Review of 2021 in retailing

Year 2021 started with hope towards vaccinations. There was hope about a potential recovery from the very strange and difficult 2020. This year did turn out different from 2020. However, as we approach the new year, there are dark clouds gathering in the horizon.

I have highlighted five big themes that I found significant and interesting during this year. This is not an all-encompassing list of most relevant things in the industry. I have left out some very important themes and companies.

Some of these include the rise of Shein. The secretive fast fashion retailer really broke through to wider awareness during 2021. However, there is scarcely data about the to properly figure out the scale of the company. It is clear that Shein has grown fast and is already a big, if not the biggest, fashion and apparel retailer. Hopefully, the rumoured IPO will happen in 2022 and we would have more information about the company.

Of the companies benefiting most from the pandemic, some failed to maintain the heightened levels of revenue (Peloton), but some were able to continue from the new and higher level of revenue. Some of the best performing of these companies were HelloFresh, Zalando and Shopify. They are all important and interesting part of the 2021 retail scene.

New normal: online & stores succeeding

The first big theme I would like to highlight is the unprecedented recovery of the bricks and mortar retailers. After a really tough pandemic year, many pundits started talking about a “new normal” with online having a completely new role. Some even argued that companies would not be able to be successful without a successful online store.

Online provide lots of benefits, but there are still many retailers that succeed very well with limited or no online channel. Online retailing did do well in 2021. Despite the 31% growth in 2020, online managed to remain above the 2020 numbers during this year. In total online has remained 30 to 45 % higher compared to pre-pandemic levels of revenue in 2019.

ECommerce was 12,4% of all retailing in the third quarter of 2021, down from the highs of 14,7% in Q2/2021. After plateauing from the pandemic high, eCommerce is now back to a similar growth trajectory that it was on before the pandemic.

Where online flourished in 2020, stores struggled. However, 2021 was a spectacular year for store based retailers. Stores saw huge sales growth this year. Traditionally Christmas has been by far the biggest month of the year and that level is achieved only during the next year’s holiday season.

This year store based retailers have seen higher levels of sales compared to previous Christmas for seven months. Even the worst hit sectors such as Clothing stores and Department stores along with restaurants have all been able to grow above the pre-pandemic levels.

Stores are on track to grow almost 20% (19% for first eleven months). That would clearly be biggest annual growth since the Census retail monthly data has been collected. Previous record was 9,9% in 1999.

Finland: big grocers battling it out

The giant news of the year in the Finnish retail sector was clearly the acquisition of Wolt by Doordash for a whopping $7 billion.

Besides that news story a lot of things happened in the industry. Probably the most significant development of the year was the “revenge” of the S-Group. After a year of losing market share, S-Group seems to have managed to gain some market share back from Kesko, offline and online.

This success seems to arise from two main sources.

In the online channel S-Group started rolling out more Prisma stores to compete with the Citymarket stores operating in Kesko’s K-ruoka.if store. Prisma is after all the most dominant grocery brand for families with children, the most important customer segment for online grocery.

This has enabled S-Group to grow faster than Kesko. During the first three quarters of the year Kesko was able to grow its online business by about 25%. S-Group on the other hand seems to have grown significantly faster as the two companies are said to have similar levels of revenue for the 2021 after three quarters. Last year Kesko was about 30% bigger online than S-Group.

For the offline part of the grocery business, the changes are smaller, but more significant in terms of absolute monetary values. Kesko has been slightly trailing the market in terms of growth this year. On the other hand, S-Group has outpaced the market growth, even though very slightly.

Where is the renewed strength of S-Group coming?

Long due refreshment of the stores. In spring of 2020 S-Group vowed to renew all S-Market stores in two years. S-Market stores had been neglected for a long time after the big price reduction campaigns that were driven by the hypermarket chain Prisma.

Renewal of 300 stores in two years is a giant feat when considering that S-Market is Finland’s biggest grocery chain. These renewals have improved sales this year and will keep on improving also during the next year.

For the last three years Kesko has managed to grow market share for about 1,1%-points. This was after a “lost decade” of 2010 during which Kesko lost market share for almost every year.

Now it seems that the market share growth is stalling. For the first ten months of the year, Kesko has grown faster than the market only during three months.

Kesko has traditionally grown when the economy is good and struggled when the times are tougher. This time is no exception. As Kesko has grown, the stores have become ever fancier. One has to wonder if there is a kind of boom time in grocery in Finland

As the inflationary pressures arise, one has to wonder when price starts to become more important. For several years price comparisons and discussion around the price of grocery products has been missing from the public discussion.

That seems to have happened in Sweden already.

Sweden: price competition heating up

The big news in Sweden this year was the announcement that ICA traders are going to take the grocery giant private.

During the year the traders became frustrated with the way ICA was managed. This probably boils down to two topics: online and price competition.

The current management of ICA has invested heavily for the online channel. The decision to transition the online operations and systems to the Ocado Smart Platform was an investment decision worth 100 M€.

Online investments are focused mainly towards two big urban regions: Stockholm and Gothenburg. These are regions where ICA’s market share is not traditionally as strong as it is in less urban areas, such as northern Sweden.

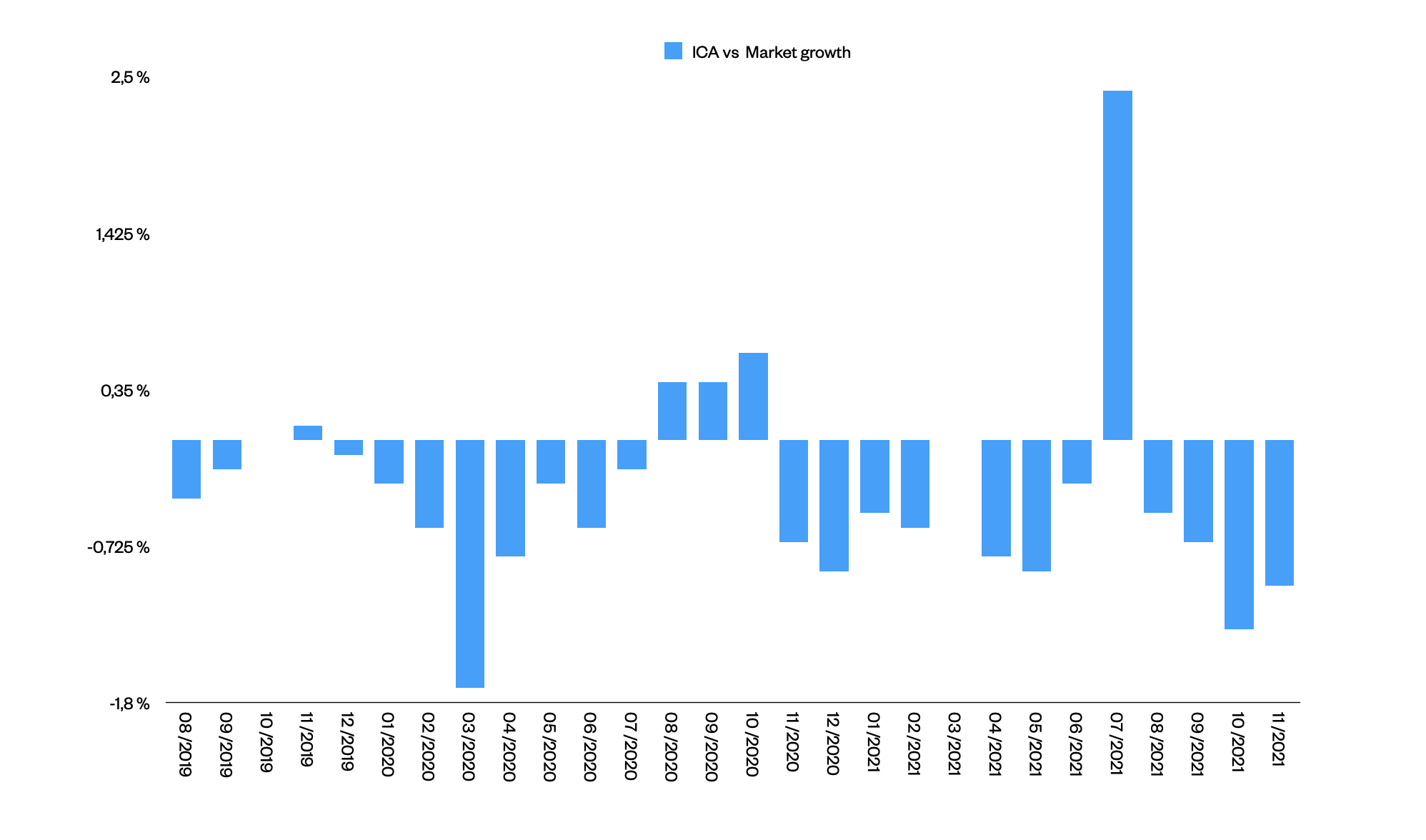

At these same time with the huge online investments, Axfood's price driven chain Willy's has been growing and stealing market share from ICA. Besides the growth of Willy's, ICA has been losing market share throughout 2021. Only once during the year has ICA grown faster than the market.

Besides the grocery news, another major news was the launch of Amazon Prime in Sweden. However, Amazon and Prime are not such a big news for the 2021 as they are a major event for the next year. Therefore, it will be covered more in the Expectations post.

Quick commerce grew rapidly

Source: sifted.eu

Internationally one of the biggest outcomes of the pandemic has been the growth of the online grocery channel throughout the western world. Within onlien grocery the biggest advances have happened in the quick commerce sector. A channel that barely existed prior to the pandemic.

With the rise of GoPuff, Gorillas, Getir and others, the investments have been pouring into the sector. Some of the companies have been set up only during the pandemic.

The fast customer adoption of the fast grocery deliveries has put pressure on the "incumbent" grocery delivery players to come up with faster deliveries. This has led the on-demand delivery companies such as Doordash and Uber to develop new kinds of models. The delivery in up to 10 or 15 minutes puts new kinds of pressures for the traditional gig worker model of the on-demand players. Many of the quick commerce players rely on employed workers to do the deliveries. For example Doordash has changed their operating model in the quick delivery services from gig workers to employed workers.

Amazon: new era(s) for the online giant

2021 was a tumultous year for Amazon also. The ecommerce behemoth was one of the biggest winners of the pandemic era and has been able to sustain the incredible revenue gains achieved during last year.

Despite that, the biggest event for Amazon was the leadership transition that occured in July. After almost 30 years in the helm, Jeff Bezos stepped down and Andy Jassy became the CEO. The change did not have any drama associated. Despite that, it still marks a significant turning point for the company. Mr. Bezos is well known for his notorious attention to detail and micro management of many key projects.

Besides this more administrative change, Amazon also kept on changing as a company. It has been acknowledged for a long time that Amazon has transitioned from a retail company selling their own inventory to a service company that provides infrastructure for anyone selling online.

During the third quarter of this year for the first time Amazon got more revenue from services than from selling products. This is especially a result of their major investments in logistics as well as in the success of the advertising platform.