HelloFresh losing Active Customers

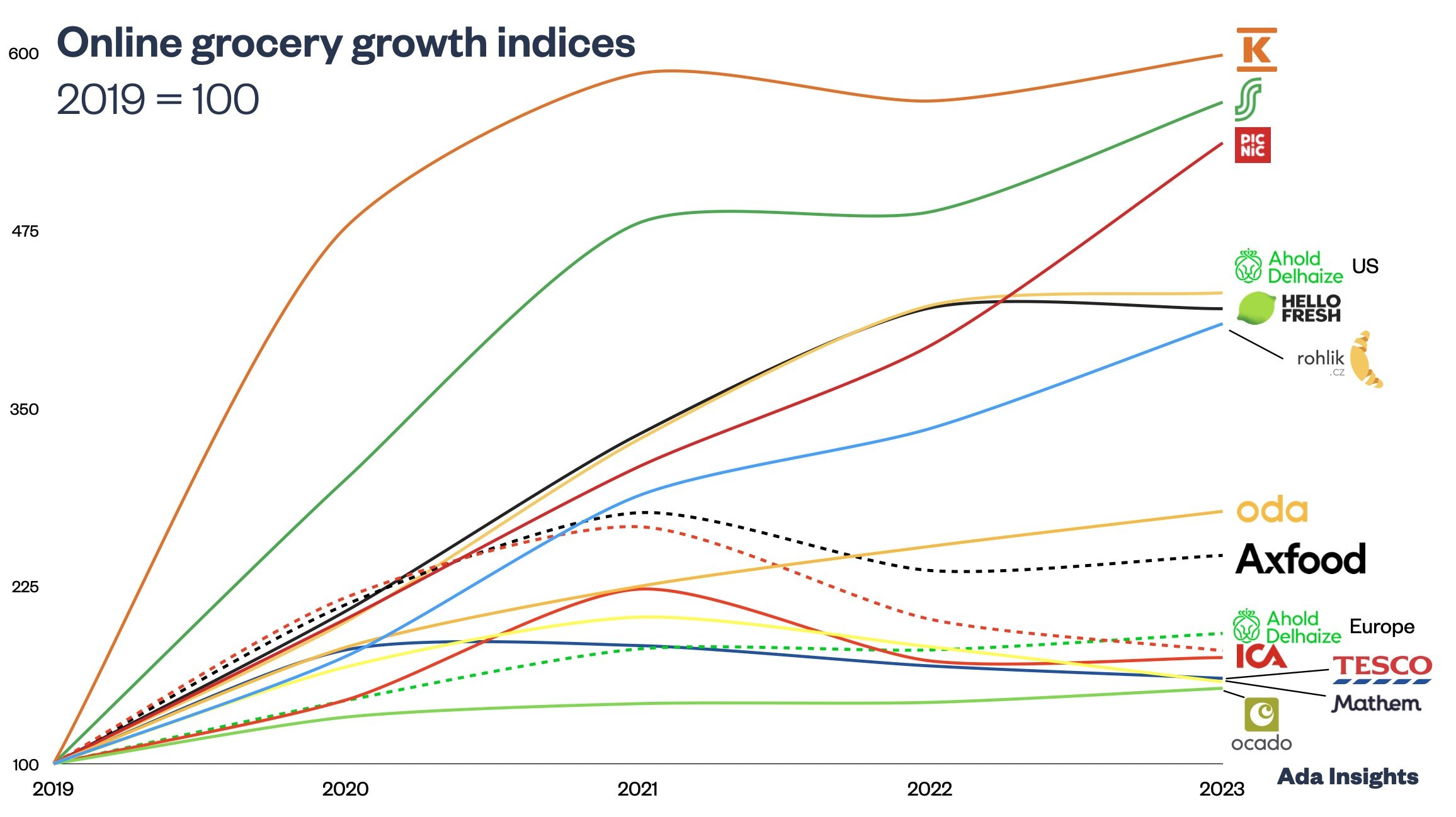

The German meal kit provider HelloFresh scaled explosively during the pandemic and sustained growth long after most of the pandemic-era growth stories started to decline. The subscription model of HelloFresh seems to enable the company to create more loyalty in the customer base. Thus, the number of active customers is an important metric, even though the company seems to stress the importance of other metrics, such as the number of meals shipped, the number of orders, and the efficiency of the operations.

The number of Active Customers started to decline in Q4/2022, two quarters earlier than revenue. This was because HelloFresh significantly improved its Average Order Value (AOV). AOV jumped slightly during the early pandemic but remained relatively static. However, during late 2021 and 2022, the AOV increased by almost 30% (from 50,2€ to 64,2€).

The number of orders has declined almost the same as the number of Active Customers. Thus, one could conclude that individual customers have increased significantly as less profitable customers have declined and the existing customers have ordered more per order, improving the order economics.

The encouraging increase in the AOV results from the company diversifying its product offering. HelloFresh has introduced the ready meal offering of Factor to more countries. At the same HelloFresh Market offering (“curated selection of quick breakfasts, lunches, snacks, desserts, and other essentials”) has been rolled out after the initial trials in the Benelux region.

HelloFresh Market offering

The significant growth potential for HelloFresh is to start identifying and acquiring more of these higher-value customers (with higher AOV and more orders). This would improve the efficiency and profitability of the companies as individual orders have more products (more gross margin per delivery), and the customer acquisition costs can be amortised over a more extended period if the customers remain more loyal.

In the Q3/2023 report, the company discusses more encouraging signs for the last quarter of the year.

“September was already better than August, July and June. October should improve versus September, so should November and December.

International has already started to trend positively on active customers year-over-year.”