HelloFresh revenues decline despite strong average order increase

The meal kit company HelloFresh was one of the big winners of the pandemic era. It was able to keep its revenue growing much longer than many other online food stores.

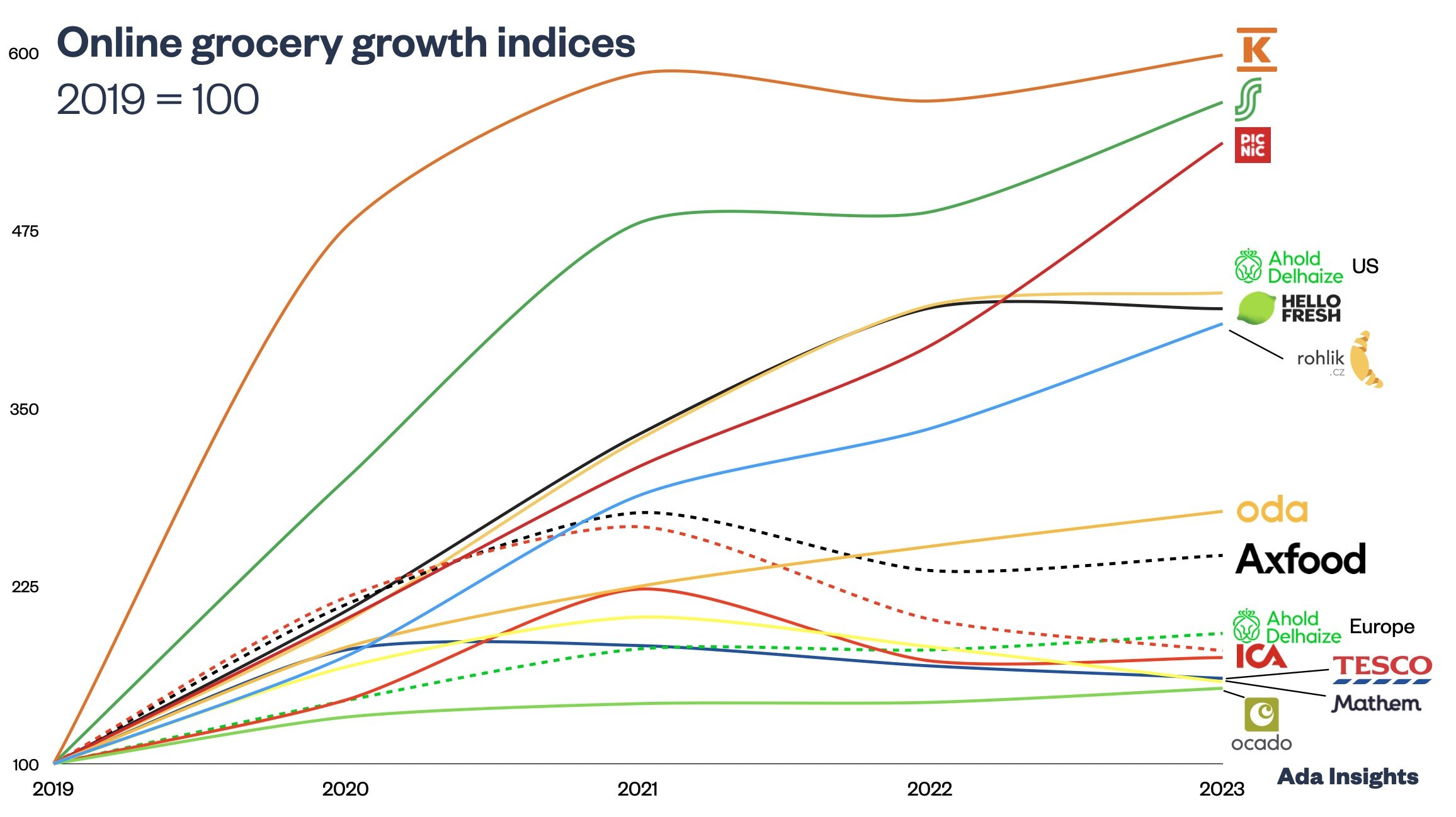

Whereas the sales of Ocado, Mathem, and other online grocery retailers dropped quickly in late 2021 and early 2022, HelloFresh continued to grow until Q1 2023.

Even during 2022, sales grew by double digits, when, for example, Ocado's sales had already fallen for a year. On the other hand, for the last 1,5 years, Ocado's sales have grown, while HelloFresh's growth has stopped.

This underlines the appeal of HelloFresh's subscription model. It provides stickiness to customers, who are easily attracted to order for longer than with the conventional one-off sales model of the traditional online grocery. The model has some similarities with the Costco model.

However, HelloFresh’s revenues were more resilient than the customer stickiness would imply. The company’s customer numbers have already dropped at the end of 2022. The decline in customer numbers and revenue has been received negatively by the investors. The share price of HelloFresh dropped by -42% as the company reduced its guidance for the coming years.

The company's sales remained on the growth track because, at the same time, the company has succeeded in expanding its product portfolio from lunch bags to ready meals, snacks, and morning snacks. This has steadily increased the average order value (AOV). In Q4/2019, before the pandemic, the average purchase was €48.6. At the end of last year, it was already €65. This is no less than 34% growth.

Due to the increased sales volumes and bigger average orders, the company's efficiency and profitability have improved significantly. HelloFresh's AEBITDA profits have increased almost tenfold (46.3 M€ -> 440.8 M€). At the same time, sales have slightly more than tripled.