HelloFresh sees first revenue decline and record profitability

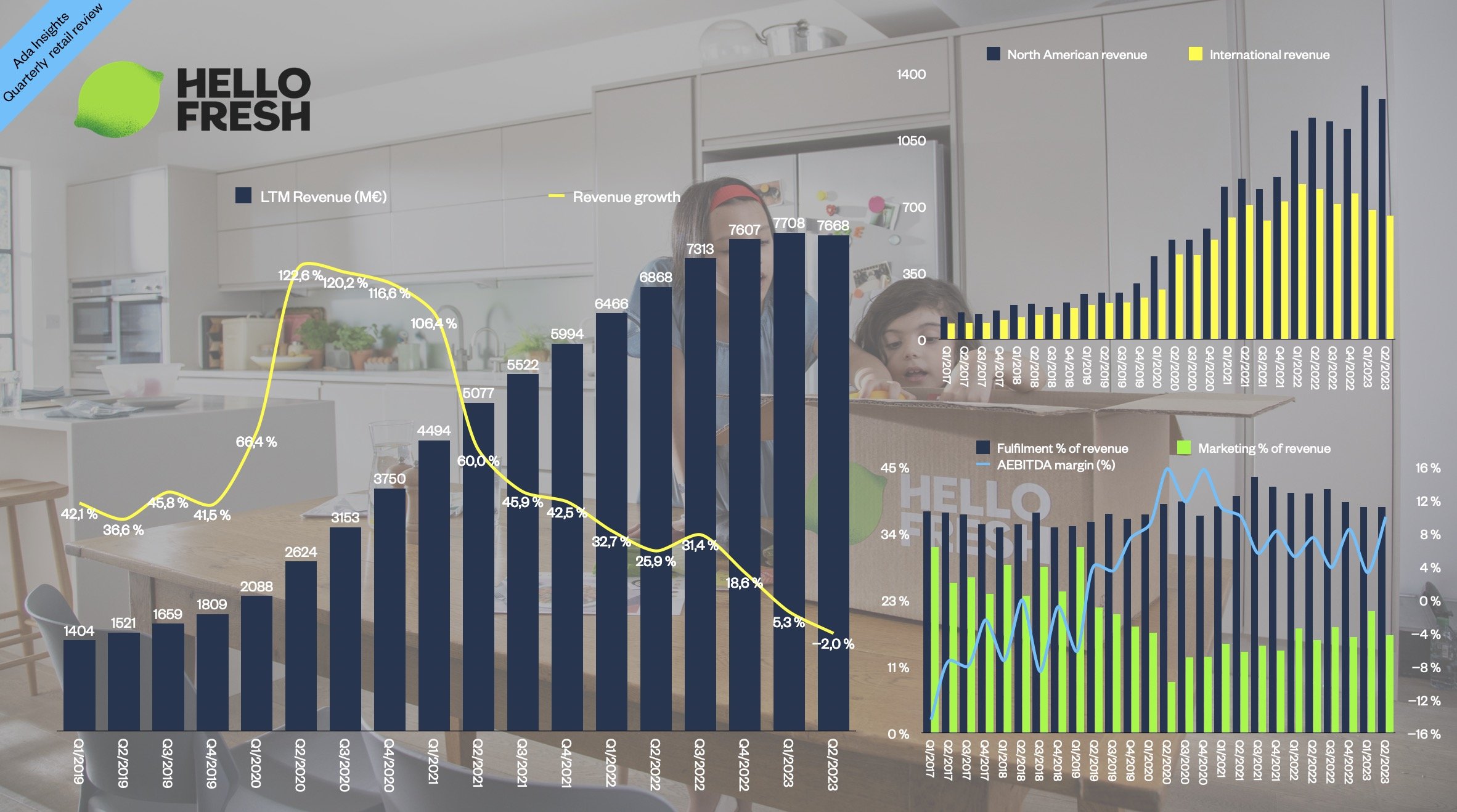

The world’s biggest meal kit maker (or a Direct To Consumer FMCG brand) HelloFresh, reported its first decline in revenue (in constant currencies slight growth) with a -2% slowdown. The revenue decline was driven by decreased active customers (7,3 million vs 8 million a year ago) and orders (30 million vs 32,26 million).

Of the business segments, International saw a steep revenue decline of -17,1%, whereas the North American segment (previously USA) grew by 8,5%. This was impacted by the change where the Canadian operations are reported as part of North America instead of International since the start of 2023. When considering this change, the International segment declined by only -3,3 % and was flat when considering the currency impacts.

Management challenge: transformation back to a growth company

Growth plateauing is a new situation for a company that has always grown rapidly. HelloFresh did make big adjustments to improve the profitability of the company. To achieve the big goal of becoming a 10 billion € company, HelloFresh needs to revitalise its growth. Time and again, the company's management has shown great ability to steer the company successfully.

One of the more encouraging signs for HelloFresh is that, according to management, the company has improved its customer base's Lifetime Value (LTV). This gives a lot of leverage in the future if the customer base's loyalty is improving. At the same time, the company stated that the Customer Acquisition Costs (CAC) have not increased. This would indicate that the product or customer experience adds value to the customers, and there is no need to “buy” customers who then leave the platform.

“After the massive scale-up over the last three years, when we more than tripled the business, these past months have certainly felt a little bit more like a transition period, but it has been healthy and made us the strongest version of HelloFresh that we win.”

Who said online grocery can’t be profitable?

The revenue decline was contrasted by the highest-ever profitability of 192 M€ in Adjusted EBITDA. This is 10% more than the 173,8 M€ during the pandemic peak in Q4/2020. The AEBITDA margin increased from 7,5% a year ago to 10% this year.

Improved efficiencies and higher Average Order Values (AOV) drove the improvement in profitability. The efficiencies were improved as the procurement expenses were reduced by -3,5%. At the same time, the fulfilment costs dropped by -7,5%. These improvements enabled HelloFresh to generate 20 M€ in Free Cash Flow (up from -140 M€ a year ago). Not many online grocers can generate that much cash per quarter.

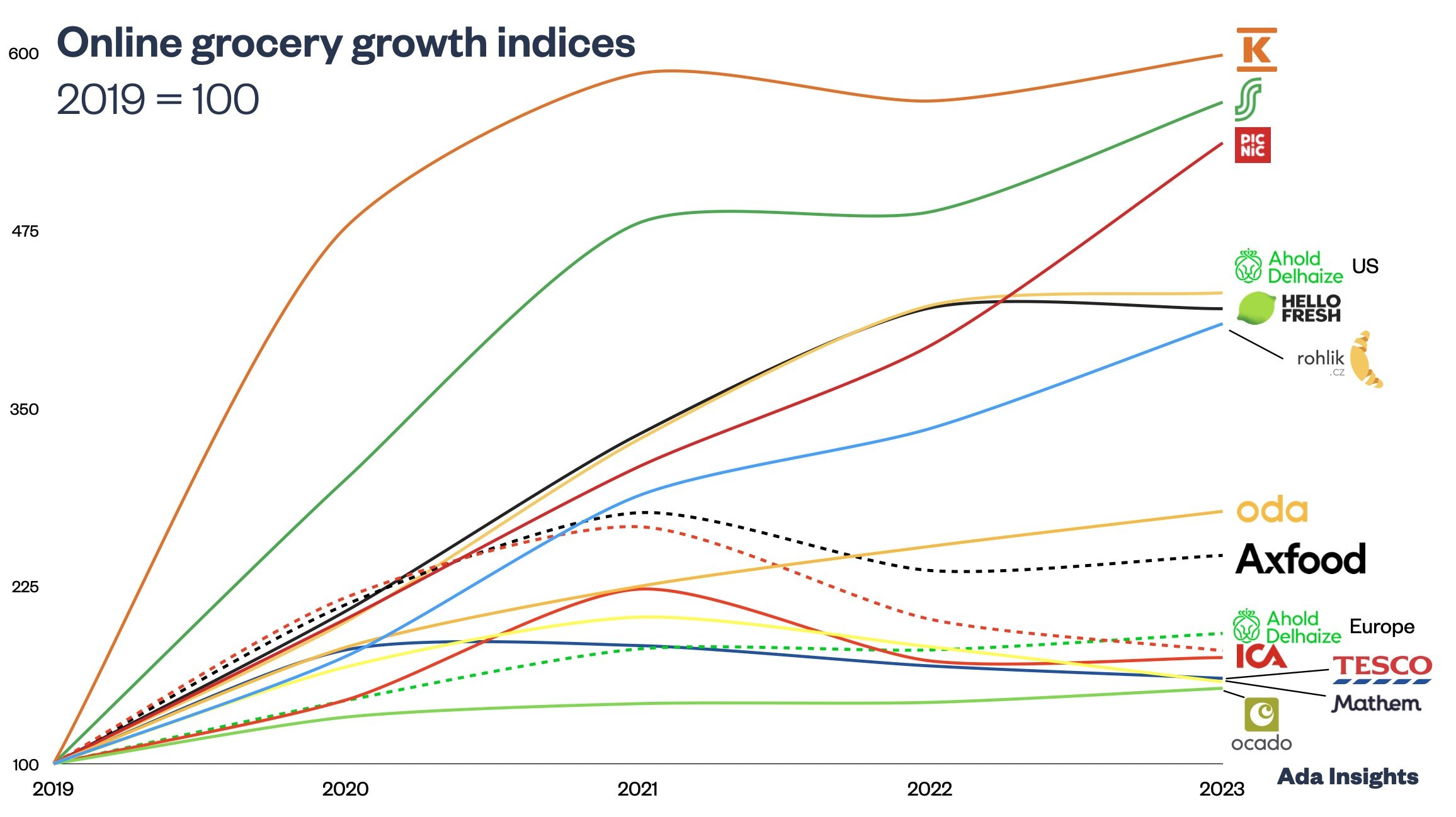

To put HelloFresh into context, with 7,7 billion € in the Last Twelve Months (LTM) revenues, the company is three times the size of Ocado.