Nike continues to decline on all main business segments, while Adidas returns to growth

💵 Sales: €12.3 billion (-7.7%)

🪙 Gross margin: 43.6% (-1.0 percentage points)

💰 EBIT: 11.4% (-2.9 percentage points)

📊 Inventory growth: 0%

🏬 Nike Direct growth: -12.3%

🏬 Direct share of sales: 40.5%

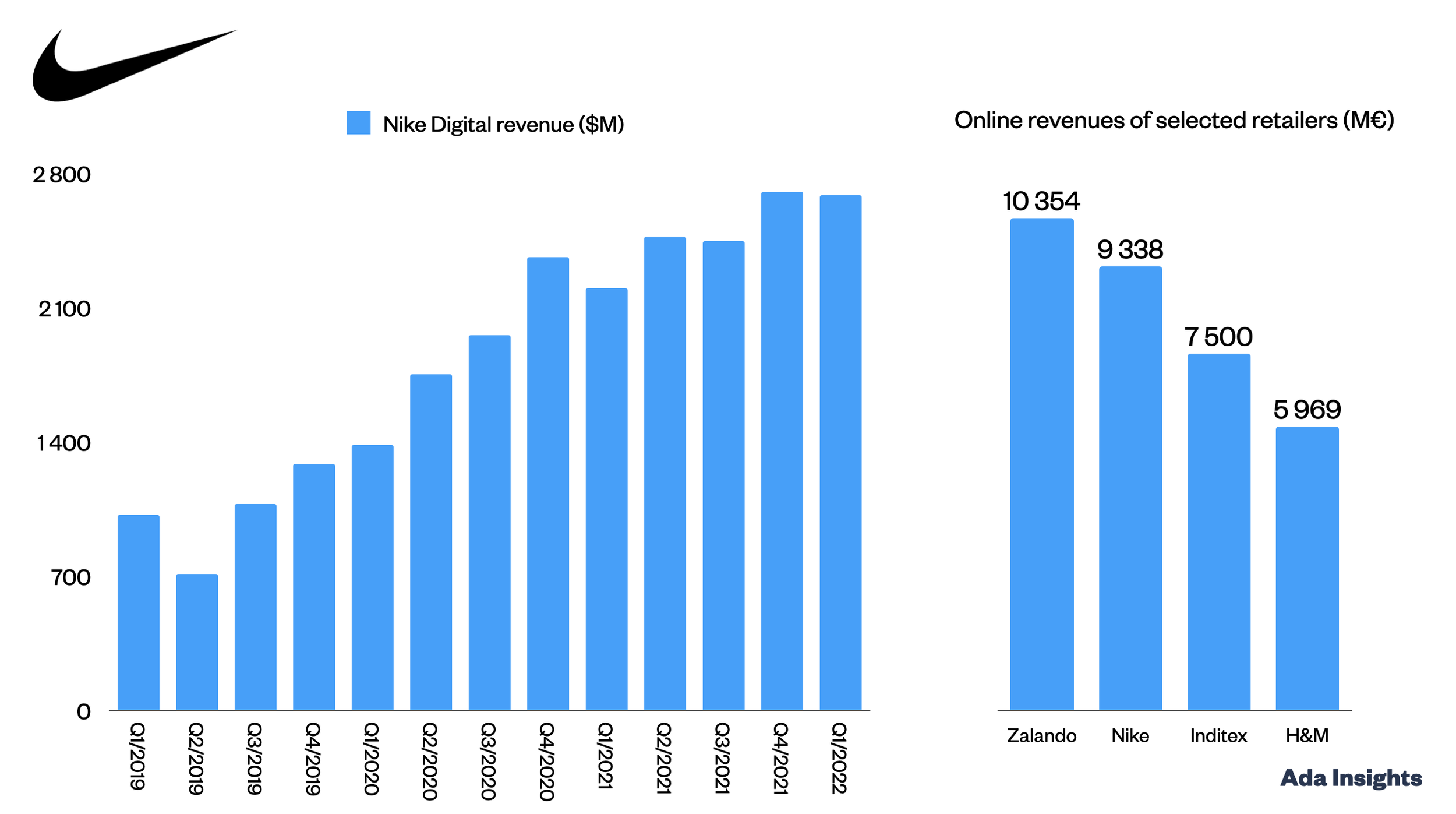

🖥️ Nike Digital growth: -21.0%

🏢 Nike Wholesale growth: -3.8%

👟 Footwear growth: -11.1%

👕 Apparel growth: -1.0%

🇺🇸 North America growth: -7.9%

🇪🇺 Europe growth: -7.4%

The sportswear giant Nike's Q2/2025 earnings report offered an unexpectedly bleak reading. Sales and profitability declined on all fronts. The drop was particularly sharp in digital sales through its Direct-To-Consumer (DTC) channels (Nike Direct), where sales fell by as much as -21%.

Sales through retailers, which Nike is seen as having neglected, fell significantly less than the company's DTC sales. Nonetheless, its DTC sales’ revenue share continues at a high level, over 40%.

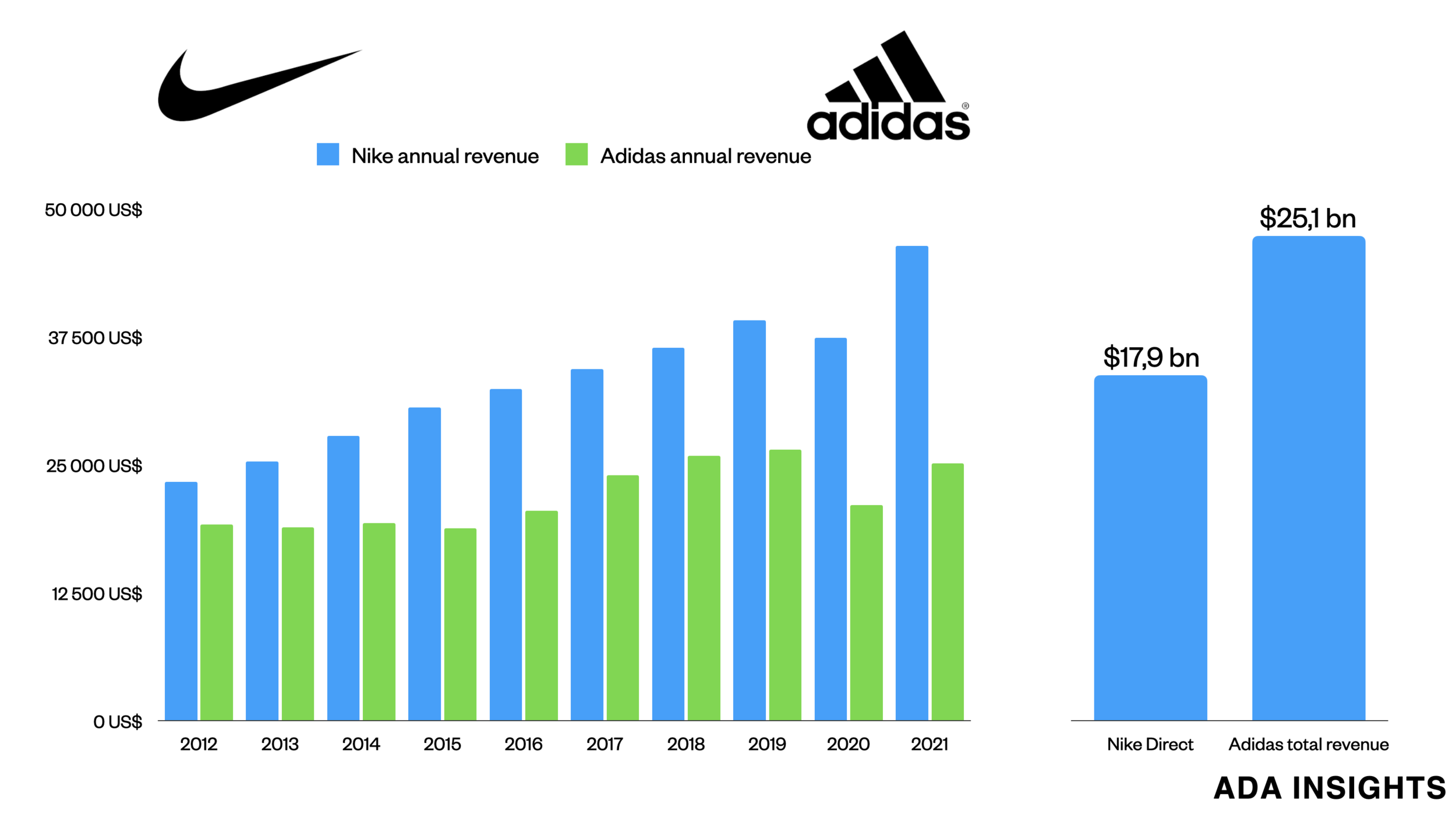

While Nike struggles with a downturn, its main competitor, Adidas, has found growth. However, Adidas's growth has not come naturally. Over the past 10 years, Adidas has only grown in short bursts, and there have been much more extended periods of decline.

Despite the differing developments, Nike's DTC channel accounts for three-quarters of Adidas' total revenue.

Nike's new CEO, Elliot Hill, emphasised in the earnings report that investments in Nike Digital have had too much impact on retail. Another point he highlighted was the company's focus on sports taking a backseat in decision-making (possibly referring to the rise of sneaker culture?).

“We lost our obsession with sport. Moving forward, we will lead with sport and put the athlete at the center of every decision.”