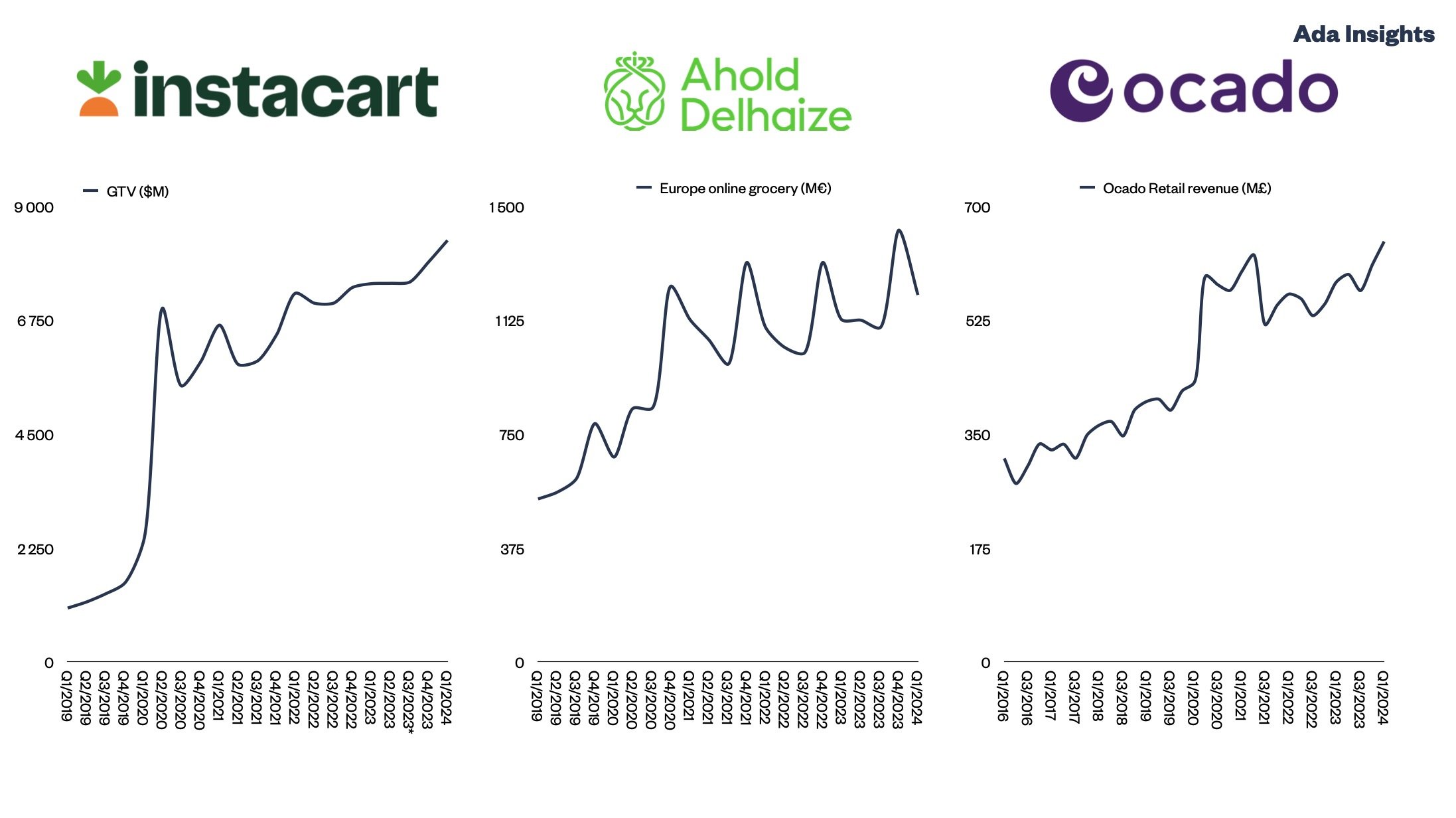

Instacart, Ahold and Ocado all show signs of growth for online grocery

Three big online grocery players in Europe and the US (Ahold Delhaize, Ocado and Instacart) report strong for the online grocery channels. Each of them has grown their revenues to surpass the pandemic highs. The last six months have given strong evidence that online grocery is back on a growth track after a couple of years of hiatus after the pandemic ended.

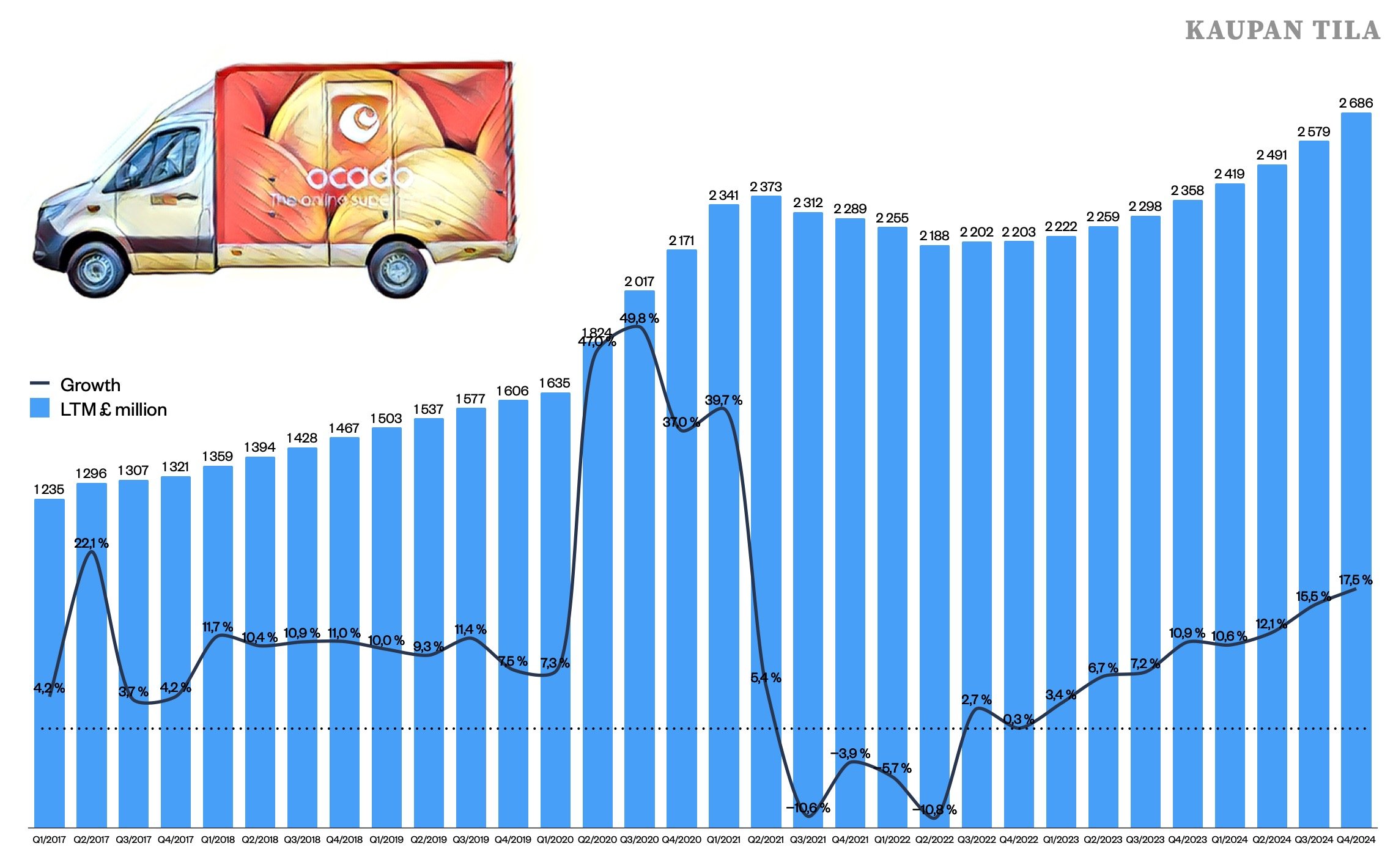

The UK-based Ocado saw probably the most significant drop in revenues during late 2021 and early 2022. Since then, the company has seen seven consecutive quarters of growth, and for the last quarters, the growth has accelerated to double-digit figures.

Ahold Delhaize growing online in Europe

Ahold Delhaize is one of the biggest online grocers in Europe. The company reported overall revenue growth (LfL +1,6%), driven by the European online channel (+8,9%).

Comparable US online revenue grew, but the overall revenue figure decreased due to the divestment of FreshDirect to Getir. However, the company states that the US banners Food Lion and Hannaford both saw double-digit growth for the online channel.

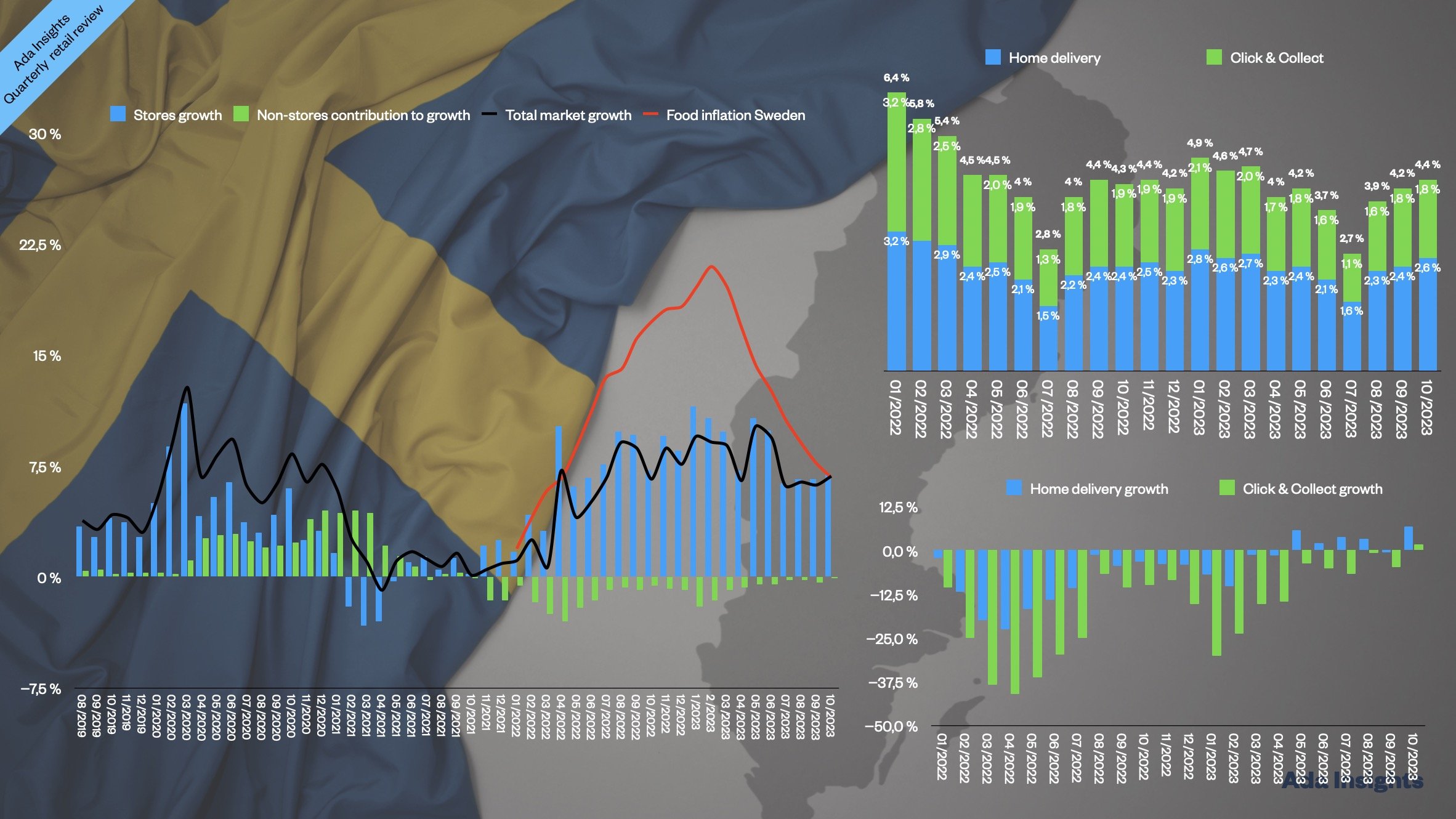

The company said that same-day services fueled the US growth. The convenience factor in online grocery shopping is growing rapidly for many retailers. Some time ago, Ahold announced a collaboration with Doordash. According to Ahold even more important seems to be the rapid click & collect proposition.

In Europe, Ahold Delhaize's online sales totalled 1,2 billion € in Q1/2024 and 4,8 billion € for the last 12 months. This represents over 15% of the company's revenues in Europe. With the non-food online arm bol.com, the online share climbs to 22% in Europe.

“Our decision to orient our online fulfillment capabilities towards more efficient less asset-intense, same-day delivery models, such as click and collect is really paying off. Our online sales in the U.S. grew 5% year-over-year in the first quarter on a like-for-like basis, fueled by new customer growth as well as strong retention of existing e-commerce customers. ”

Instacart continued strong growth

Instacart reported strong growth in revenues and Gross Transactional Value (GTV). GTV growth has accelerated for five consecutive quarters, jumping back to double-digit growth. This was the first time since 2022 that Instacart GTV has grown by double digits.

The 8% revenue growth was driven equally by Transactions (+7,9%) and Advertisements (+8,5%). During the first quarter of the year, Advertising revenue represented 26,5% of all Instacart revenue (28,6% for the last 12 months).

Similarly to Ahold Delhaize, Instacart emphasised the importance of convenience. Contrary to pre-pandemic customer behavior, on-demand orders have become the majority of Instacart’s orders.

“The number one reason customers use Instacart is convenience, which is why we keep making our service faster every year.

In 2017, the majority of our delivery orders were scheduled 4 or more hours in advance, while in Q1 more than 80% of delivery orders were on-demand, which means customers don’t have to plan so far ahead. About half of these on-demand orders were priority — our fastest delivery option with a median delivery time of less than 50 minutes.”