Schwarz Group has become the dominant European retailer

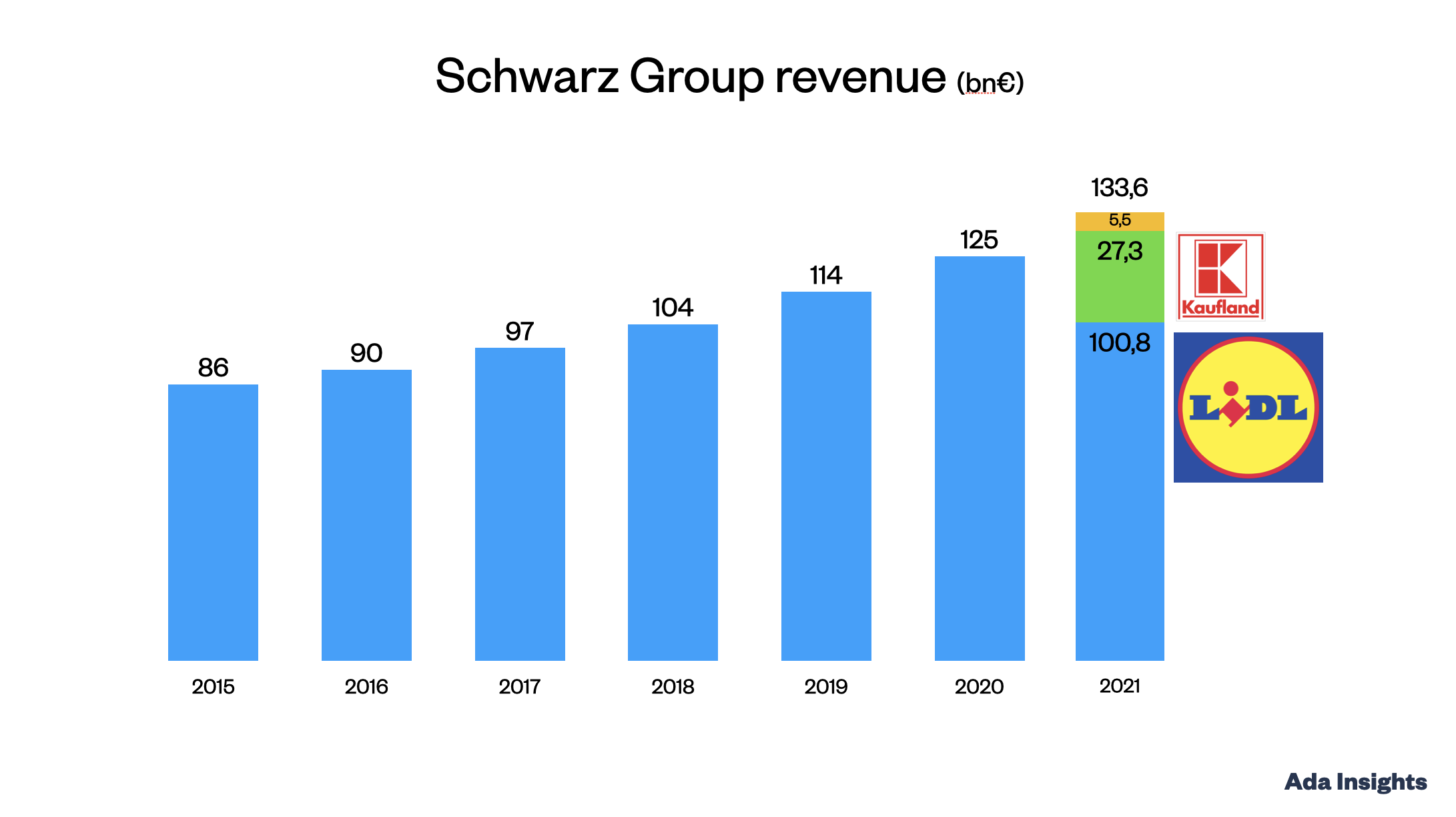

The German discount retailer Schwarz Group has grown to dominate European retail market with a 133,6 billion € revenue in 2021. Internationally Schwarz is already world’s second biggest grocery retailer and fourth biggest retailer overall.

The growth of Schwarz has been driven by the main business of Lidl, which accounts already 100 billion €.

Lidl is one of the most international retailers with operations in 31 countries.

This is especially notable as Lidl operates in grocery retailing, the sector which traditionally has not been very international. Grocery markets traditionally have one to three big local incumbents who dominate the market.

Differentiation & small market share - in many markets

Lidl has been able to grow due to it’s unique business model, which relies on small assortments to drive efficiencies and enabling the company to sell with very low prices even with rather low volumes in individual countries.

Traditionally grocery retailers have relied on big assortments and large store networks generating big sales volumes in individual markets. Thus, the big incumbent grocers have become generalists with almost similar business models. That has made internationalisation difficult.

For a traditional grocery incumbent it has been difficult and expensive to go to a new market and start building the store network and purchasing volumes. The local incumbent have rather similar business models making the differentiation difficult. This on the other hand makes it slow and expensive to build volumes. Before big volumes are reached, the sourcing volumes for individual products remain small and uneconomic.

Lidl and Aldi have made trade-offs a core element of their strategic differentiation. A textbook example of great strategic management.

They are happy (and forced by the small assortment) to be smaller challengers in many markets. This has enabled the two companies to grow into huge giants. With small assortments, they can generate sourcing volume benefits rather early on in new markets. Additionally both companies have rather share of Private label products, which they can source in huge volumes for all countries at the same time. This reinforces the cost advantages even further.

The small(ish) market share and assortment also protects Lidl and Aldi from the incumbent. As they are small in individual markets and serve only partial need for the customer (less big weekly shops), the big incumbents are focusing more on each other than the discounters.

Former giants struggling

At the same time as Lidl and Aldi have grown, the local incumbents have struggled since the financial crisis of 2008.

Before the financial crisis Tesco and Carrefour were the biggest European grocery retailers. Both were very much in a growth mode with lots of new markets opened and with great growth ambitions. After the financial crisis, both companies have hit significant problems and have been forced to retreat from some or all of the foreign markets.

Since 2009 Schwarz Group has grown by 135%. During the same time period both Tesco and Carrefour have not been able to grow, but in fact have declined slightly as they have focused on their core markets.

What the future brings for Lidl?

As the inflation starts biting the consumers’ wallets, it would be easy to assume that the discounters would be strengthened further, just like after the financial crisis. As the both major discounters have already grown to be rather big in many markets, the big question is whether they are able to grab bigger share of the market with the strategic trade-offs they are making? However, there are yet many new markets to conquer for both of the companies. It would be difficult to see that any other European retailer could challenge Schwarz and Aldi as the biggest European retailers.