ICA continues to lead growth against Axfood as the customer becomes more confident

The Swedish grocery giants Axfood and ICA reported their Q3/2024 results yesterday. The results are a testament to the fundamental changes that can be made in grocery retailing.

Axfood dominated the grocery industry with their Willy’s chain throughout high inflation. As dramatic as the rise and domination of Willy’s was, the turnaround of fortunes has also been significant.

The market leader ICA, which lagged behind Axfood, has picked up growth, especially compared to the competition. The streak of above-the-market growth quarters was extended to four. More importantly, ICA has extended its lead over the competition. For four quarters, ICA has grown faster than the market and increased the lead during each quarter.

ICA CEO Nina Jönsson highlighted the importance of the price investment in an interview with Dagligvarunytt:

“It gives the impression that there is optimism among customers, even though price is also extremely important.”

”We believe that price is absolutely the right way forward and we will ensure that we are right in price.”

This quarter, ICA was able to outgrow the market through all four of its chains. The hypermarket chain Maxi continued to lead the growth with +6,3 % growth against 5,6% for overall ICA and 3,6 % for the market. With Axfood’s growth, one should remember that the company (especially the Willy’s chain) has very strong comparative numbers from the previous year. During Q3/2023, Willy’s grew revenues by +15,8 %. This was double the growth rate against the market and three times the growth rate of the main competitor, ICA, at the time.

The tough comparative figures make it more challenging for Axfood to grow. This was also highlighted by the new CEO, Simone Margulies, in an interview with Dagligvarunytt. Axfood has decided to follow ICA's lead and invest strongly in price to reinforce the low-price image of Willy’s.

“The fact that we are maintaining our growth despite high comparative figures is a strong achievement, especially considering the more than twice as high growth last year.

We have chosen to strengthen Willy’s price position during the quarter so that there will be no doubt about this. It is a long-term investment.”

As ICA grows and takes market share, Axfood has been forced to grow less than the market. The leading chains of Axfood, Willy’s (+3,8 %) and Hemköp (+4,7 %), grew slightly faster than the market. However, their growth fell behind ICA’s.

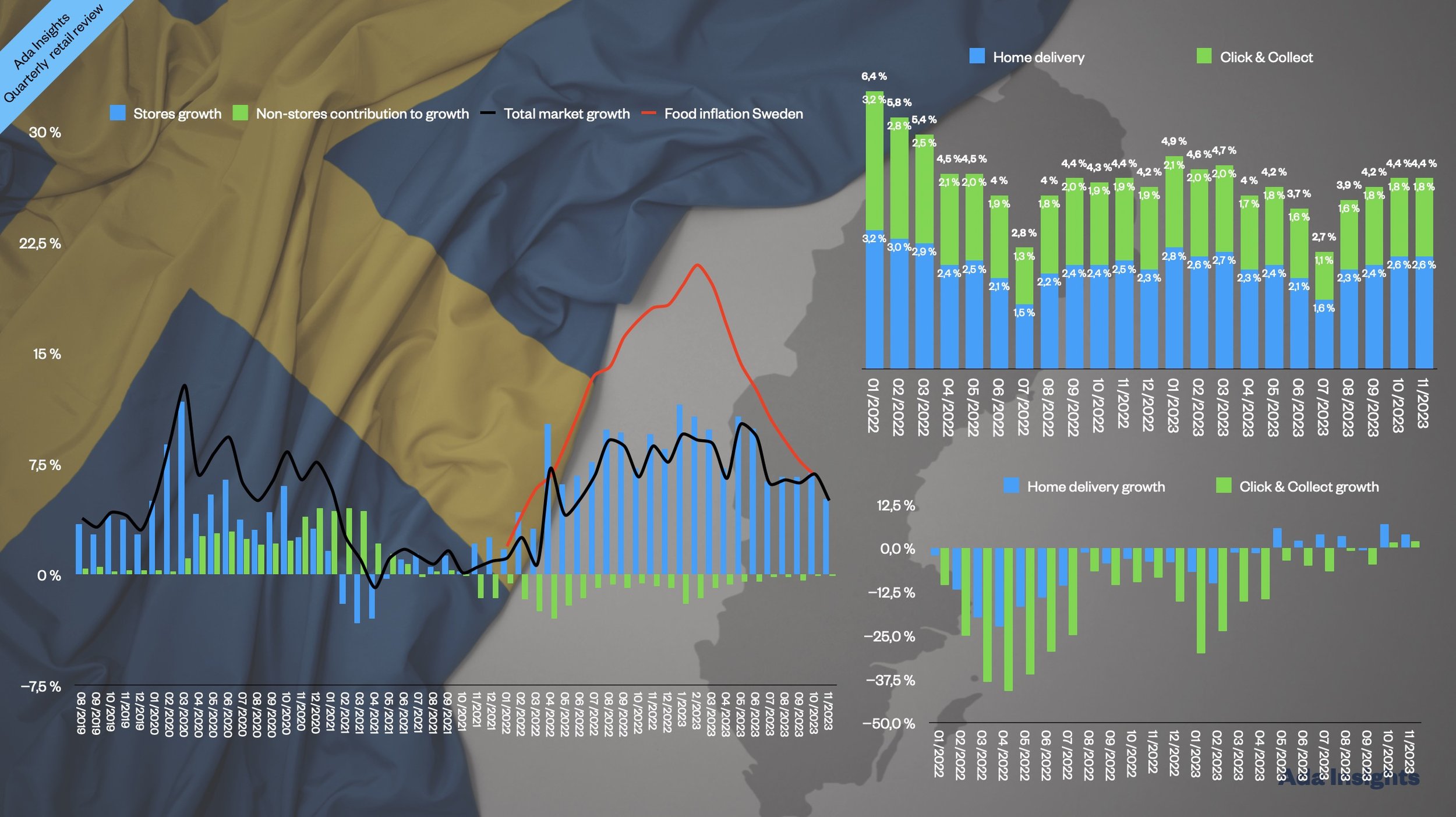

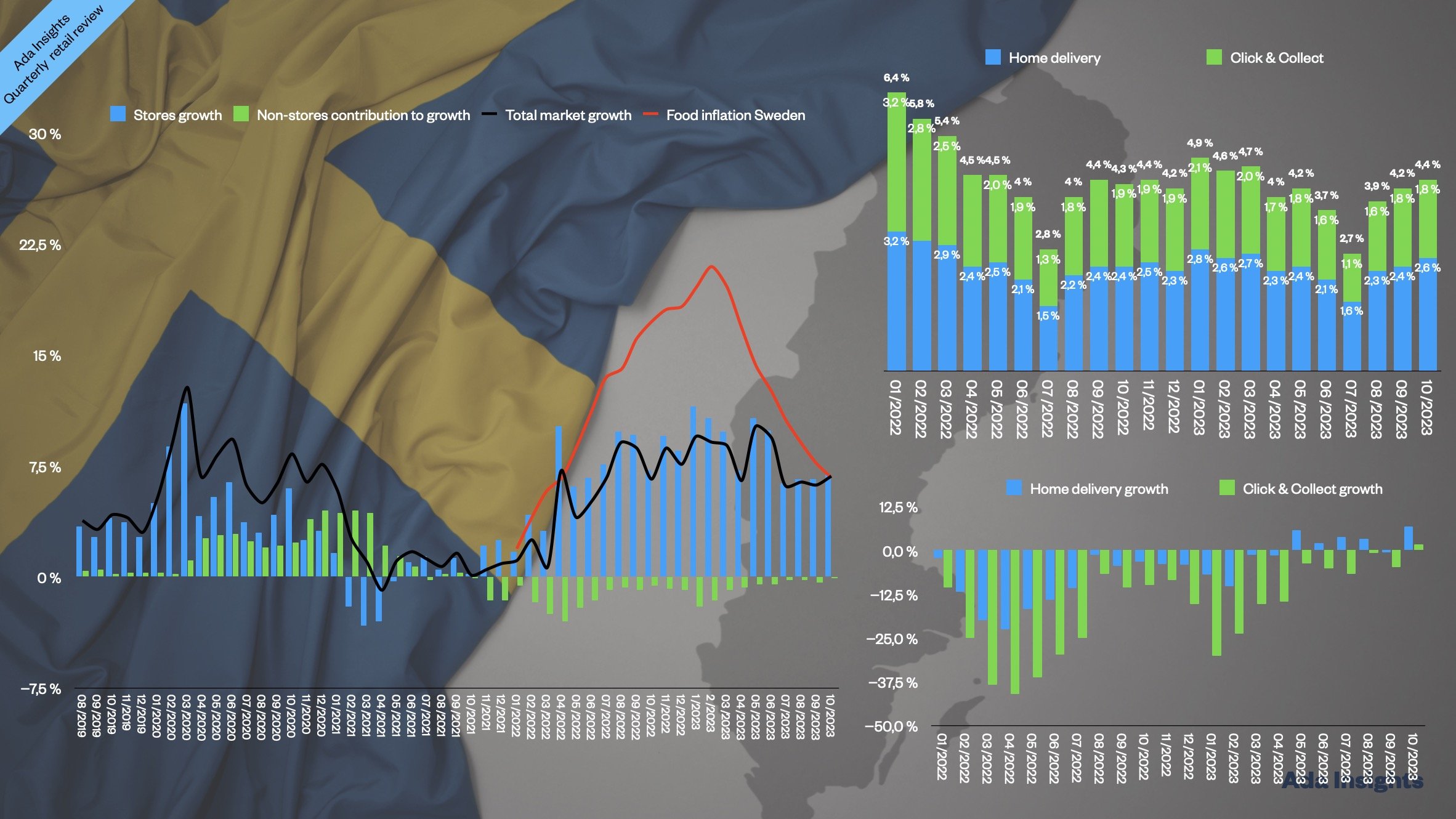

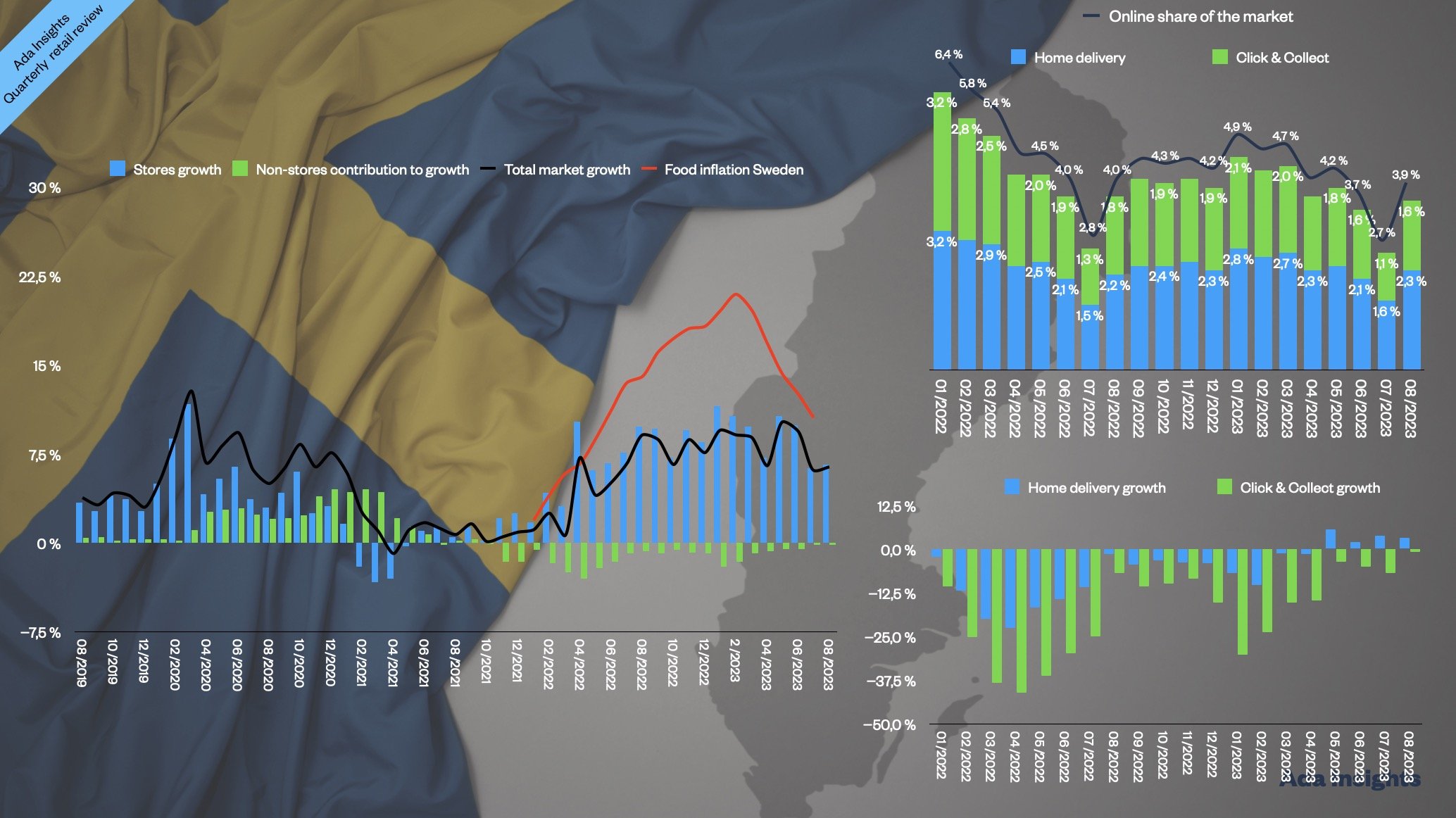

Both growing online

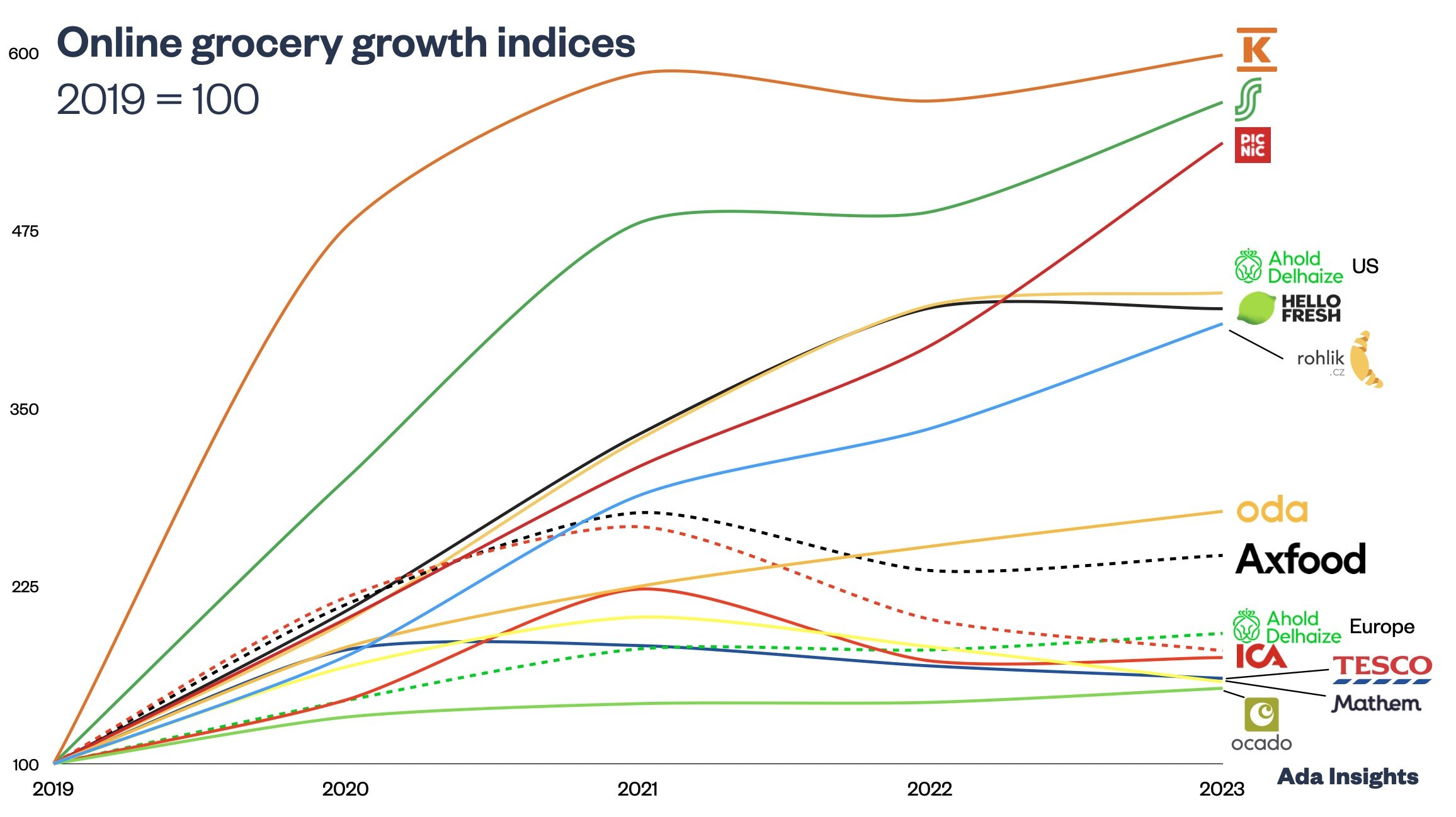

Both grocers picked up growth pace with their online businesses with double-digit growth: Ica with +11,8 % and Axfood with +10,1 %. That was also faster than Sweden's overall online grocery market growth (+7,5 %).

As a result of the continued faster online growth, Axfood has significantly gained ICA’s lead in the online channel. Before the pandemic, ICA’s online sales were almost 75 % bigger than Axfood's. Currently, ICA is only 24 % bigger.

ICA pharmacy with a stellar quarter

If the grocery business of ICA has rebounded to solid growth, the pharmacy chain Hjärtat has continued to go from strength to strength. The chain reported its sixth consecutive double-digit growth quarter. In two years, the revenues have grown by almost +25 %.

The most substantial growth for Hjärtat came from the online channel, which reported +25 % growth for the quarter, a third consecutive 20+ % growth quarter. Despite the solid and sustained growth and 2,3 billion SEK in the last 12 months (LTM) revenues, Hjärtat lags far behind the online market leader Apotea. Apotea reported 6 billion SEK LTM revenues during the summer.

Currently, Hjärtat has almost 12 % of revenues coming from online. The pharmacy market in Sweden had 21 % of revenues from the online channel in 2023, and the share keeps growing. This means that online will probably continue driving growth for ICA Hjärtat.

With 20,6 billion SEK in LTM revenues, Hjärtat is the biggest pharmacy chain in Sweden.