Inditex profits soar as the integrated business model reaps the benefits

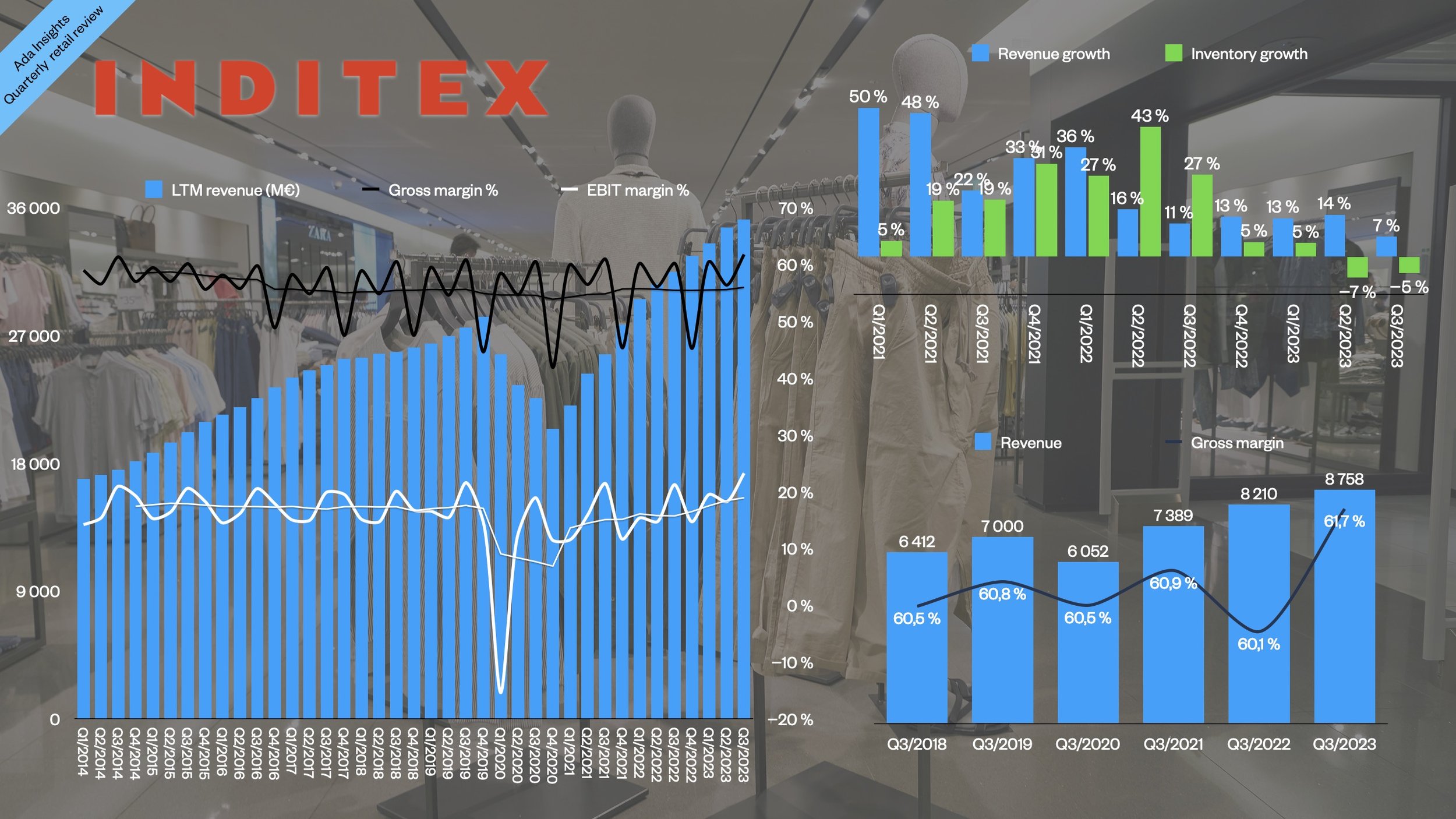

There is a not lot to say about the stunning performance of the Spanish fast fashion giant Inditex. The company robust revenue growth, but especially impressive the growth in profitability. Both gross and ebit margins improved significantly.

The company emphasised multiple times in the quarterly presentation that the integrated nature of the business model is what distinguishes the company from the competition.

Inditex did report a ”satisfactory sales growth”. For the first nine months of the year revenues grew by 11%. The satisfactory part of the revenue growth is the fact that the quarterly growth has slowly declined. In Q3 the growth dipped to single-digits.

This was the first time since the end of the pandemic that the growth went below 10%.

Inditex outpacing H&M, especially in profitability

Same time as Inditex continued to grow, the company was able to reduce the inventory levels, improving already robust profitability. Also the margin growth of Inditex outpaced the revenue growth (9,4% vs 6,7%) taking the Gross margins significantly higher than previous year.

The management of Inditex thinks that they still could improve the Gross margins by another 75 basis points.

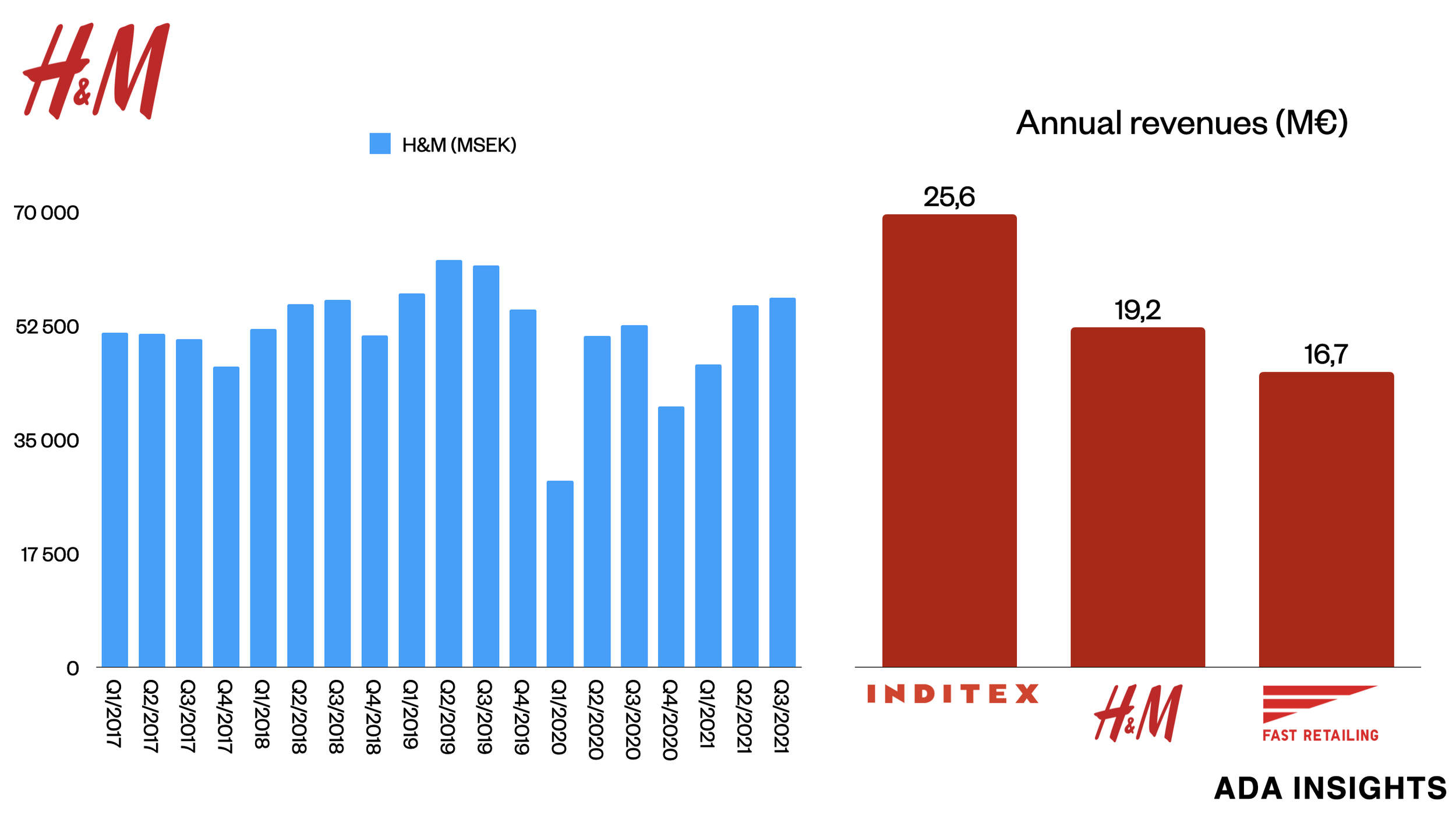

The outperformance of Inditex is illustrated when compared to the main competitor, H&M. Before the pandemic both companies had somewhat similar gross margins. Inditex has for a long time had quite significantly higher profitability (EBIT margins). However, that difference has started to grow over the last year.

Similarly Inditex has been able to grow a bit faster than H&M. However, big part of the difference in revenues (in euros) is related to the exchange rates, as the H&M revenue is reported in Swedish Krona.