HelloFresh to a record quarter amid slowing growth

The German meal kit company recorded an all-time high revenue for the first quarter of the year with a first quarter of more than two billion € in revenues. The record quarter came amid slowing growth rates. However, one should note that the 5,3% growth came from a significantly heightened pandemic quarter Q1/2022.

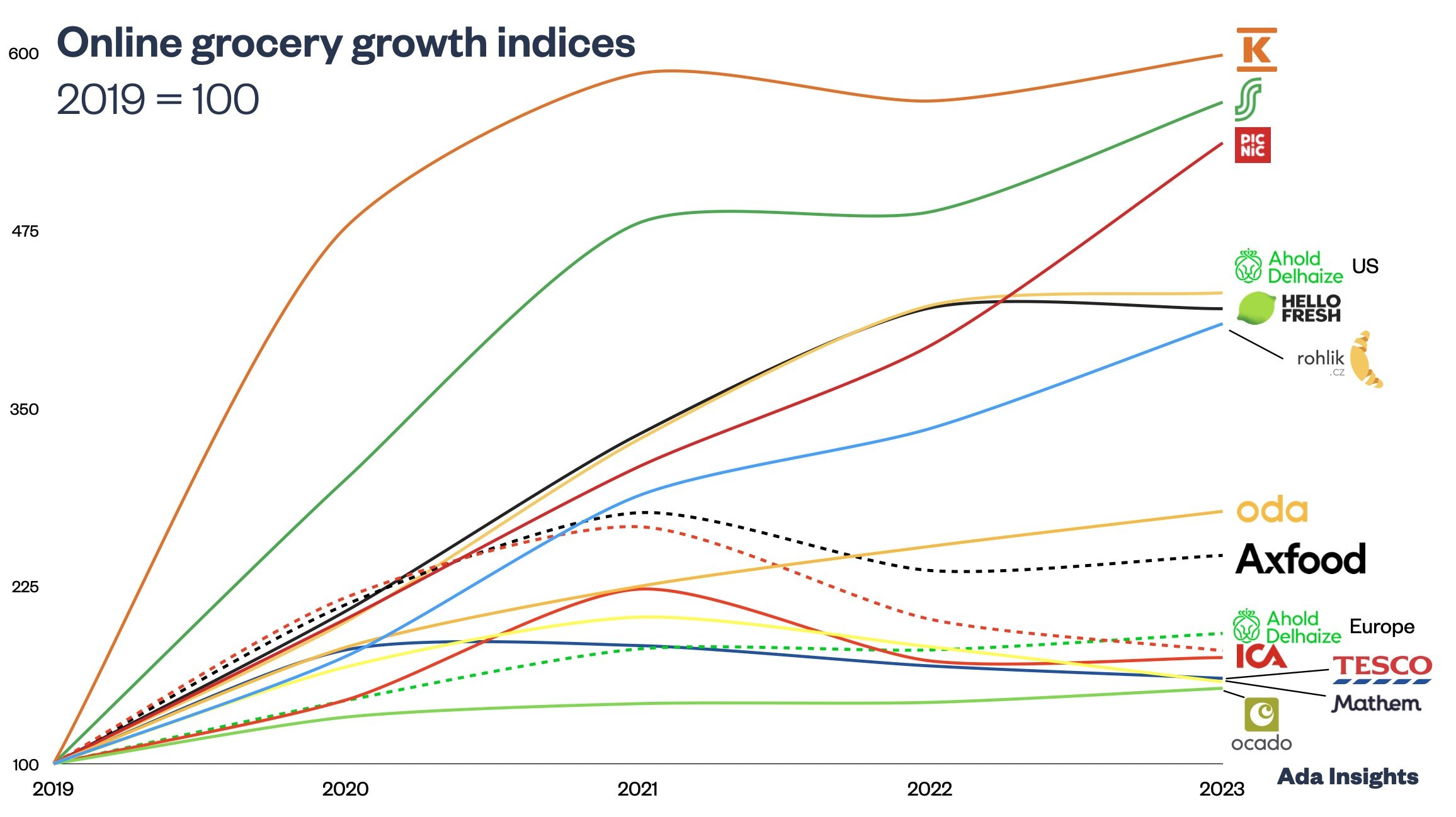

HelloFresh remains one of the few pandemic-time winners that has been able to keep the growth acquired during the pandemic and grow on top of that.

The North American business (including Canada from Q1/2023) drives the growth. The North American business grew by 9,7%, whereas the International business declined by -2,4%.

HelloFresh did slump to a loss with -9 million € in EBIT. The company improved its efficiency in fulfilment, but the increase in procurement expenses and marketing activities drove the overall business to negative profitability.

HelloFresh states that they are optimistic regarding growth for the year’s second half. The first half still has significant comparison figures from the pandemic times in 2022.

The most important reason for the positivity is that they have started to roll out their grocery offering, HelloFresh Market. In 2021 the service was offered in nine markets, whereas in 2022, it was already operating in 12 markets. There are plans to roll out the service to other markets this year. Expanding the service offering from purely meal kits is essential for customer satisfaction and the total addressable consumption potential. Another important driver for a positive customer experience is the possibility for the customer to customise the meals in the meal kit.

The third area the company is rolling out in the year’s second half is the ready-to-eat part with their brand Factor. As customers adopt more ready-to-eat solutions, the average order sizes also increase. This can be seen in the US business, where HelloFresh has significantly higher average order values in the international markets.