Nike revenues dragged especially by the declining Digital sales

Nike's recent struggles with its direct-to-consumer model and reduction of wholesale partners have been widely discussed in the media. The significant 10% decline in revenues during the latest quarter highlights the company's problems.

To put this decline in context, the company has reported similarly big revenue declines twice since 2007: once in Q1/2010 and once during the pandemic (for only one quarter).

These poor numbers are especially concerning considering that the previous quarter also saw revenue declines, and the two quarters before were essentially flat. Nike last reported revenue growth a year ago, and even then, it was a meagre 2% — not great for a company that prides itself on growth.

Direct to blame?

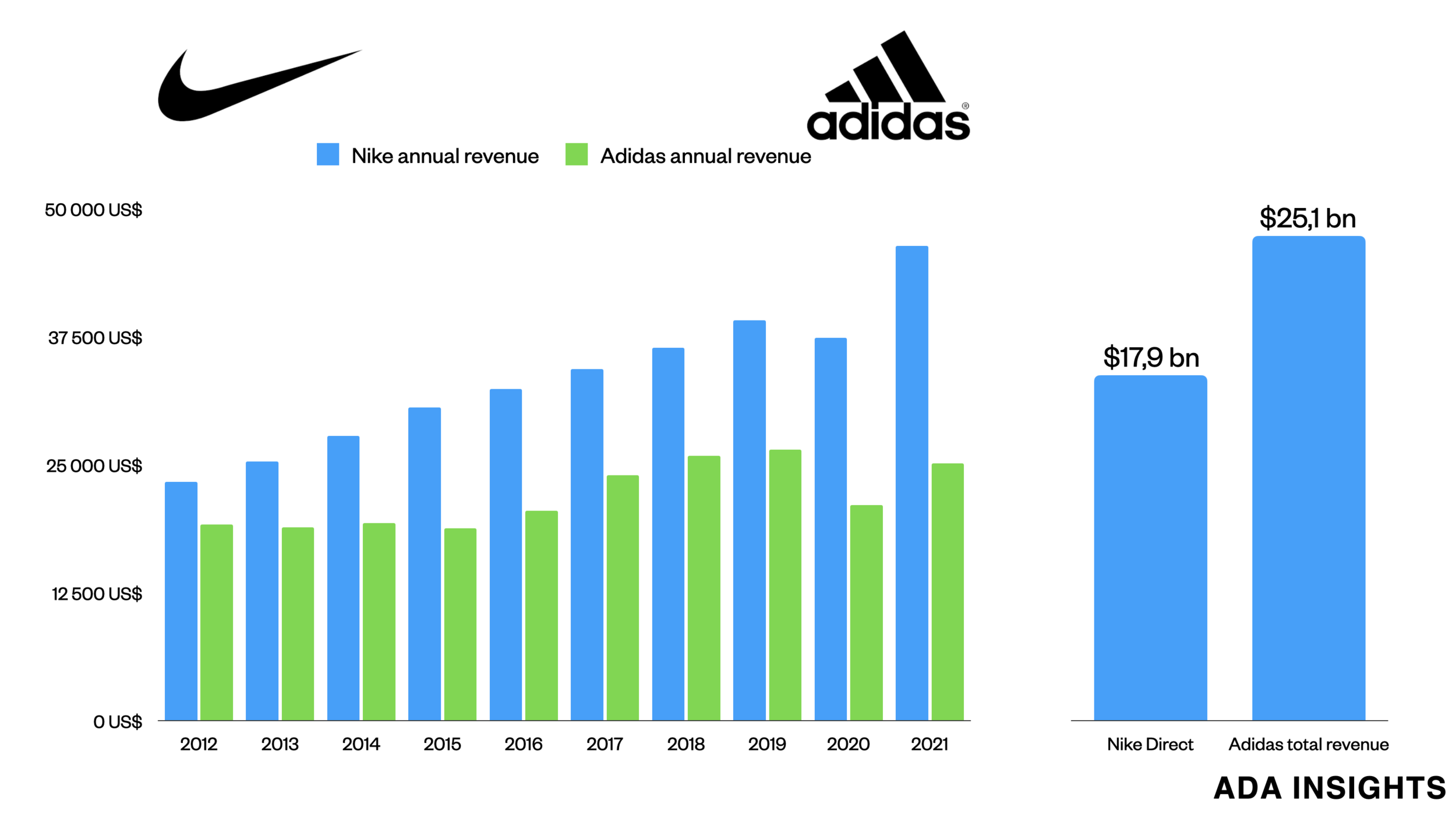

The Nike Direct strategy has received the brunt of the blame from the media. The direct business has indeed performed significantly worse than the wholesale channel. Revenue in the direct business declined by 13% this quarter, following a 7% decline last quarter. Wholesale revenues, while also down, declined by a lesser 8%.

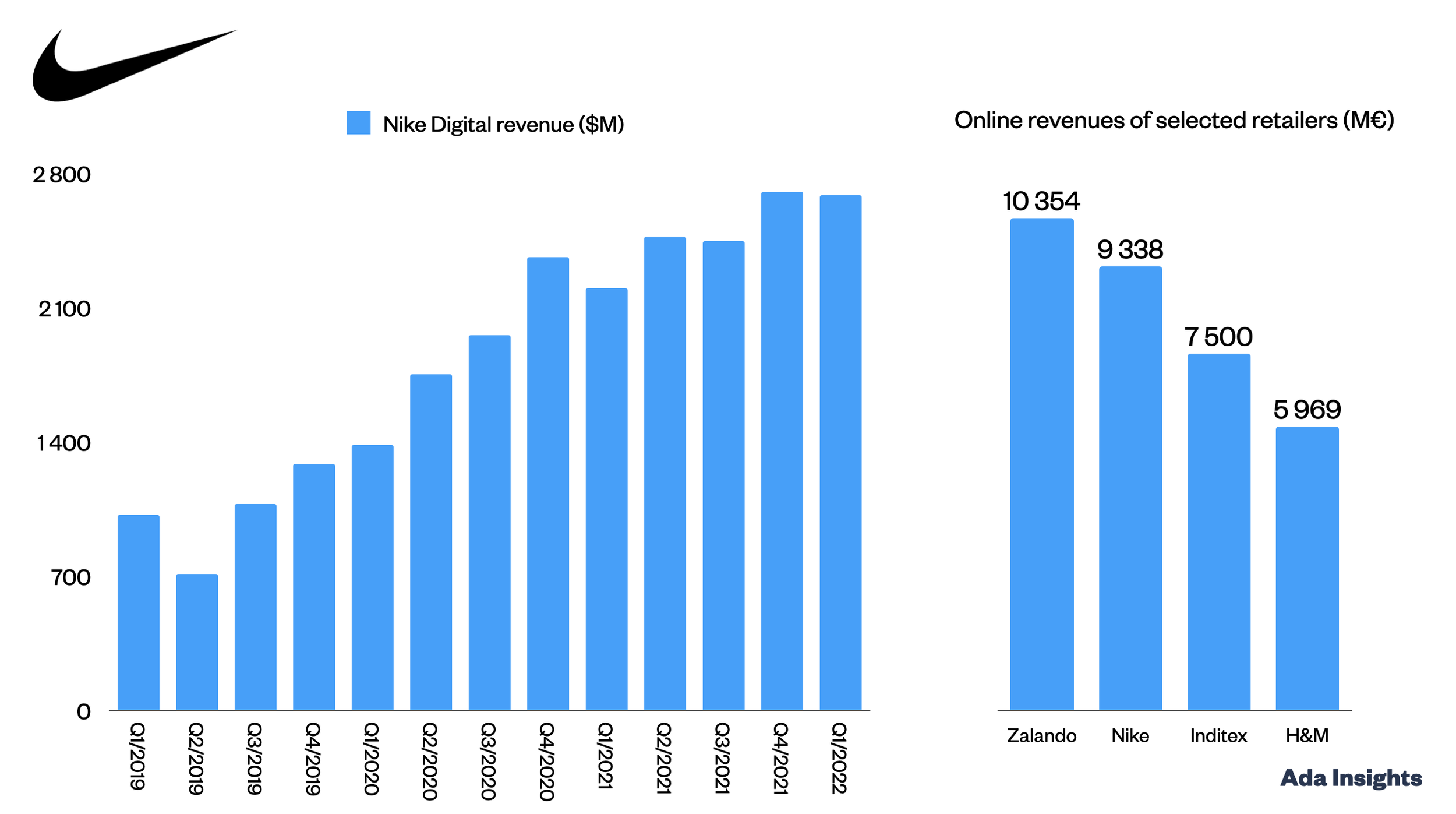

Digital sales reported the most significant declines for the Nike Direct business segment. Digital sales declined by a whopping 20%, following a quarter with a drop of 10%. While considering these revenue declines, one must keep the longer-term perspective in mind.

Nike Digital’s revenues have grown by 150 % over the last five years. At the same time, Nike’s store business has remained flat, and the wholesale business has decreased slightly. Thus, one has to remember that Nike’s entire growth over the last five years has come from Digital.

While the Nike Direct strategy could be viewed as a misstep, it's important to remember that the direct-to-consumer approach has benefits. Over the past two years, direct-to-consumer has accounted for over 40% of Nike's total revenue. This shift was accelerated during the pandemic and has remained elevated, especially as the company invested heavily in direct digital channels and cut ties with some retailers.

This strategy provides Nike with vast amounts of first-party data, something their main competitors don’t have. The 40% of revenues from the direct channels also gives Nike significant leverage in discussions with the wholesalers. Lately, that leverage has been misused.

Nike-lifer to return the company to its roots, and to more wholesalers?

The company's poor performance has led to the departure of the CEO, John Donahoe. He's being replaced by company veteran Elliot Hill, who has been with Nike for over 30 years. Hill is, in many ways, the opposite of Donahoe, a former consultant and eBay CEO. Donahoe spent years on the Nike board, the closest he has been to the world of sports apparel brands. Elliot Hill, on the other hand, famously started as an intern at Nike more than 30 years ago.

It'll be interesting to see how Hill approaches the direct-to-consumer business.

Even the strongest brands rely heavily on wholesalers and high retail sales volumes, primarily when operating at the same scale as Nike. The direct channel is traditionally more focused on customer and data quality, while wholesaling is viewed as a volume business emphasising mass-market products. Donahoe’s big mistake was to take Nike too far to the exclusive side of the retail industry.

One could speculate that Hill might want to focus on rekindling strong relationships with wholesalers while maintaining a vibrant direct channel. This potential shift in strategy could bring about a positive change for Nike.

To achieve this, he'll need a strong pipeline of exciting products — something easily overlooked in the world of big brands. Customers love and appreciate brands, but they’re only relevant if they offer exciting products. Nike used to embody this but may have lost some of its magic in its intense focus on digital and exclusive products. Retailers, especially those cut by Nike, have been eager to give selling space for new and upcoming brands, such as Hoka.

This was highlighted by the CEO of JD Sports (a major Nike seller) CEO Regis Schultz:

“”On Nike, we are more positive than you (the analysts) are. I think that we see some good things happening. I think that Elliott will bring energy in the business and focus on product and innovation and wholesale partners.

Consumer wants new products. And if they don’t find them from Nike, they will find them from other brands.””

Decline on all fronts, for some time to come

It's worth noting that Nike's revenues declined across all geographical segments and product lines, underscoring the breadth of their current challenges.

Europe -12 %

North America -11%

Asia -2 %

China -3%

Footwear -10 %

Apparel -9%

Equipment +15 %

Despite being a global behemoth, the company is still heavily driven by two segments: North America and Footwear. As CFO Matthew Friend told the investors during the quarterly investor call, the company is working to balance these segments.

“”Q1 showed that we took an important step forward as we shift our portfolio to create better balance in our business. We have been intentionally reducing the proportion of our business driven by our Classics Footwear franchises, Air Force 1, Air Jordan 1, and Dunk. And as expected, NIKE revenue in Q1 from these franchises decelerated, declining more than the total business as we tighten marketplace supply. We expect this trend to continue tempering our reported revenue over the coming seasons. …

We have taken the most aggressive actions in NIKE Direct and especially Digital. In Q1, these franchises were down nearly 50% versus the prior year on NIKE Digital while we saw much better sales trends in wholesale. Expect digital to decline double digit in fiscal 25.””