Axfood outgrowing ICA by a wide margin

As inflation has persisted, the soft discount chain Willy’s has continued running circles around its main competitor ICA Maxi hypermarket chain. In Q1/2021, the revenues of Willy’s were 79% of ICA Maxi’s revenues. Two years later, Willy’s has almost caught Maxi. Currently, Willy’s is 97% of Maxi’s revenues.

Willy’s has accelerated into a phenomenal growth trajectory. It is the only grocer in Sweden and probably among the rare in Europe that has outgrown inflation.

For the last three quarters, the company has recorded 20+% growth quarters. Willy’s has grown for 62 quarters in a row.

Axfood flying with Willy’s

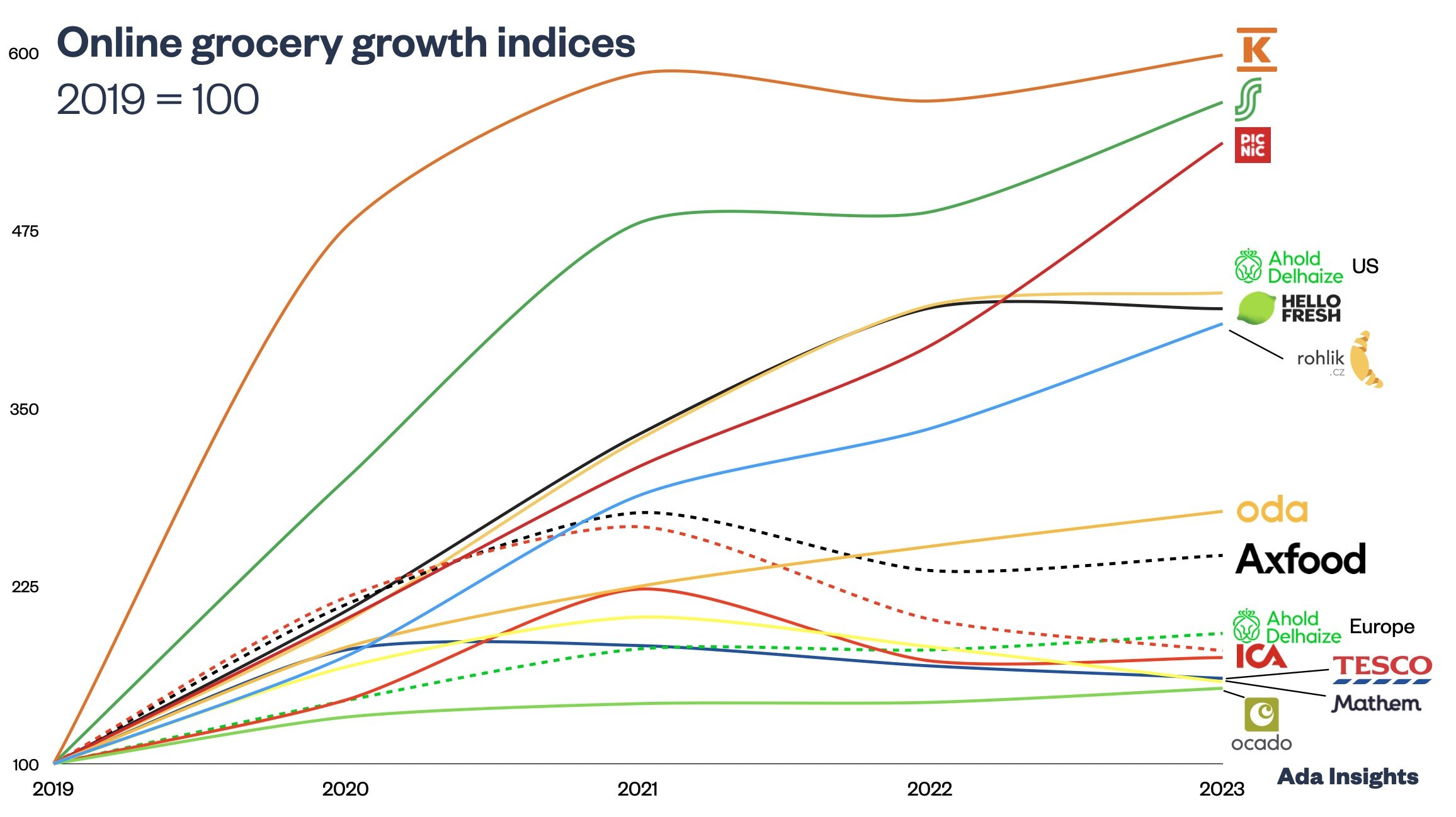

Axfood is grabbing market shares from competitors with faster-than-market growth, offline and online. For the online business, Axfood saw revenues decline -by 4,9% as the market declined by -14,4%. If one considers that Axfood divested its online grocery arm Mat.se in Q1/2022, the Like-for-Like (LfL) online sales grew by +2,0%.

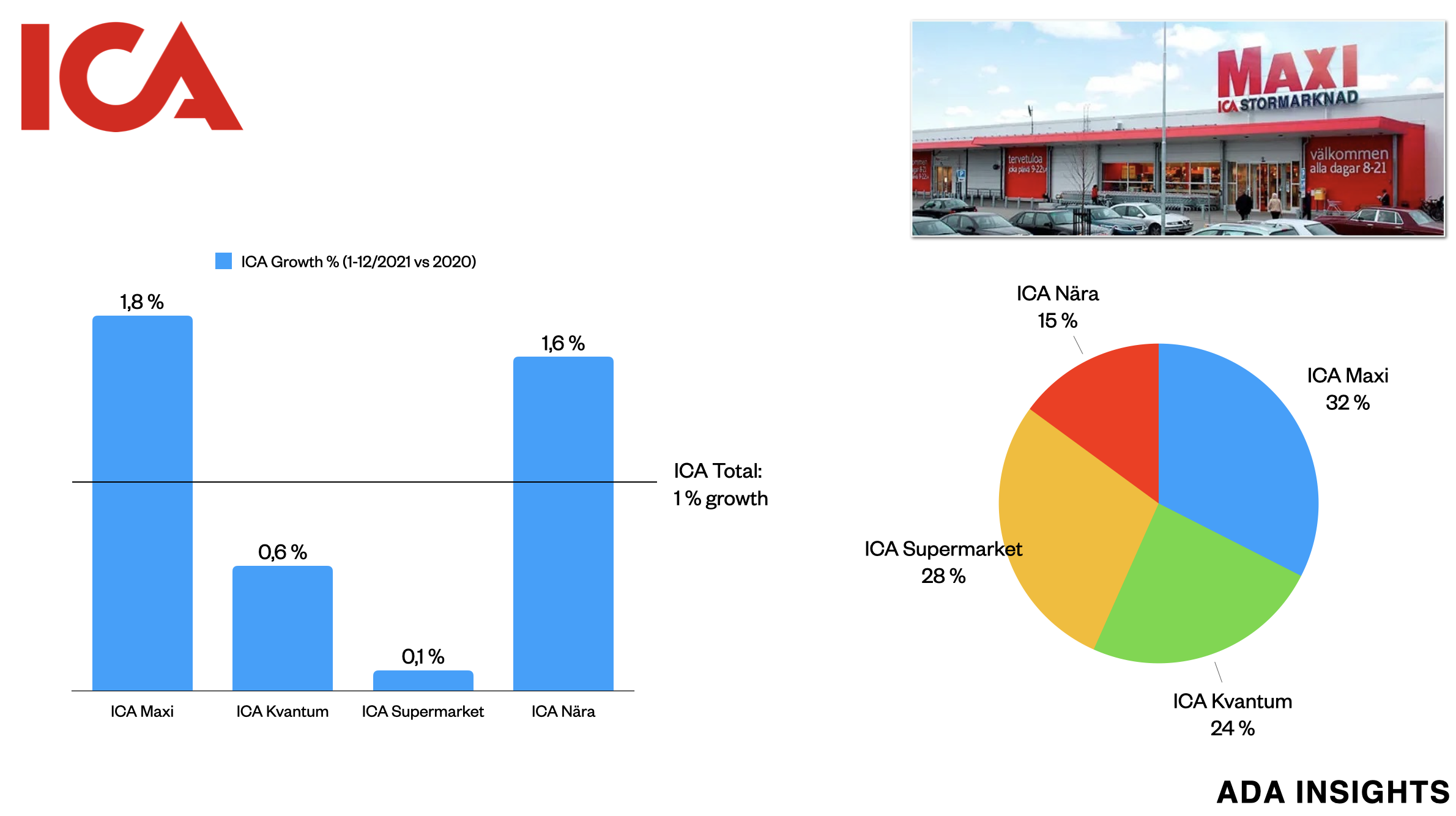

ICA losing heavily

As Axfood (especially Willy’s) grows rapidly, ICA struggles to match market growth, let alone inflation. ICA has grown less than the overall market for the last six consecutive quarters. The most severe loss of market share has been online. The market declined in Q1/2023 by -14,4%, but ICA’s online revenues dropped by -24%. Meanwhile, Axfood’s LfL online sales grew by 2%.