ICA continues to outgrow market and improve profitability

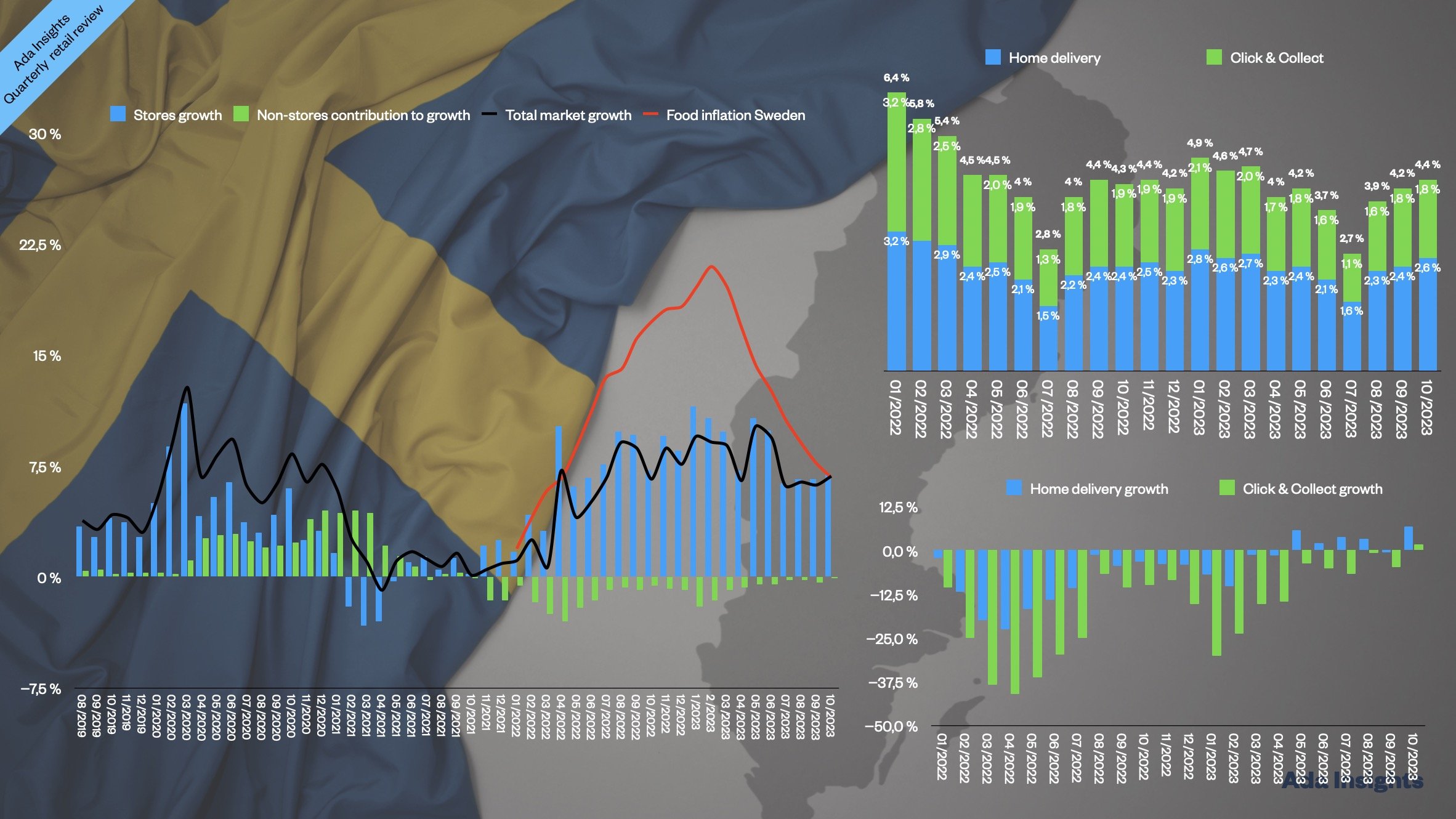

The Swedish grocery giant ICA reported another strong quarter of above-market growth. For the third consecutive quarter, ICA grew faster than the Swedish grocery market. The company also grew faster than its main competitor, Axfood.

When comparing growth figures, one has to remember that Axfood (and its growth engine, Willy’s) had extraordinarily strong comparable growth figures from Q2/2023. A year ago, Axfood grew by +12,6% (Willy’s +19,8%). On the other hand, ICA’s growth a year ago was only 6,5%, with inflation racing at 15,5%.

Again, ICA’s growth was driven by the hypermarket chain ICA Maxi, which has spearheaded ICA’s price investments over the last 6-9 months. Maxi even outgrew Willy’s for the third quarter in a row.

The company’s strong revenue growth is partly due to its strong price investments. However, the price investments have not impacted ICA Sweden’s profitability. The company's profitability has improved since ICA started to promote prices more heavily in its stores late last year. For the last three quarters, ICA’s operating income has grown significantly faster than its revenues (12,6% vs. 3,9%).

This might be due to the increased sales volumes that improve many operational aspects of running a grocery business, from sourcing to logistics and store operations. The improved profitability might result from improving customer sentiment due to lower food inflation. One also has to wonder if ICA has been as aggressive in lowering prices as the store communications might suggest.

If ICA has outgrown the market for three quarters in the physical stores, this was the first quarter when ICA online grew faster than the market. Online currently represents 2,8% of all revenues for ICA.

Pharmacy with another strong quarter

The ICA Hjärtat pharmacy chain reported another robust quarter with fast revenue growth and even faster profitability growth. Hjärtat has grown revenues for 13 consecutive quarters, of which the last five have seen double-digit growth. On an annualised basis, Hjärtat surpassed 20 billion SEK for the first time.

With the strong growth, the pharmacy chain is approaching 5% EBIT margins, something it has not managed earlier.

Growth for Hjärat was driven by both channels, even though online grew significantly faster (+21,9% vs 9,6%). With 2,2 billion SEK in revenues online (Last Twelve Months), online represents 11% of Hjärtat revenues. Despite strong growth, Hjärtat is still trailing the biggest online pharmacy Apotea. Hjärtat online is only 40% of Apotea’s revenues.

“Price investments led to a slightly weaker gross margin for ICA Sweden. Cost savings (among other things in e-commerce) and improved efficiency (within logistics, for example) meant however that operating earnings were largely on a par with the previous year”