Three findings from the Swedish grocery market in 2023

The Swedish Food Retailers Federation summarised the year 2023 in their monthly Dagligvaruindex. Here is a summary of the three most interesting findings from the December and full-year figures.

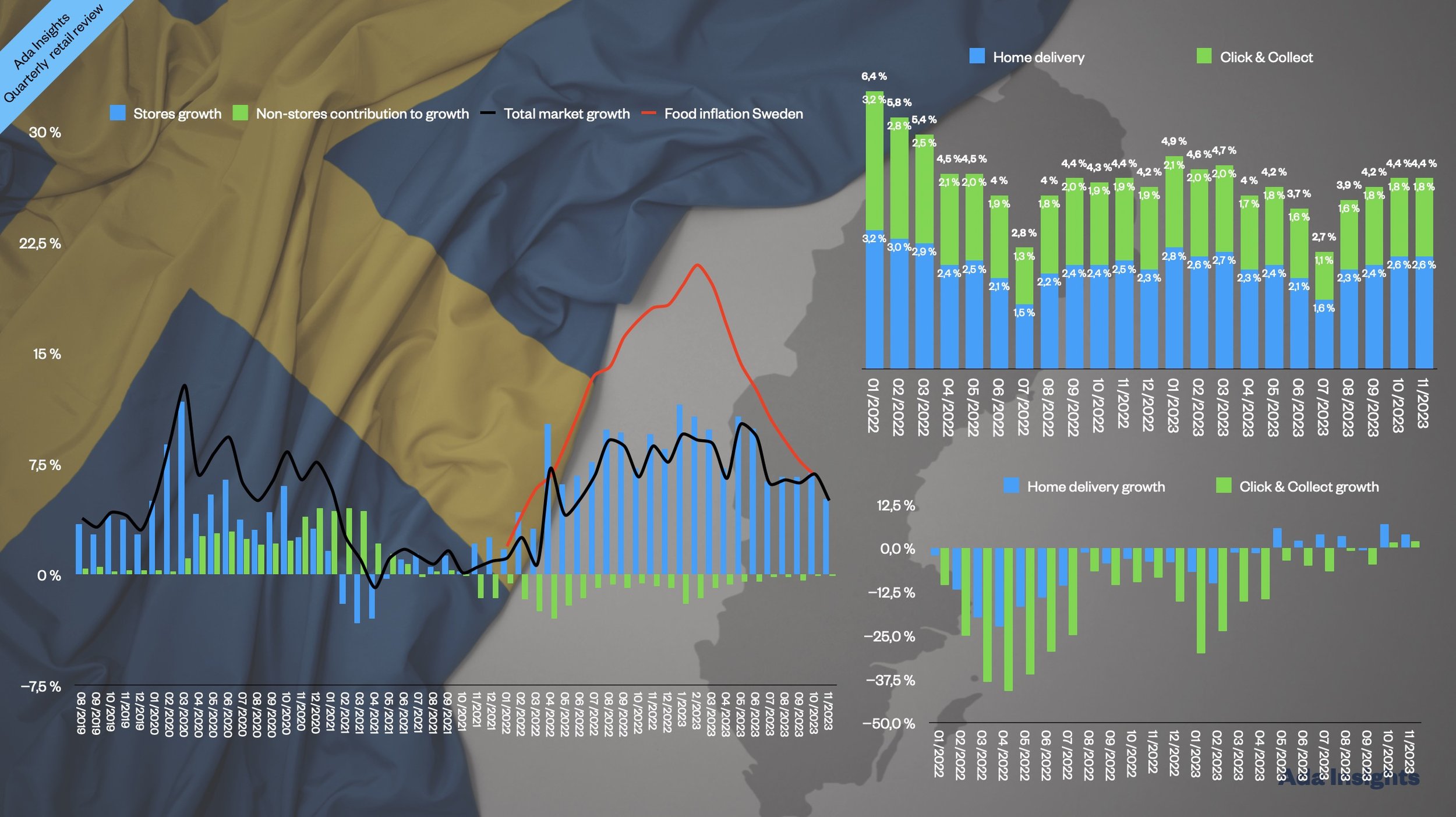

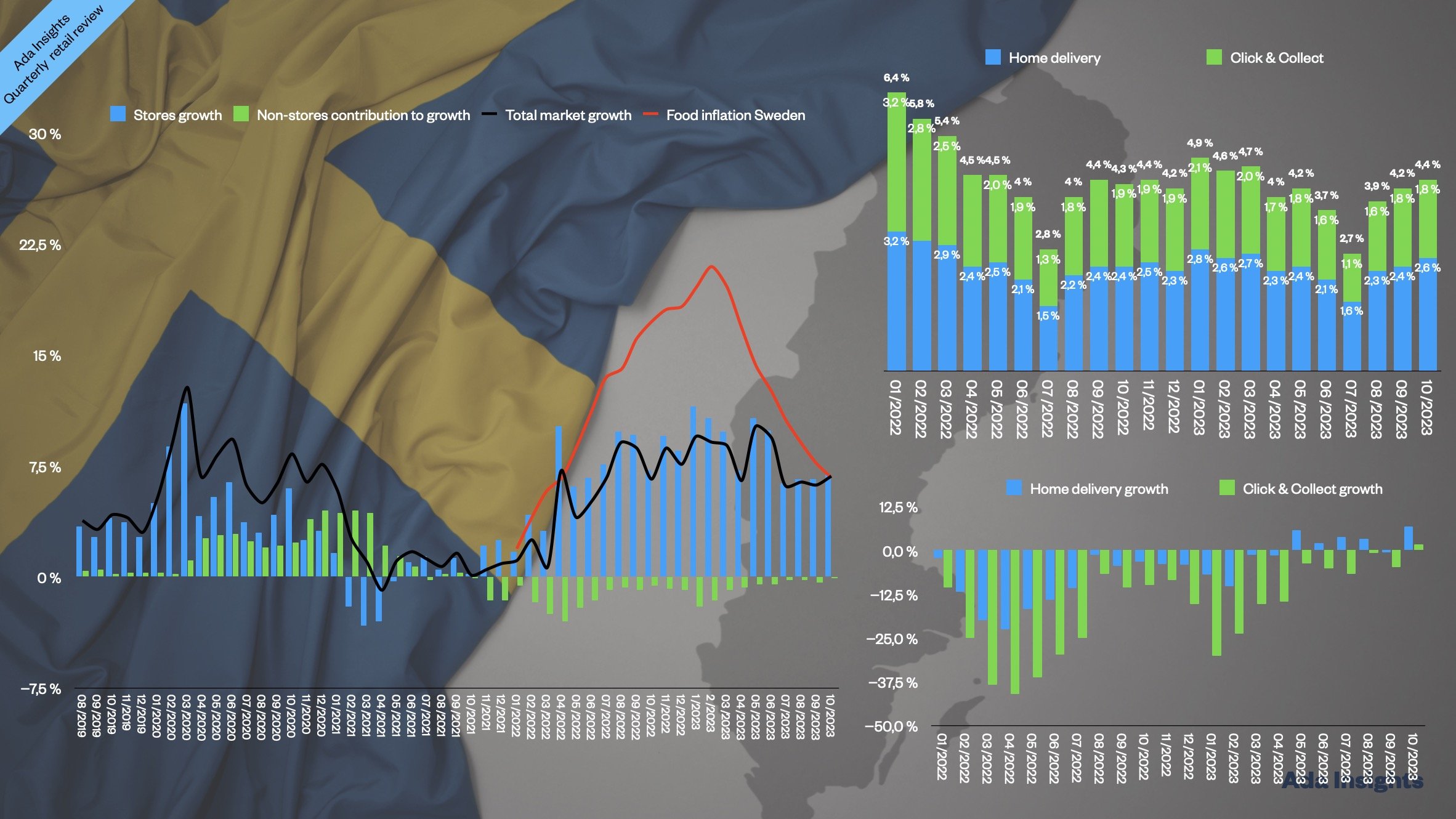

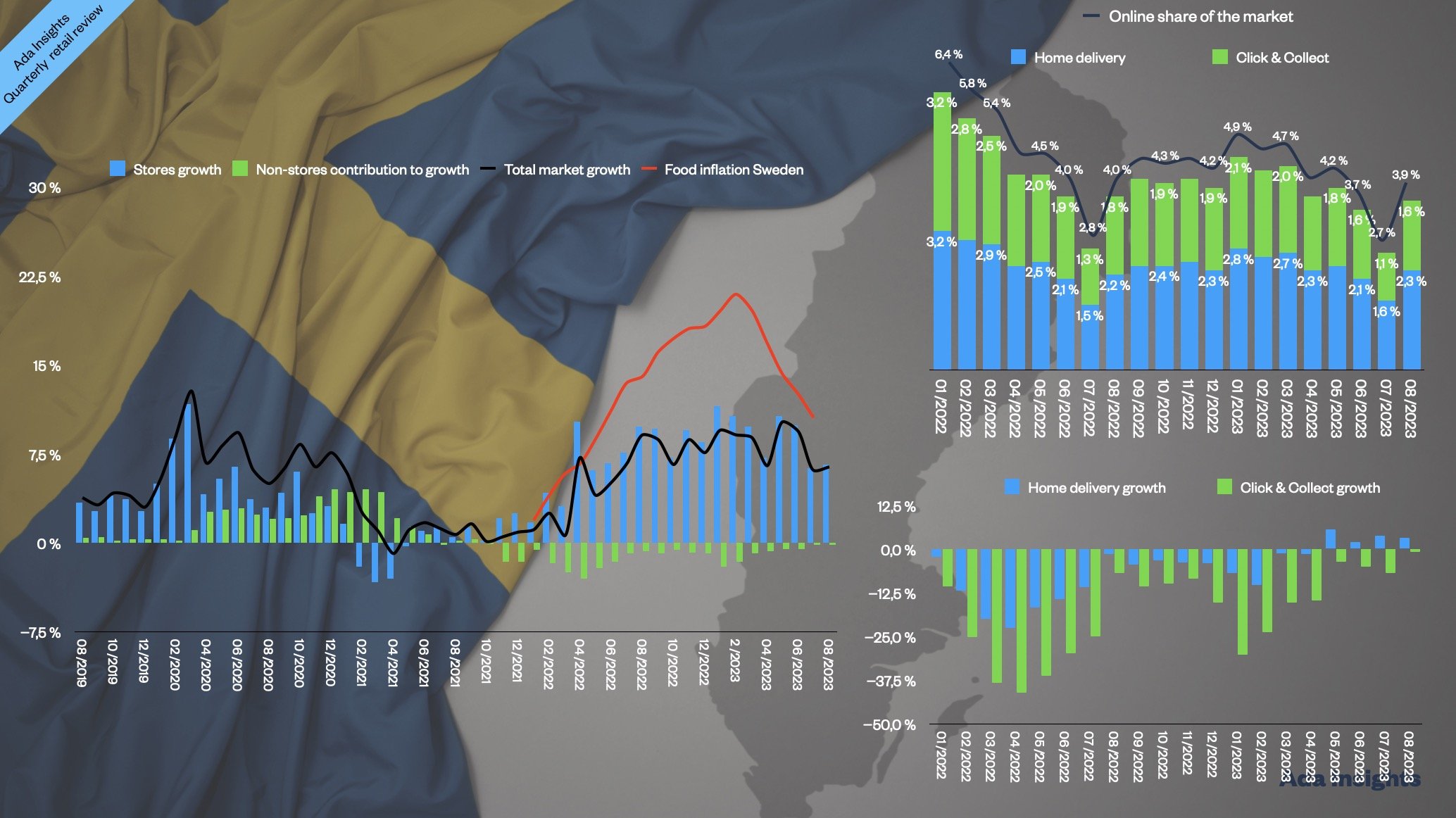

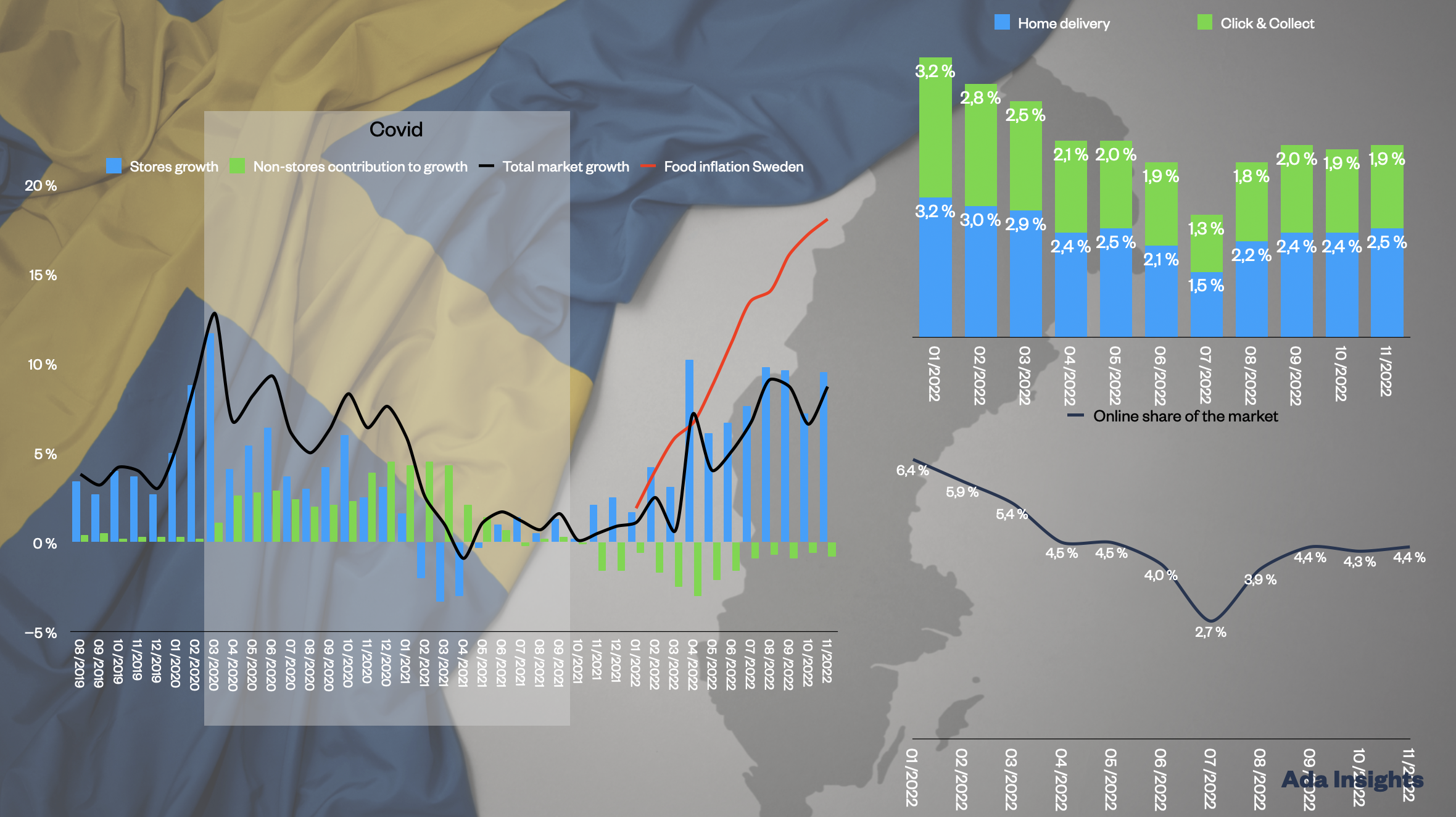

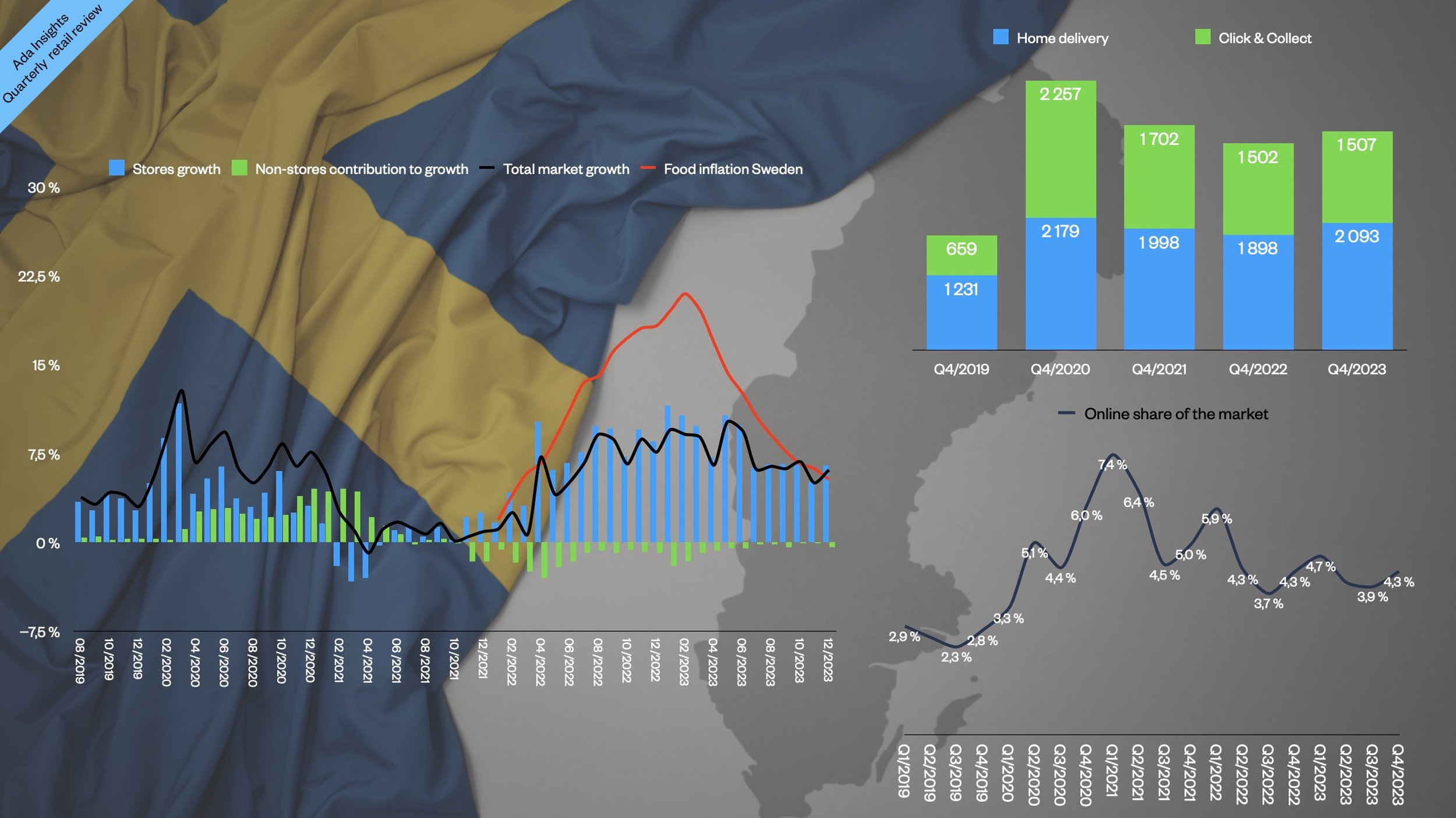

1. The market has started to grow faster than inflation

The Swedish grocery market continued to grow during the Christmas season of 2023. The 6,1% growth was the second time the market grew faster than inflation, which was +5,3%. Stores drove the growth in grocery sales as the online channel declined slightly from the previous Christmas.

December marked the 10th straight month of declining inflation. Since February, food inflation has declined from 20,95% to the current 5,3% in December.

2. Home delivery leading the growth of online

For the last quarter of the year, the online channel grew +1,9%. This was driven by the home delivery, which saw a +3% growth. For 2023, the home delivery market grew by +6%.

With that growth, the home delivery market is approaching peak revenue levels from the heights of the pandemic. In Q4/2023, home delivery revenues were only 4% smaller than at the peak of Q4/2020. Last year was 5,5% smaller for home delivery than the peak year of 2021.

On the other hand, the Click & Collect market declined by -11,5% in 2023. This caused the online market to decline by -2,2% last year.

3. How will this year look with the changing market dynamic?

The entire grocery market grew by +7,7% last year. This was driven by stores and especially by the price-driven grocers, such as Willy’s and Lidl. They have gained the most from tightened budgets and rising grocery prices.

It remains to be seen where the inflation goes during early 2024 and how that impacts customer behaviour. Will ICA gain traction as the price is not such a big issue anymore, or will the price continue to dominate the grocery market?

The relaxed pressure from inflation should also encourage the online channel, especially Mathem, as the only big pure player. Will the renewed and more efficient operational excellence from Oda enable Mathem to offer better service quality and possibly lower prices?