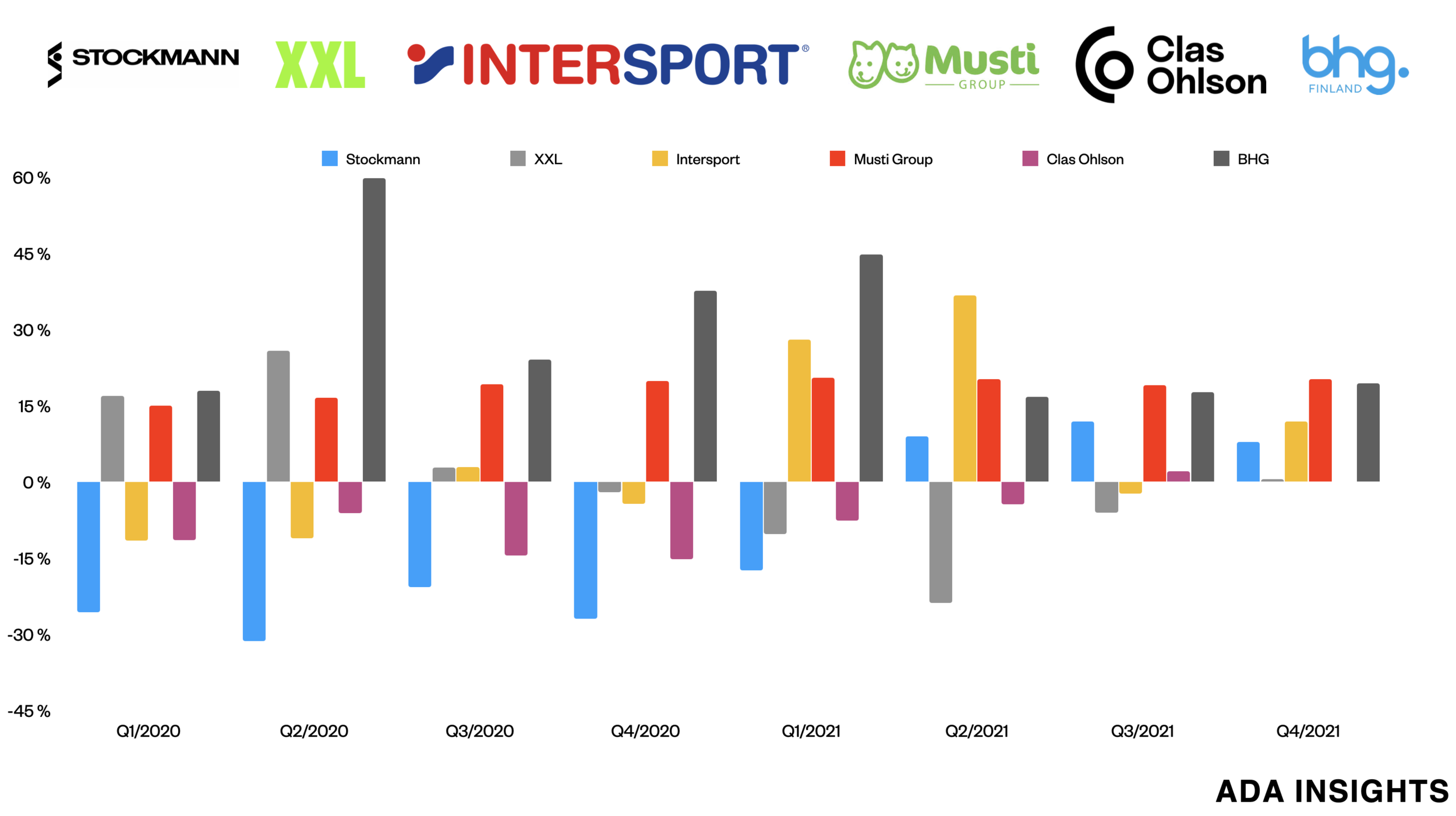

Smaller retailers with big variance in sales

Smaller retailers in Finland have had much more volatile times during the last two years. Some retailers and categories saw huge drops in revenue as a result of the pandemic. That was followed by big increases in revenue during the latter part of 2021.

On the other hand some saw big revenue increases early on and have struggled to maintain that in 2021. And then there is Musti Group and BHG Group, which both grew steadily throughout the last two years.

BHG Group had a staggering revenue growth during 2020, but was also able to grow between 15-20% throughout the 2021.

The combined growth of DIY category and online channel propelled BHG Finland to 21% growth in 2021 (after a 36% growth in 2020).

Fashion and accessories saw a severe decline in 2021. Stockmann is an example of that. As they have narrowed down their assortment, they have move away from the generalist nature of the big retailers illustrated above. That focus made them much more vulnerable for big changes in the clothing retail market.

For the sports and outdoor category the last two years provide an interesting competitive dynamic between the two giants XXL and Intersport. Early part of the pandemic was driven by the success of XXL, which grew rapidly during the early part of 2020. However, since the Q4/2020 XXL has been struggling to sustain the pandemic growth.

As XXL has declined, it's main competitor Intersport managed to turn to growth. Subsequently Intersport has grown in 2021 (except Q3).

And the growth came from...

To summarise the above description of some of the main players in the Finnish retail market, one could say that online capabilities have turned out to be important during the last two years. BHG Group, Verkkokauppa.com, Musti Group (~20% of sales) and also hypermarkets relied a lot on their online channels to drive growth. BHG Group is a great case in point for the potential of online.

Despite the strong growth of K-Rauta on the back of strong DIY category growth, BHG Group grew significantly faster during each quarter.

Another strong reminder about success in retailing is the importance of broad range of assortment. All of the successful big retailers (Tokmanni, K-Rauta, hypermarkets, Verkkokauppa.com) did not rely too much on one category for their success.

On the other hand, Stockmann suffered significantly badly, because it relied very much on the fashion & apparel category. Fashion turned out to be one of the most severely hit categories during the pandemic.