European online grocers continue to grow in 2023

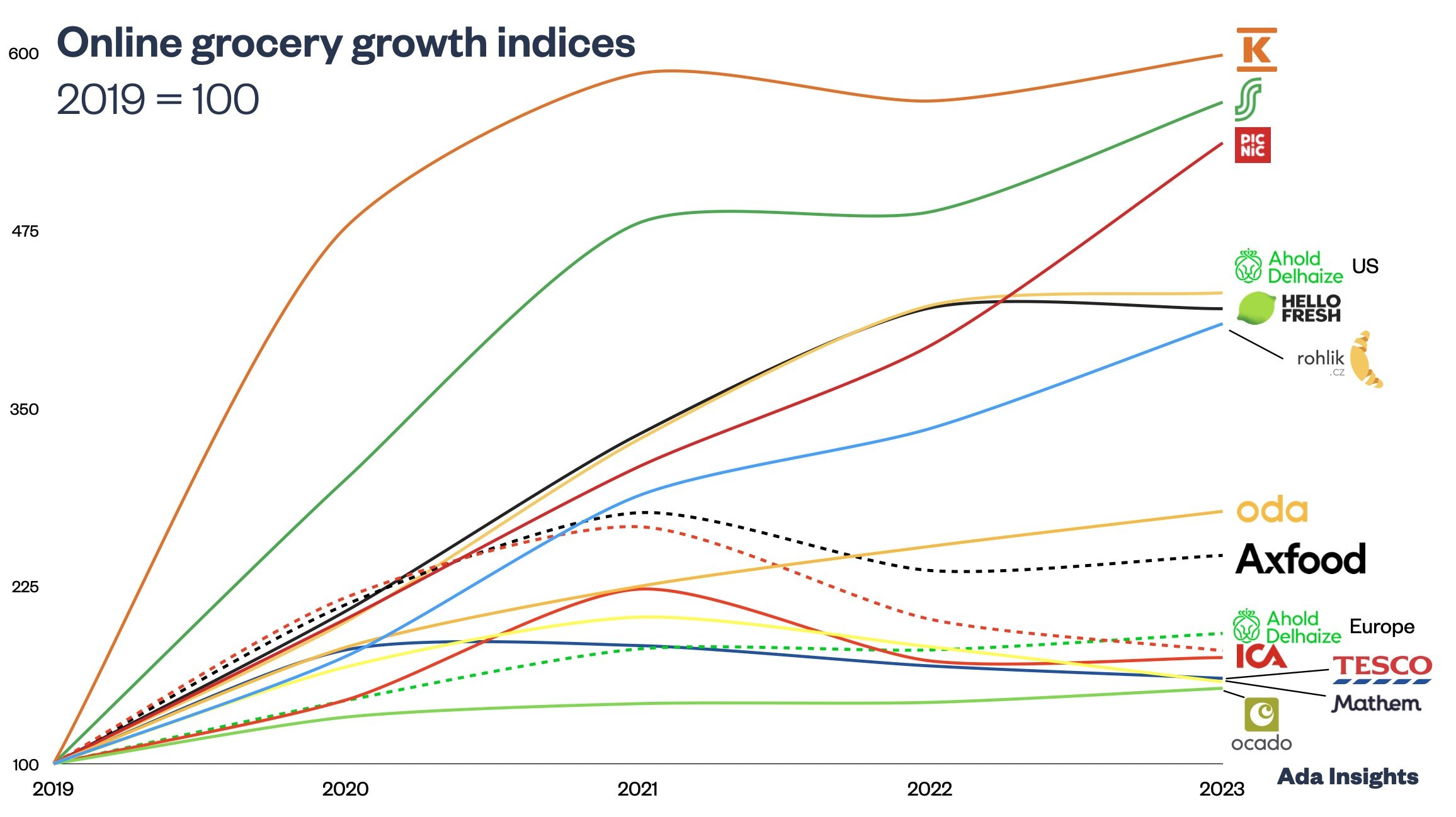

Despite the rapid revenue growth during the pandemic and the following slump in sales, most of the significant online grocers in Europe have rebounded back to growth in 2023. All of the online grocers remain significantly above the pre-pandemic levels. Each significant online grocer has at least 50 % bigger revenues than pre-pandemic 2019.

The market is showing promising growth, with smaller online grocers (such as Picnic and Rohlik) experiencing rapid growth and the bigger ones (Ahold and Ocado) also showing modest growth. Despite some seeing revenue decline in 2023, the overall trend is positive.

Tesco and HelloFresh, for instance, have successfully turned back to growth after a decline last year. For HelloFresh, the recent growth has been steady, whereas Tesco has reported a significant +8,9 % growth online, with online sales driving the growth of the UK business for Tesco.

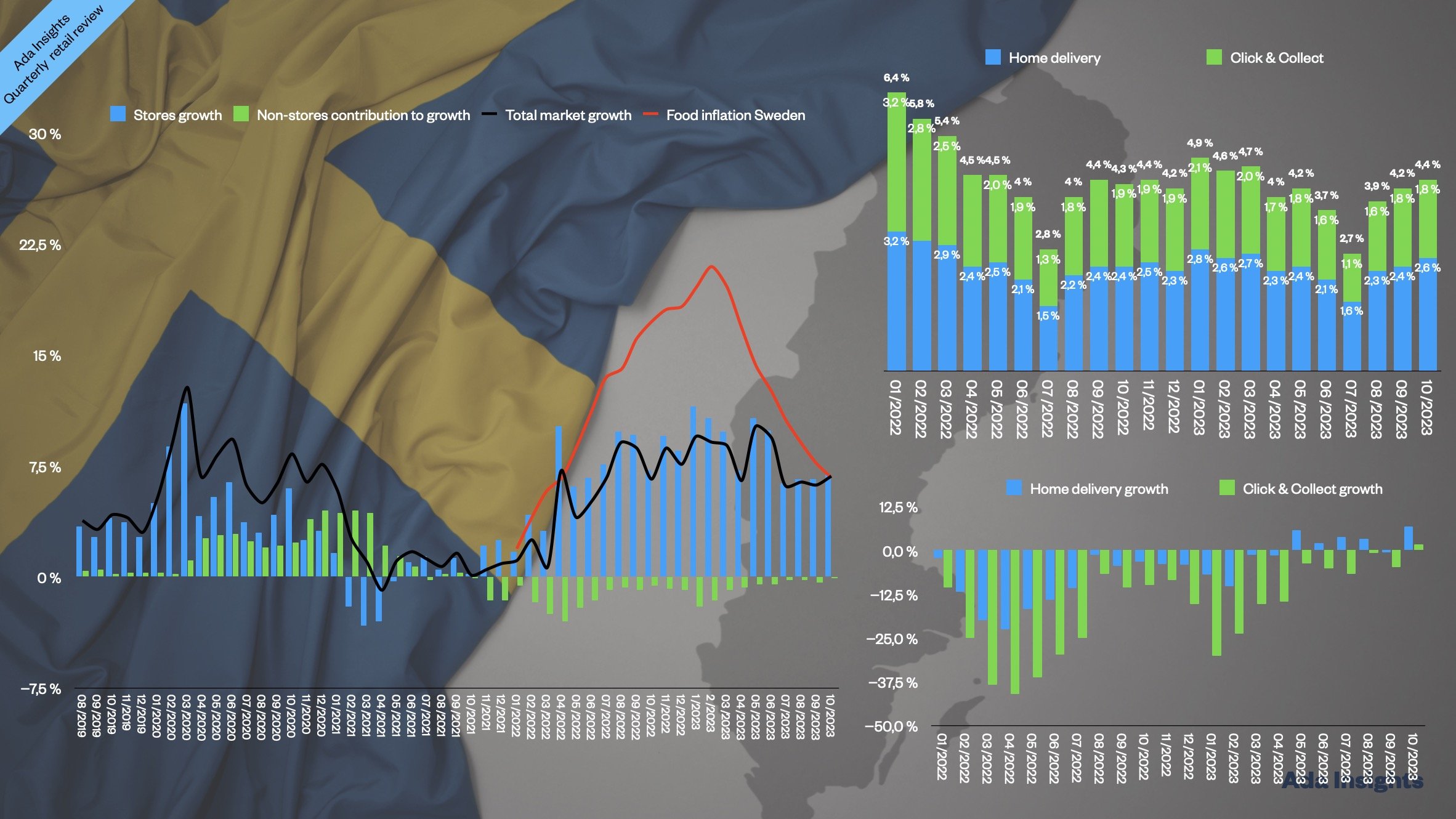

Only two online grocers reported double-digit revenue declines: Swedish ICA and Mathem. Mathem struggled seriously to find revenue growth and turn its business into profitability.

Picnic surpassing Ocado eventually?

Picnic is the biggest success story of the most rapidly growing online grocers. It has grown at least 25 % per year through difficult times and has grown revenues sixfold since 2019.

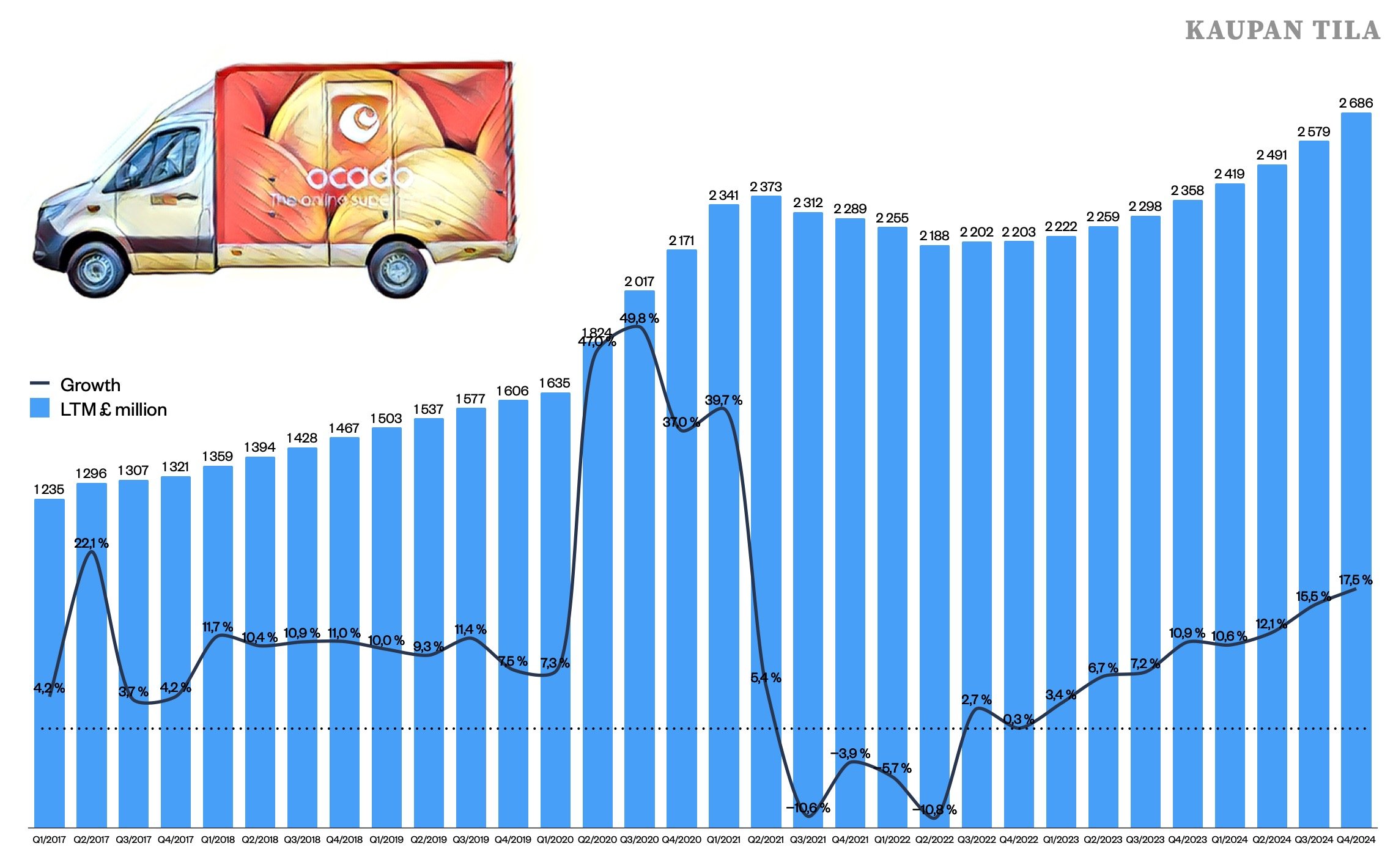

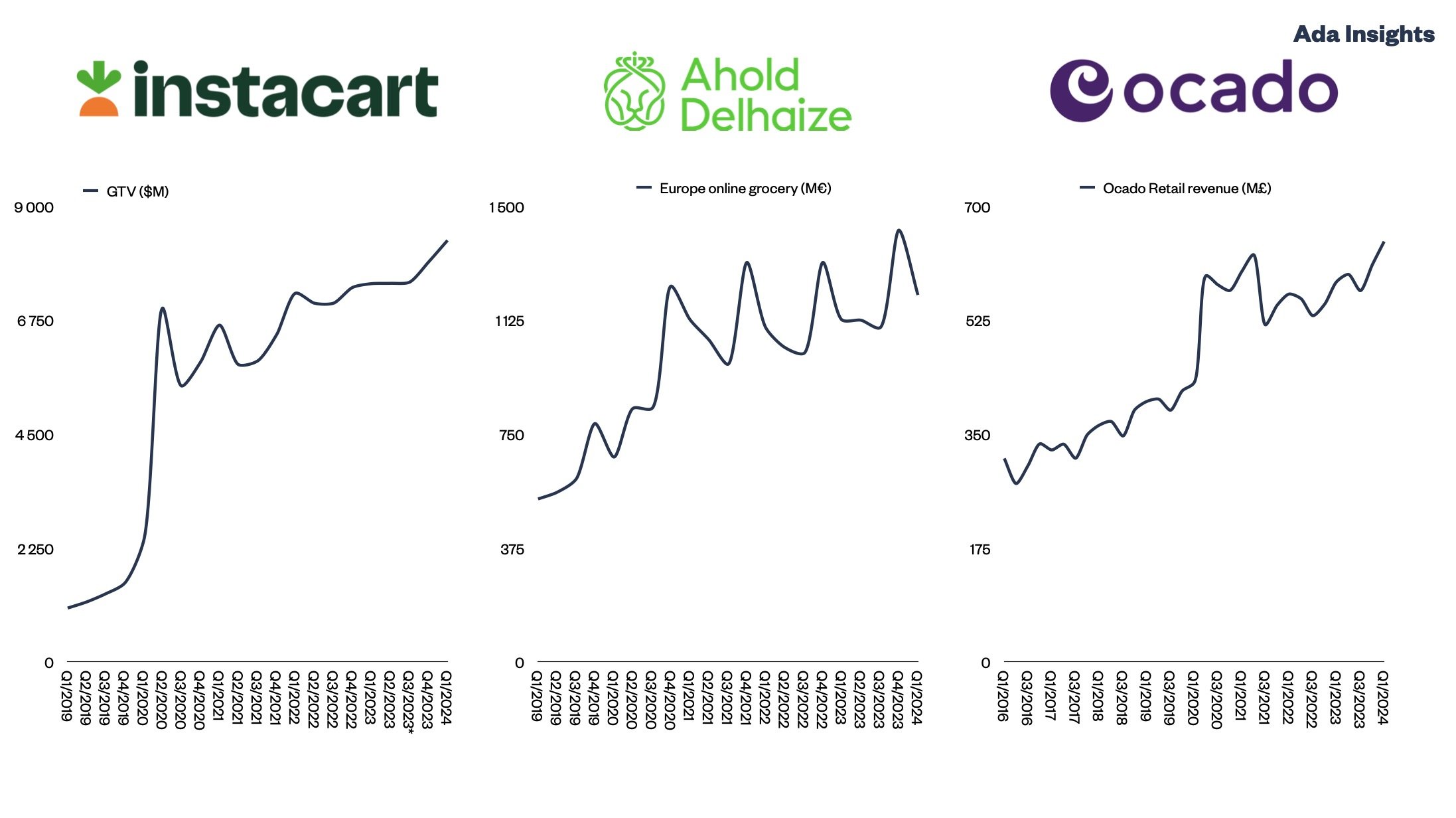

With that growth, the Dutch-based pure player can, in the coming years, challenge Ocado as the biggest pure-play traditional online grocer (HelloFresh is miles ahead). Currently, Picnic is about 50 % the size of Ocado. However, Picnic is growing almost six times faster than Ocado (6,9 % vs 36,2 %). Picnic has a bigger market to capture as it has established itself in France and Germany.

Oda Group is the biggest in the Nordics

With the merger between Oda and Mathem, the combined Oda Group has become the biggest online grocer in the Nordics. The Group is about 30 % bigger than the next biggest ICA. The Norwegian part of the group, Oda, has continued to grow throughout the difficult post-pandemic years, with almost double-digit growth last year. Of the Nordic online grocers, Finnish grocery giant S-Group has been the only company that has consistently grown online sales. S-Group’s online grocery business is a bit smaller than Oda in Norway.

Other Nordic online grocery businesses saw revenues decline in 2022, with Mathem and ICA also declining in 2023. Axfood and Kesko rebounded to growth in 2023, whereas ICA saw online revenues return to growth in Q4/2023.

Tesco, HelloFresh and Ahold competing for the top spot

For a long Tesco has been considered the biggest online grocery retailer in Europe. The pandemic changed that. As Tesco saw online revenues decline in 2022, HelloFresh surpassed it to become the biggest online grocer in Europe with revenues exceeding 7,5 billion €.

At the same time, Dutch-based Ahold-Delhaize has grown its online business rapidly, both in Europe and the US. Despite doubling its online revenue since 2019, Ahold Europe is smaller than Tesco. However, when the US and European online grocery businesses of Ahold are combined, Ahold is significantly (about 30%) bigger than Tesco.

Thus, one can say Tesco is the biggest in Europe in terms of online grocery revenues, but Ahold and HelloFresh have bigger online grocery businesses. Both companies have significant International online grocery operations.