Rusta - another discounter with strong and profitable growth

The Nordic discount chain Rusta reported its first quarterly earnings after the IPO on 19.10.2023. The company reported strong growth of 14,4% across the four operating markets. The Like-for-Like growth was very strong at +10,8%. A strong value proposition and some new stores drove the growth.

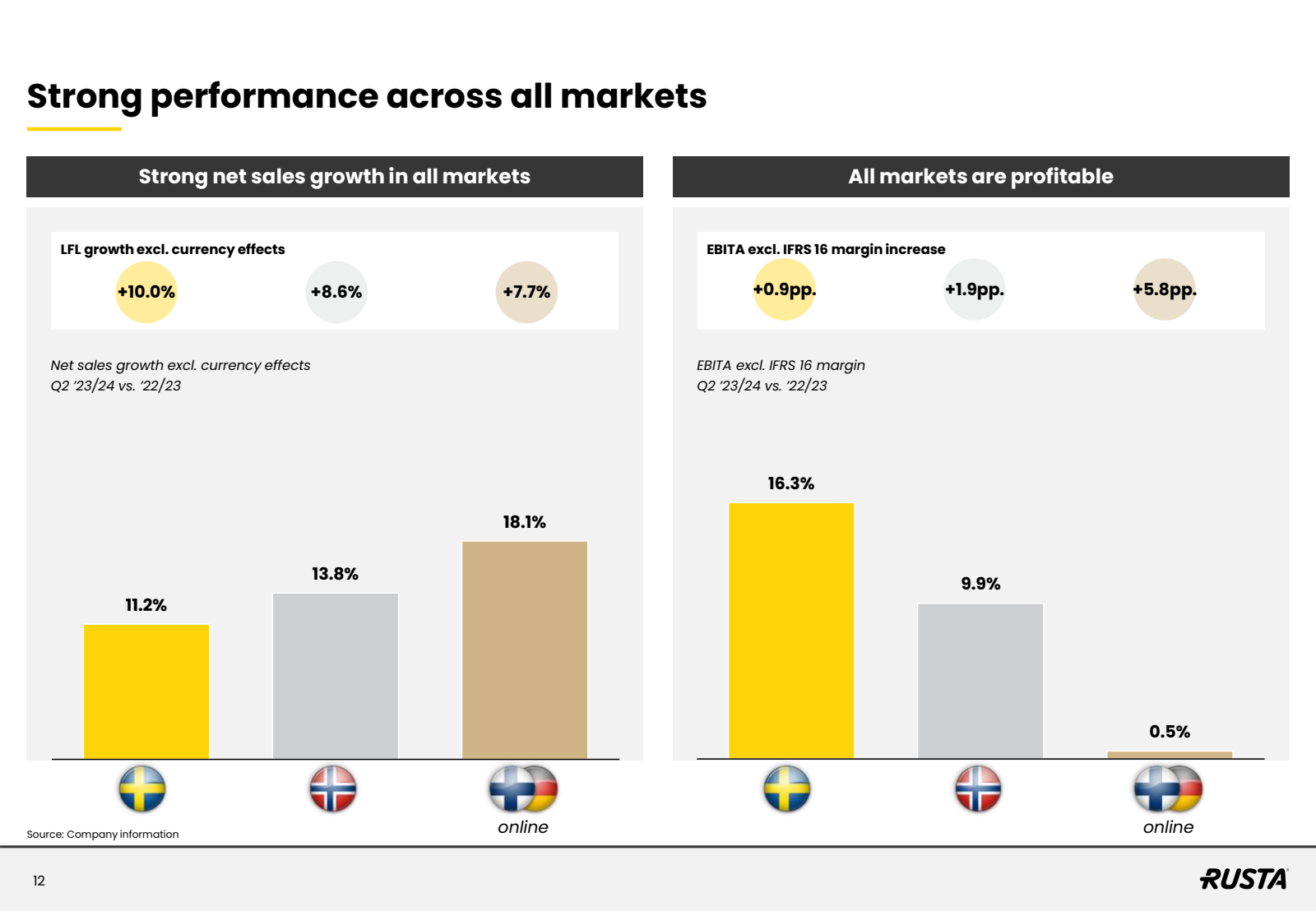

With the Finnish and German markets (the segment of “Other”) the growth was partly driven by the currency changes. The growth in the Other markets was +18,1%, but excluding the currency effects, growth was +7,7%. On the other hand, the other markets represent 23% of the company's total revenue.

The most notable in the growth of Rusta is the strong performance of the core market in Sweden. The Rusta value proposition of low-priced items currently resonates strongly in Sweden. The Swedish market, which represents 56,5% of Rusta’s revenue, grew by +11,2%.

Rusta is one of the biggest variety discount retailers in the Nordics. The company is probably the second biggest player in the category after Tokmanni in Finland. Rusta’s revenue is approximately 975 million €. This is quite a lot smaller than Tokmanni’s 1 260 million €. However, with the growth levels that Rusta is reporting, the company could challenge Tokmanni, which has seen low single-digit Like-for-Like growth rates lately.

However, acquiring Dollarstore will give Tokmanni an important advantage and transform it into a growth company again.

The competition in the Nordic discounter space continues as Motonet expands into Sweden and Jula in Finland.