Instacart, part 2: the other side of the coin

The previous blog post covered the Instacart S1 filing. The filing included a lot of interesting details about the Instacart business. As much as the S1 provides information about the Instacart business, it does not offer much information about some aspects of the business. There are some big questions regarding the Instacart model in the future. This influences whether Instacart can maintain its success.

Efficiency of the overall online grocery value chain

With the limited information about the overall efficiency, it is difficult to compare the Instacart ecosystem to the competing online grocery operations. Operations such as Ocado, Oda, or Picnic have been built from the ground up with the overall picking and delivery efficiency in mind. Instacart model, on the other hand, relies on the existing store infrastructure. Traditionally, stores have been a more cost-efficient model to start online grocery operations, but much less efficient in terms of the overall process.

There is little information on how efficient the Instacart model is.

From the perspective of Instacart, the overall efficiency is not financially as relevant for the company as the transactions. One could say that the picking and delivery are secondary. They are outsourced to a third-party Shopper.

The efficiency naturally influences the overall customer experience and thus is important for the company’s longer-term success. As the online grocery market matures, the poor efficiencies will eventually become an issue.

The gig-economy model

The other unanswered question relates to the Instacart Shoppers. As mentioned earlier, there has been a lot of debate around how much the gig economy workers are paid. Instacart, unfortunately, does not offer much information around this question.

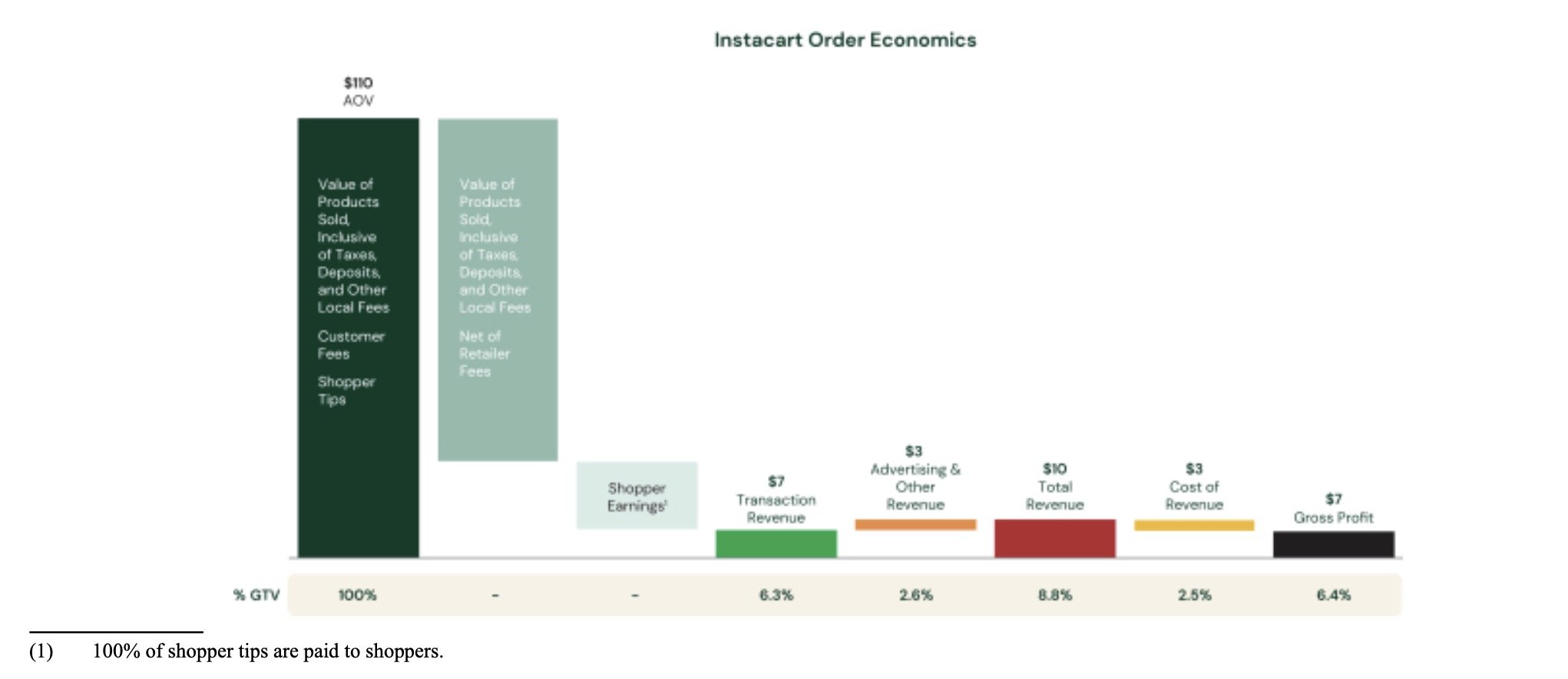

In 2022, the Shopper earnings (excluding tips) represented 8,2 % of the overall GTV of Instacart. This amounted to $2,36 billion for the approximately 600,000 Instacart Shoppers. This would generate a bit less than $4 000 for each Shopper. This amount naturally differs significantly between active and occasional Shoppers.

Image source: Instacart

The competition

The breakdown of the Instacart Order Economics provides some interesting information. According to the company, Instacart takes an 11,4 % stake from the order. The rest of the 88,6 % is divided between the Shopper and the Retailer.

When one considers the low gross margins of the grocery industry, either the Shopper or the Retailer will be left with a thin slice of the overall pie. If one considers the Instacart statement that 8,2% of overall GTV would go to the Shopper, the retailer would be left with 80% of the GTV. In other words, Instacart and the Shopper would take 20% of the Average order.

When one considers that the average gross margin of a grocery retailer is between 20 % and 30 % (without online), there is not much left for the grocer.

This leaves the grocer with two options: either to be happy with the limited profitability or increase the prices on Instacart to improve the overall gross margins.

This tension in profits is one major reason why the grocers will be interested in building their own online channel as the online channel grows enough.