Inditex - the golden standard in retail operational excellence?

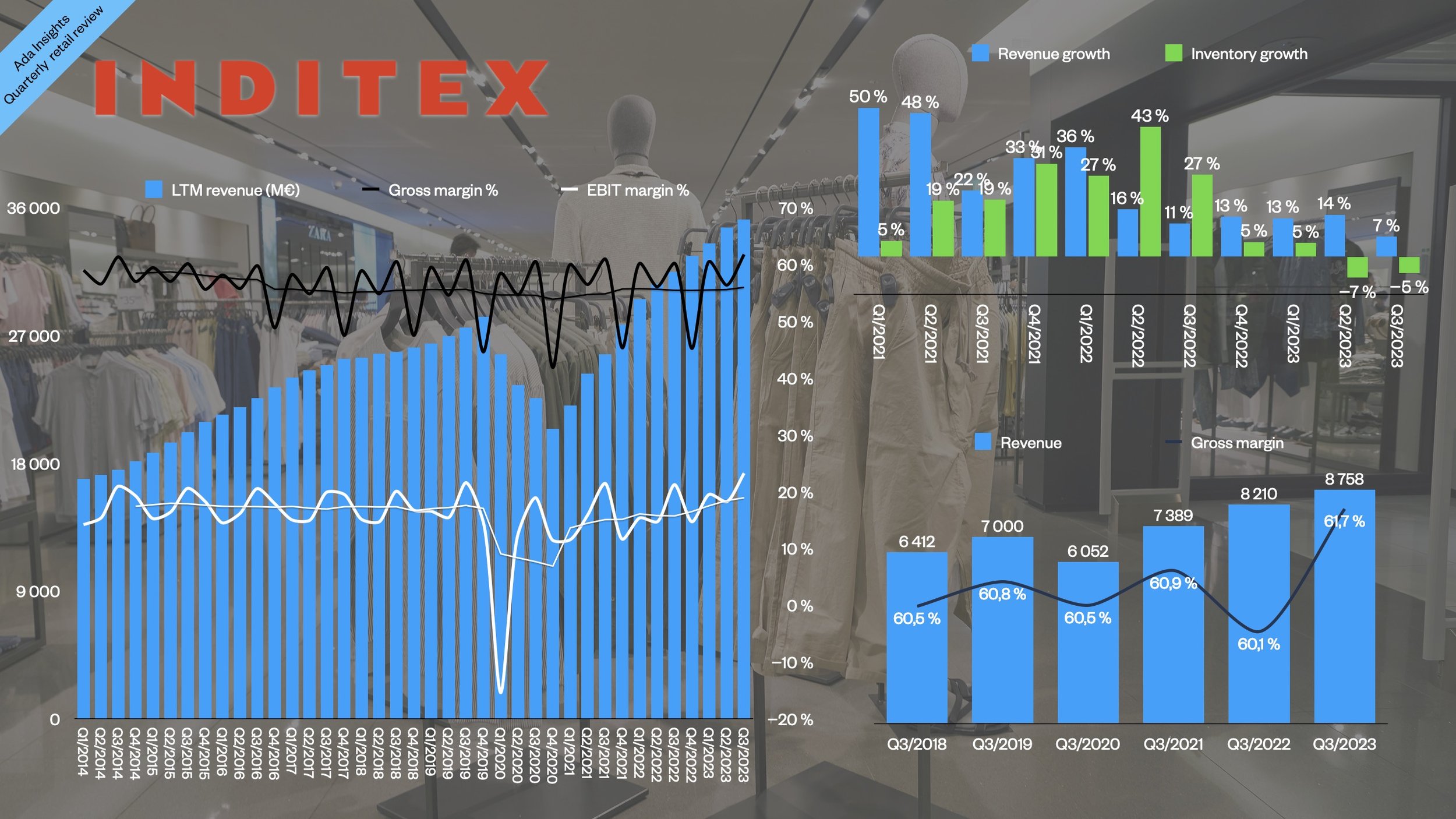

The Spanish fashion giant Inditex reported another strong quarter with +14% revenue growth. The most impressive part of the growth was Zara (73,4% share of total revenue) reporting a +13,1% growth.

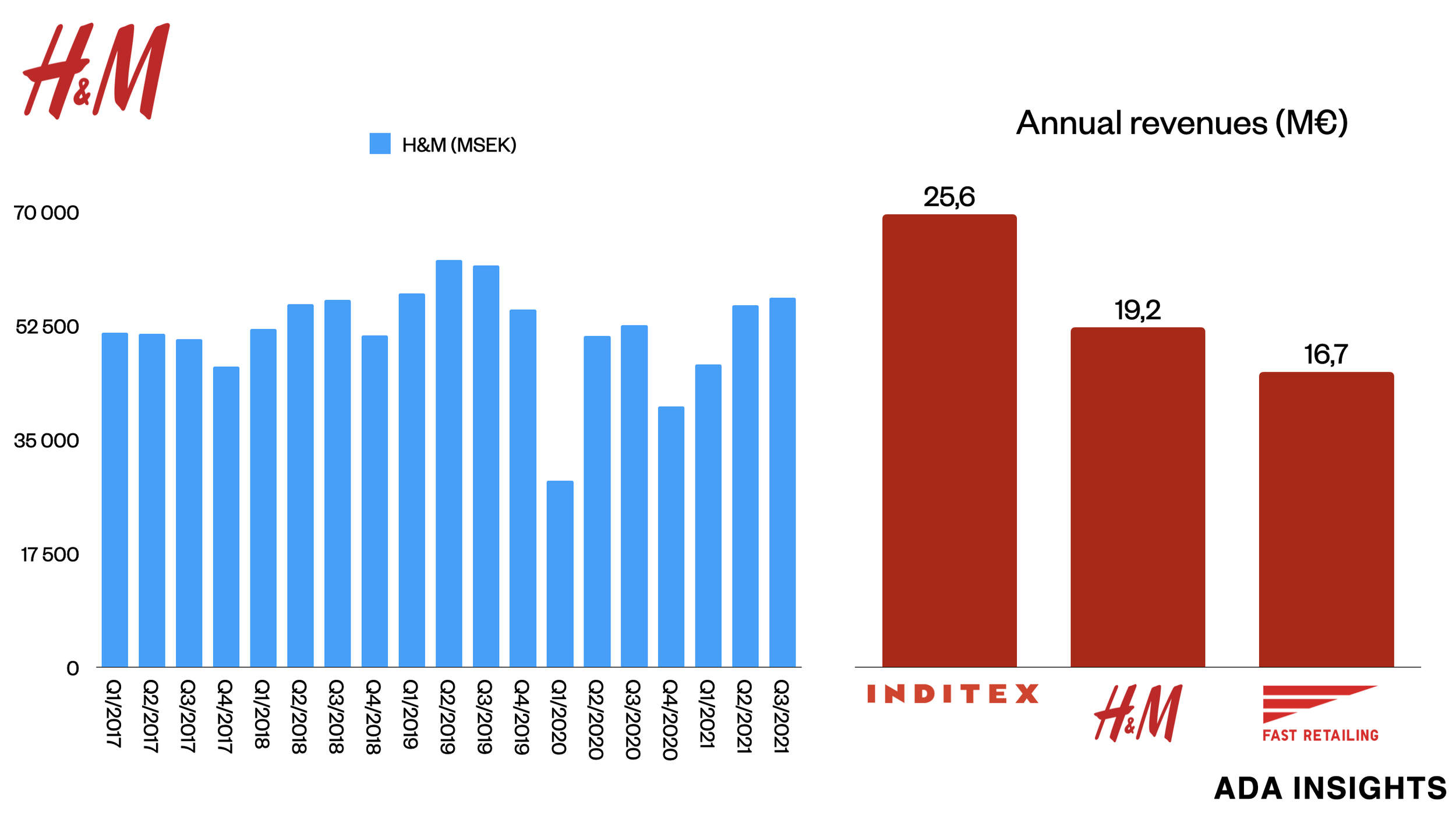

This improved growth of Inditex illustrates the differences between Inditex and its main rival, H&M, which has had more varied success and saw revenue growth slowdown.

Over the last years, Inditex has been able to grow faster than H&M. In Q4/2020, Inditex was only 13,5% bigger than H&M (in euros). This gap has widened to 40+% in 2022 and higher lately. This is partly due to the weak Swedish Krone that H&M operates in.

Is Inditex the best-performing retailer? Whether there are better companies out there, Inditex seems to be succeeding in the holy trinity of retail performance:

growing revenues

improving margins

higher market share (not precise data available)

The operational excellence of Inditex

Inditex’s operational excellence is highlighted by improving gross margins, strong cost control, and inventory management.

Gross margins improved by 0,3%-points from a year ago

Operational costs grew slower than revenue, and their share of revenue dropped from 29,9% to 29,4%.

Inventory levels declined by -6,9%, leading to improved inventory position. Inventory share was 10% of the Last Twelve Months (LTM) revenue (compared to 15% a year ago). Inditex now has a 50% faster inventory turnover compared to H&M.

This all led to

+40% growth in net income to 2,5 billion € in H1

+57% higher Cash from operations in H1

A lot of room to grow

The company reported that the US is the second biggest market, with 19,4% revenue. Europe (excl Spain) is still the biggest market with 47,8 % (with Spain 62,2%).

The big share of Europe illustrates how much room Inditex has to grow in both the US and Asia (18,4% of Inditex revenue).