How much did the pandemic boost online grocery?

Online groceries saw a huge rise in revenues during the pandemic. Since the peak of the pandemic in Q1/2021 the online grocery markets have started to return back to the more normal levels. The big questions regarding the influence of the pandemic are:

how big influence the pandemic really had on the growth of online grocery?

how the online grocery markets and companies will grow in the future?

To shed light on these questions, I have examined in more detail how different markets and companies grew during the last couple of years.

With regards to some companies with more data on the online grocery sales, I have also tried to analyse the impact of the impact pandemic on the growth trajectory of the businesses.

Market growth

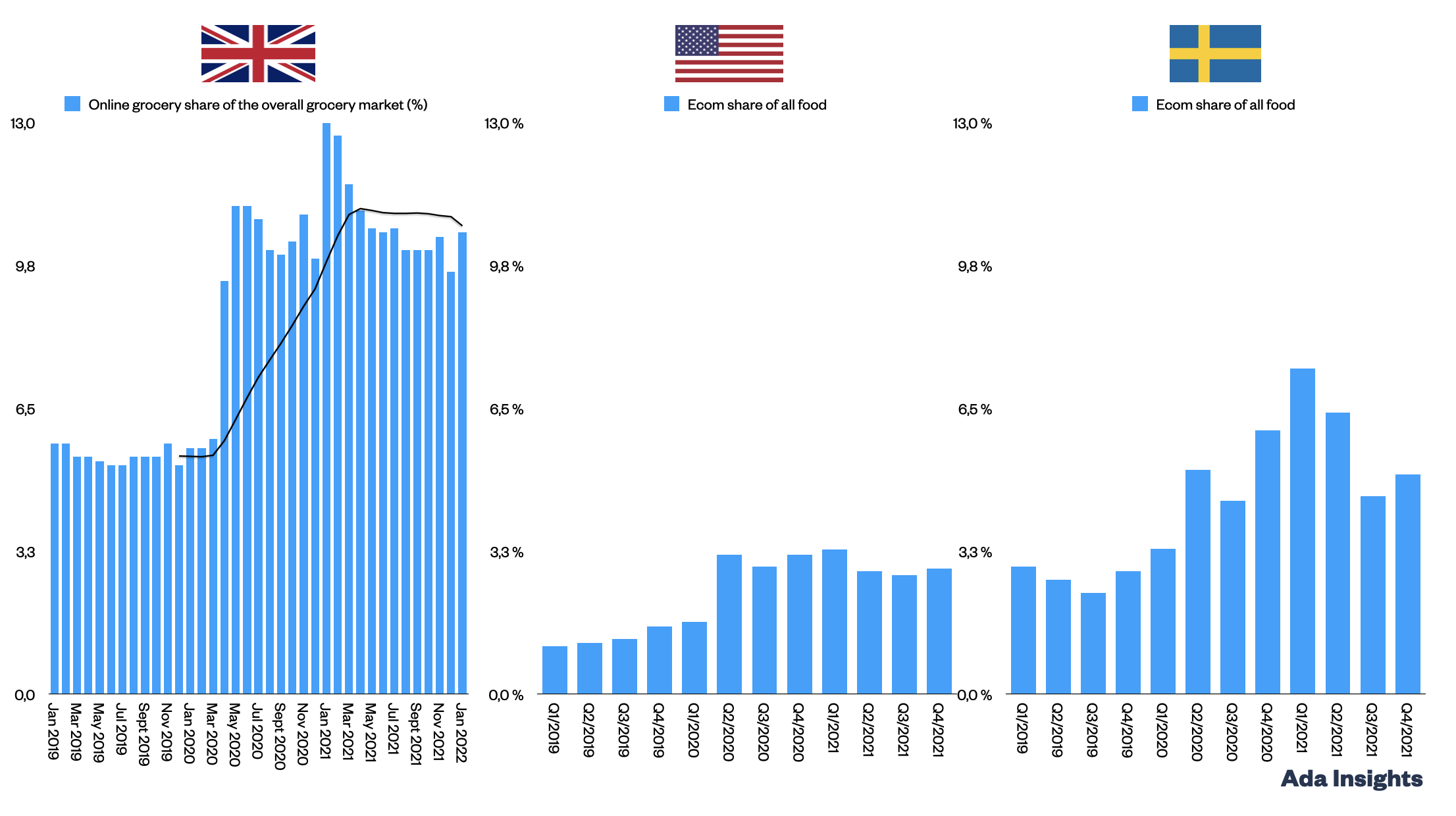

With regards to the markets, the markets behaved rather similarly in different countries. Even in the most mature market, the UK, the growth of online share of all groceries was really rapid during the spring of 2020. In three out of of the four exemplary markets, the share of online roughly doubled.

The only outlier in terms of the markets was Finland where the share of online more than tripled during 2020. This is most probably due to the fact that Finland has been trailing the other markets for years.

The more granural data shows that growth of the markets saw a steep decline after spring of 2021 (Q1/2021).

Since then the share in the three markets of UK, US & Sweden has plateaud and gradually increased in the run up to Christmas.

Same development can be seen in the growth of the publicly listed online businesses. The first quarter saw a rapid increase, whereas during the H2/2021 the companies struggled to find growth. The only outlier being Ahold, which was able to report growth for the online business throughout 2021.

Growth of online retailers

When observing the growth of online grocers, one can see that there have been multiple trajectories of growth. Some companies jumped more rapidly during the early pandemic whereas some other companies were able to sustain the growth achieved during 2020.

Why have companies performed so differently?

Two main reasons come to mind:

1. Business model (pure play vs omnichannel)

2. Maturity of the markets and the online businesses

These two reasons can be seen in action in the images below.

Sales indices of selected online grocery retailers (2019=100)

The influence of the business model is illustrated clearly on the Y-axis of the indices. As one can see, the omnichannel retailers on the right hand size image grew significantly more rapidly than the pure players. One can also see that in 2021 the online revenues of the omnichannel retailers plateaued more than for the pure players.

Omnichannel

The impact of maturity can be seen in the order the companies are ranked by the indices. Especially for the omnichannel businesses in the right hand image.

The more established the online business and the market, the lower the index value for the company.

Finnish Kesko and S-Group with lowest maturity of market or company have the highest values whereas Tesco and Ahold Europe are among the most experienced online grocery retailers with both double digit share of online for the business.

Pure players

For the plure players, the image is not as straightforward. Ocado coming from the most maturity and having the longest maturity as a company has the lowest value. However, the highest growth has come from HelloFresh and Rohlik (and Picnic, which has not reported 2021 revenues). Unlike Oda, MatHem and Nemlig, these companies have grown by expanding into multiple markets.

Of the local online grocers, Oda has already opened new markets with the launch of Finland and coming launch of Germany.

The difference to historical growth trajectory

For some online grocers there is enough data to create some kind of estimate on how the revenues would have grown without Covid. The idea was that the growth trajectory of the couple of years prior to the pandemic (2017-2019) was calculated for 2020 and 2021. This gives us a comparison point on what the growth could have been if there had not been the outbreak of Covid-19.

For the local online grocers with enough data the difference of 2021 online revenues was roughly 50-60% with the UK retailers as outliers.

Ocado combined the slowness of the warehosue business model (couple with some operational problems) to the maturity of the market and the business. On the other hand, Tesco was able to capitalise on the rapid growth of the overall online grocery market in the UK. This agility was a result of Tesco's use of the stores in scaling the online business to meet the demand. Another aspect influencing the big jump Tesco gained from the pandemic was due to the fact that Tesco's online business had not been growing very rapidly during the run up to the pandemic.

The Nordic online grocers had been growing around 10-20% per year during the years leading up to the pandemic. They all received quite significant boost to revenues from the pandemic.

The big question naturally for all online grocers is how the markets continue to grow during 2022.

The early signs from Sweden and UK indicate that the markets are not declining any more, but they have found a kind of new normal level from which the future growth will continue.