ICA continuing to lose to the market and especially to Willy’s

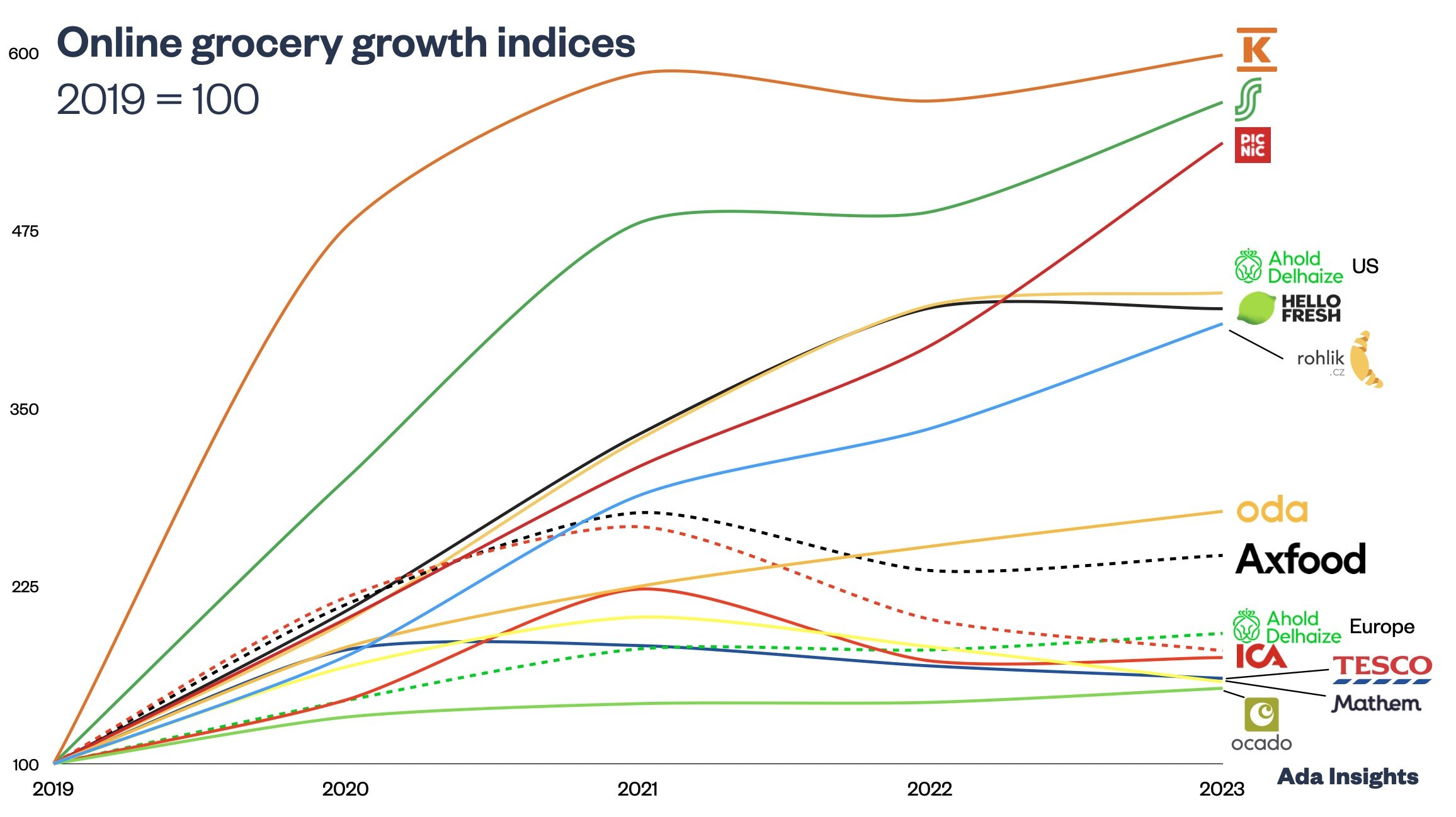

The Swedish grocery giant ICA has struggled in the high inflationary period in the grocery market. The pandemic-era winner has grown less than the market for the last seven consecutive quarters. The decline has been even more dramatic for the online channel, which has lost to the market for nine quarters. And ICA used to be the channel’s clear market leader and growth setter.

The volume and market share declines have caused actions in ICA. The company has launched price competition and is looking for organizational efficiencies. Also, the company seems to be upping its investments, up almost 75% from the previous year. Now would be an essential time for ICA to invest in prices and the store network.

“slowly but surely, we are nearing a market in which we have positive volume growth again. This will not come free of effort, of course, but will require a clear customer focus and that we reach the finish line for the extensive improvement and efficiency work that is being conducted in all our operations.”

This all influences the profitability of the company. The Operating margin of ICA Sweden decreased from 4,8% to 4,2%.

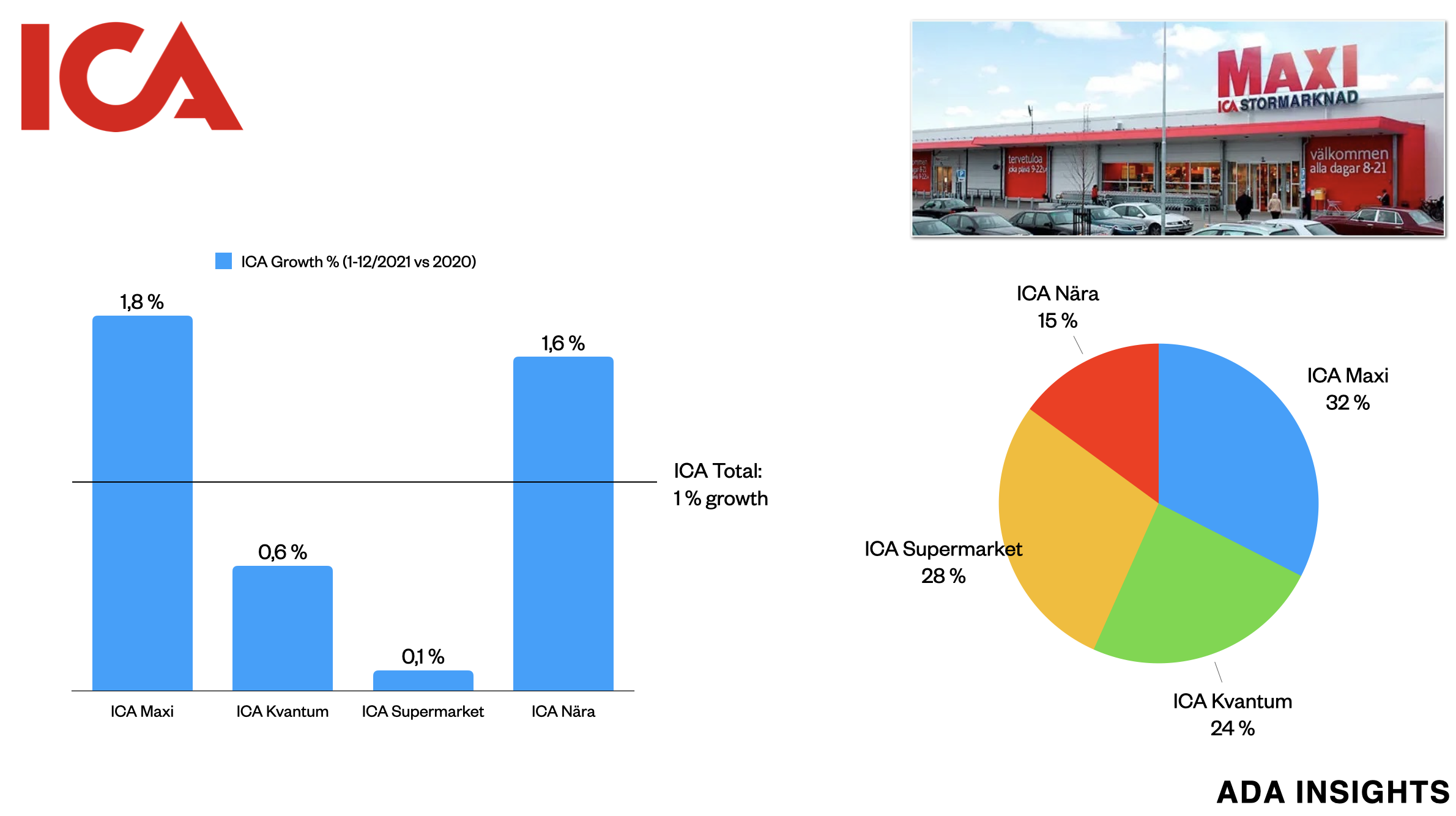

The challenges of ICA are highlighted by the rapid growth of its biggest competitor Willy’s by Axfood. The price-driven challenger has outgrown ICA and even the most price-competitive chain within ICA, the Maxi hypermarkets. The last time Maxi grew faster than Willy’s was in Q3/2021. Since then, Willy’s handsomely won the competition.

To put the difference in growth into context, ICA Maxi has grown by 11,9% over the last two years. At the same time, Willy’s has increased by 35%! Two years ago, Maxi was 36% bigger than Willy’s. Today the difference is 12%.

This loss in competitiveness for ICA has been noticed in the media also. Despite the increased activeness with regard to the price cuts, some commentators have been asking for more drastic measures. Thomas Ohlen went on to suggest that ICA ought to invest in a new price-driven chain to compete with the discounters truly.

Long road to recovery for quality grocery

The results from both Kesko and ICA illustrate how difficult the current market situation is for both quality-driven grocers. The big question is whether the current situation is temporary or will become a more normal situation as it did during the financial crisis of 2008.

If this is the case, intelligent retailers would need to take more drastic actions to become more competitive in the face of price-driven challengers. ICA already made the company private, reducing the need to generate profits and potentially move them to the prices. Kesko and ICA need to figure out something new to differentiate from the competition truly, or else they need to plunge head-on to the expensive read-ocean price competition.