Normal growing abnormally fast and profitably

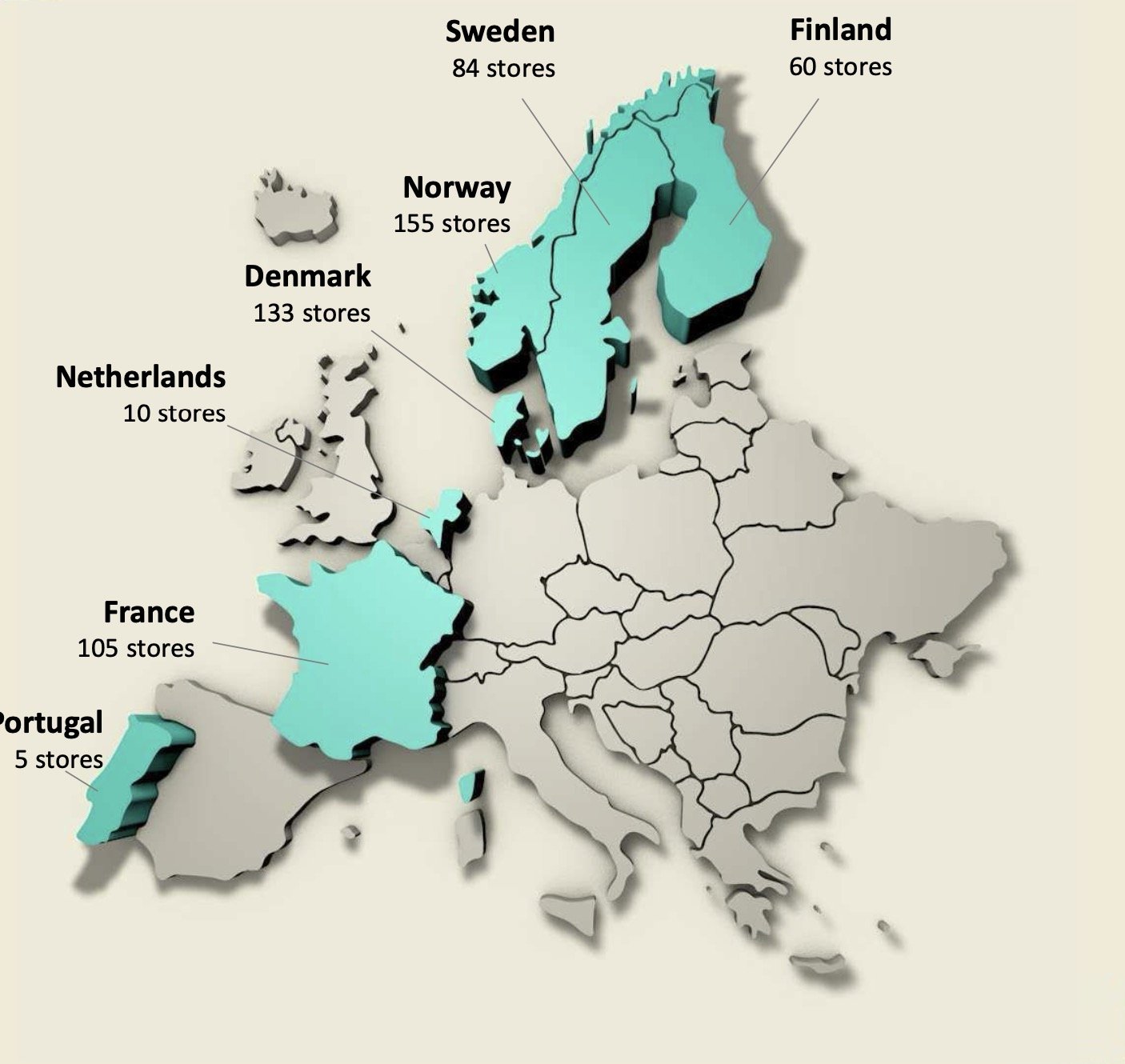

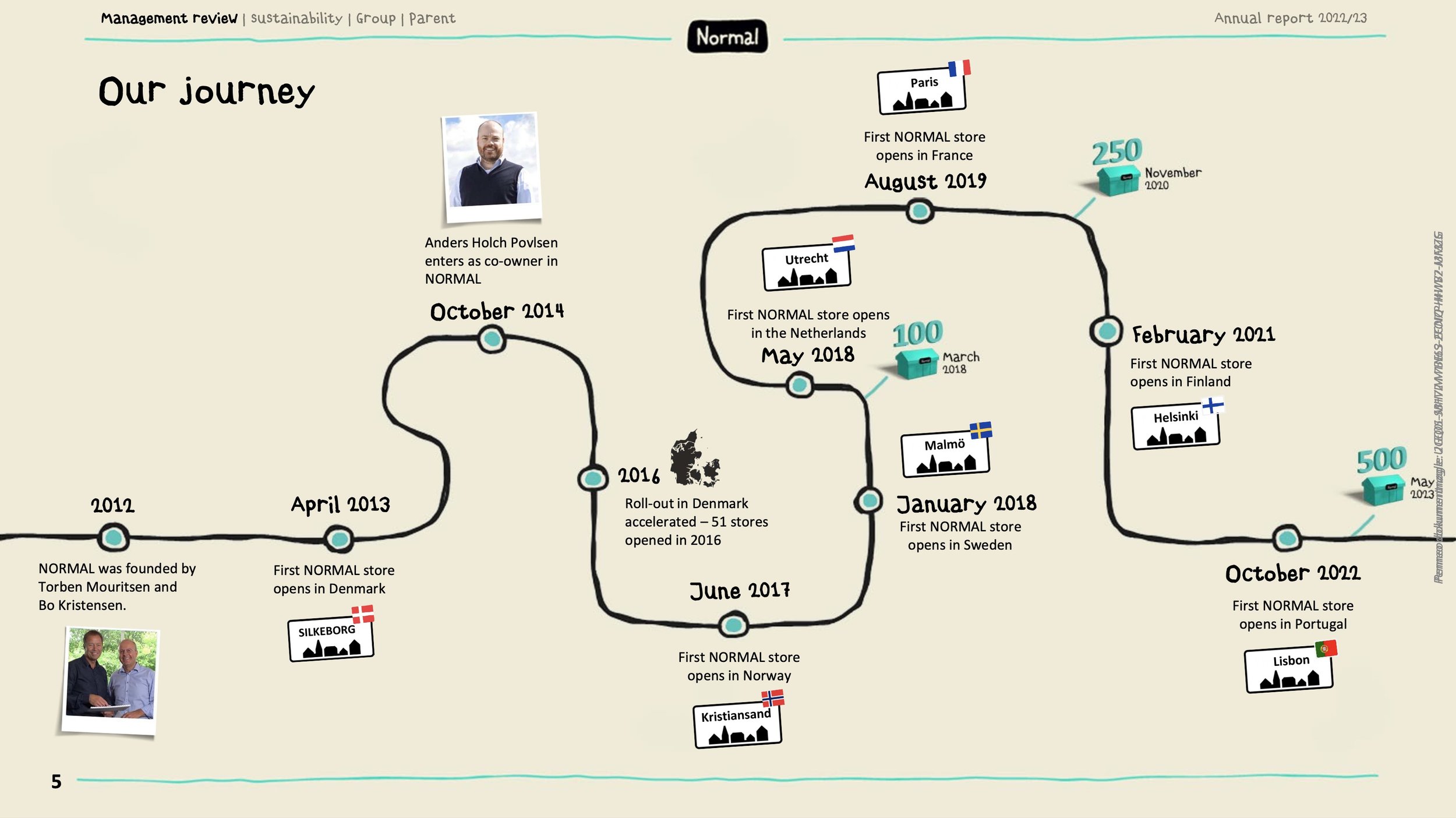

The Danish fast-growing chain of personal care and cosmetics products is an excellent example of international retail growth. Normal’s growth highlights that growth can be solid and profitable when the concept is clear and differentiated. The company has already spread to 7 countries and over 550 stores, and growth has barely slowed.

The company states its mission as follows:

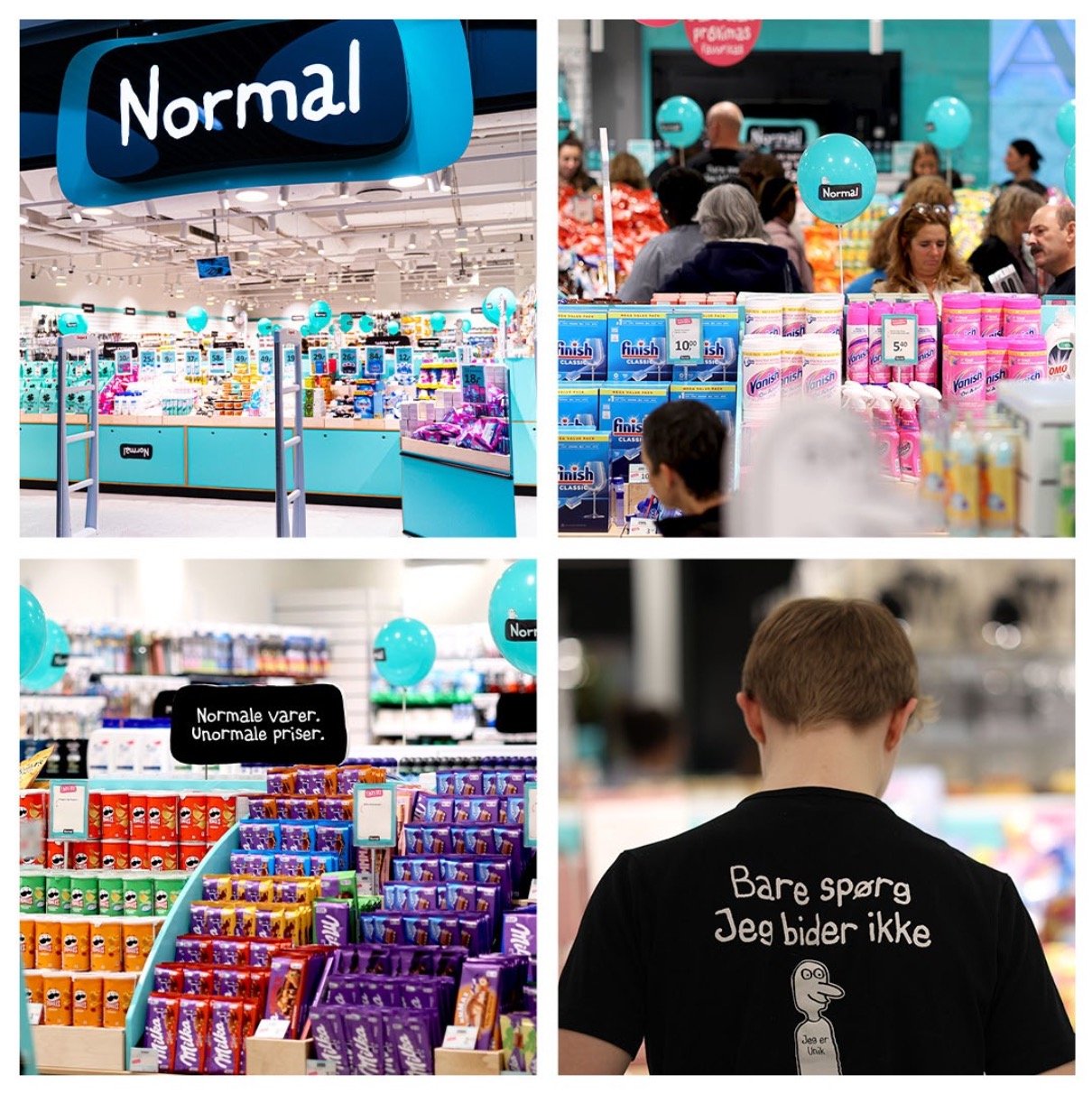

”to make it inexpensive and adventurous to shop branded everyday products and to give our customers a unique shopping experience at everyday low prices every time they visit and shop in our stores.”

The differentiation of Normal comes in two ways (at least)

Firstly, the product assortment competes with cosmetics specialists such as Kicks. However, Normal offers only a small assortment of products with fixed and low prices. The assortment is differentiated from the cosmetics specialists by offering everyday staple products like sweets, snacks, and cleaning products. The everyday products increase the shopping frequency, enabling Normal to sell more.

The product assortment is well-built to balance high buying frequency and robust margins. The lower margin of everyday products balances the high margin of cosmetics products. The everyday products that are sold in Normal are the ones which have the highest margins (snacks, candy, shampoo, cleaning products…) and the most well-known brands. This makes it easier to manage the assortment in different countries.

The reported gross margins in Normal's annual report are somewhat confusing. The company includes ”other external costs” in Gross margins, not only the costs of products sold. Normal's traditional Gross margin (revenue - cost of sales) has been 42% and 44% for the last two years.

The other aspect of the Normal concept that differentiates the company from most of the competition and enables it to sell more is the maze-like store set-up (or forced circulation from IKEA). It gives Normal a lot of flexibility in playing around with the store setup and testing out the most efficient ways of getting customers to notice different product combinations.

Besides product differentiation, Normal has been very good at focusing its marketing activities on social media on a clear customer group: young women.

Differentiation and good concepts enable strong growth

”During this financial year NORMAL celebrated its 10th birthday, opened store number 500 and now have more than 10,000 enthusiastic colleagues.”

During the last four years, Normal has grown by 285%. And this rapid growth has come with a healthy operating margin of around 10%. The strategy of opening small (and almost identical) stores in prime locations along high foot traffic makes it easier to grow fast.

One should compare Normal’s growth strategy to McDonald’s or Starbucks rather than a traditional retail chain.

At the same time as Normal has been growing rapidly, the average revenue per store, a classic growth metric in retailing, has grown by 45%. This means individual stores sell 45% more today than four years ago. Thus, it is clear that Normal is growing by opening new stores and generating more sales from existing stores.

”During this financial year we opened 141 new stores, and in the coming year our plan is to open even more.”

Normal expects the growth to continue at a rapid pace this year also. If the company were to grow revenue either by 50% or by 3,000 MDKK, it would put the company beyond 10,000 MDKK, which would be close to the 1,5 billion € mark.

With that level of revenue, Normal would be similar in size to Nordic retail giants such as Rusta or Tokmanni.

And one can see a lot of growth in the future if Normal can grow in markets like France or the Netherlands. Why wouldn’t the concept work in Germany or the UK if it works there?