Zalando strengthens growth as Boozt and RVRC see slowing growth

The online fashion giant Zalando has reported a second quarter of growth after a lengthier streak of slower growth or declining sales. At the same time, the Nordic online clothing retailers Boozt and Revolution Race (RVRC) continued to grow, albeit at a slowing pace.

The stronger third quarter for Zalando resulted from a better start to the autumn/winter season compared to last year. The company stated that consumer demand has picked up throughout their industry. The B2C part of the Zalando business was the driver for the turnaround. After two quarters of declining revenues, the B2C business (about 90% of Zalando's revenue) went from a -8,7 % decline to a +4,3 % growth.

The B2B segment also reported growth of +11,1 %. The B2B growth led the Zalando platform's Gross Merchandise Value (GMV) to grow by 8 %. For the Last Twelve Months (LTM), the GMV of Zalando surpassed 15 billion €.

Boozt with a solid quarter

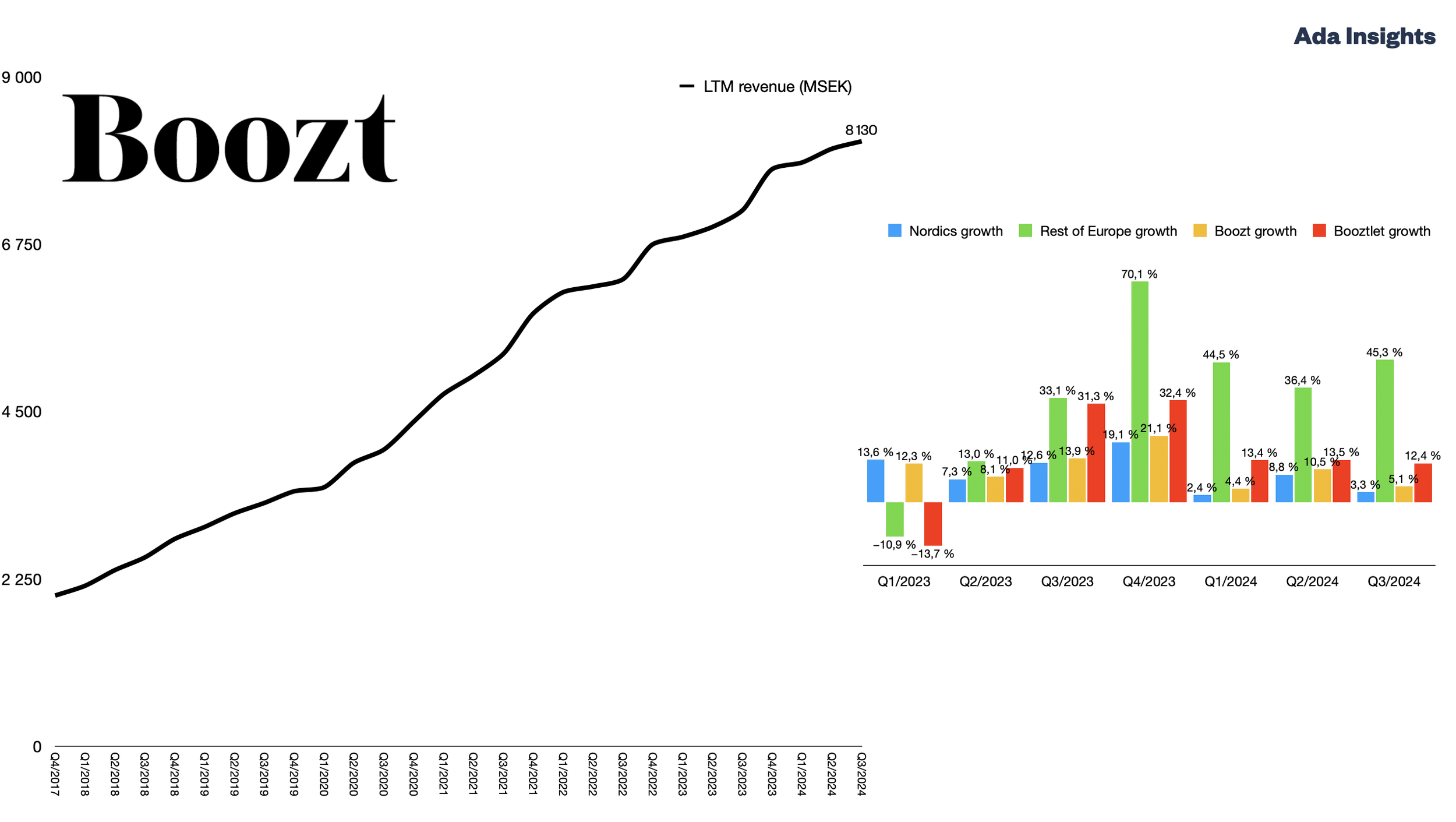

As the revenue growth for Zalando has improved for four consecutive quarters, Boozt has seen variation in the growth figures. However, the revenues continue to grow in all markets. Despite all the turbulence in the market, Boozt has been able to grow profitably.

The strength of the Boozt model comes from the company's multiple sources of growth. Even though the development of the Nordic market declined to 3,3 %, Booztlet (+12,4 %) and especially the Rest of the World (45+ %) grew strongly.

This quarter, with slightly lower growth and profitability, albeit a bit lower than a year ago, was regarded as “satisfactory” by Boozt management. The company stated that active customer numbers grew in all markets. The declining gross margin impacted the profitability. Maybe due to more increased price pressure in a challenging market?

Revolution Race with declining growth

Revolution Race has been growing robustly over the last few years. It has reported more than 10% growth for seven consecutive quarters. In Q3 the growth declined to 2,3 %. This was driven by the lacklustre Nordic market, which saw a -9 % revenue decline. The region was impacted by poor performance in Finland.

The most significant segment, DACH, continued to grow by 4 %, and the Rest of the World grew strongly by +13 %.