Strong performance of Nike in three charts

The athletic giant Nike reported another strong quarter, with sales growing by 14% despite the -10% decline in the Greater China region. A year ago, China was the second biggest market for Nike.

The North American market drove strong growth with +23%, and the Digital channel grew by 20%. The strong performance of Nike can be illustrated in three images.

#1: Reduction of inventories

Like many other non-food retailers, Nike has struggled with rapidly growing inventories. Since Q3/2021, inventories have been growing more quickly than revenue. In Q2 & Q3 of 2022, the inventory growth was especially fast.

In Q4/2022, Nike was able to curb the accelerating growth of inventories. In Q4, inventories and revenues were growing approximately at the same speed. However, like with so many retailers (like Target, LINK), this came at the cost of margins. Nike's gross margins dropped from 46,6% a year ago to 43,3% in Q4/2022.

#2: Direct catching up Wholesale

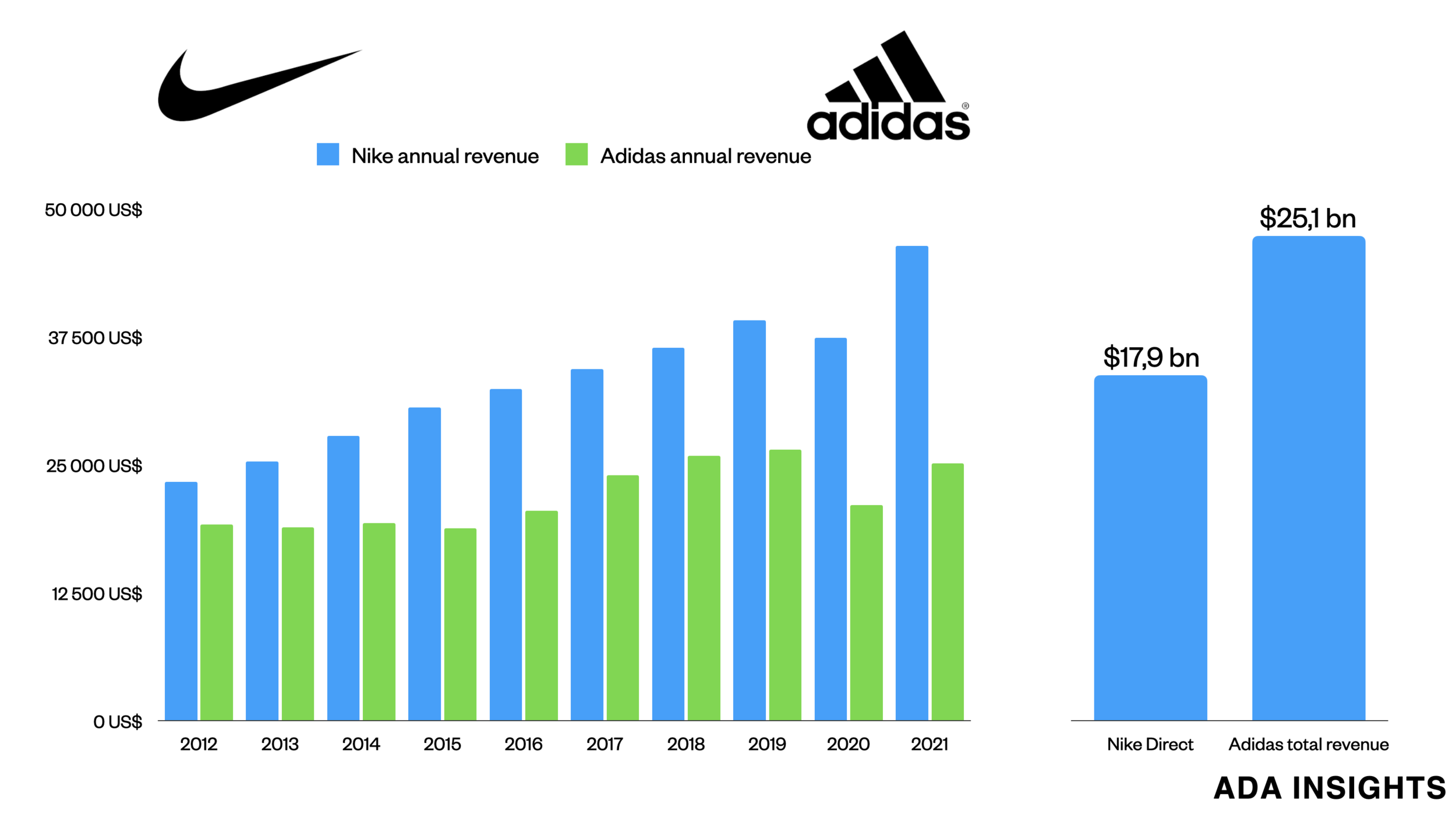

Nike has been consistently working to build up its Direct channel into the dominant sales channel for the company. In Q4/2022, the direct channel outgrew wholesaling to reach 42,8% of all Nike sales.

The share of revenue going to the Direct channel has steadily increased. Before the pandemic in Q4/2019, the Direct share of sales was 33%.

Since Q4/2019, the Direct channel has grown by 60%, whereas the Wholesale channel has grown by only 4,7%.

It will be only a few years before the Direct channel surpasses the Wholesale as the more significant sales channel.

To put Nike Direct in perspective, with revenues of $20,6 billion, Nike Direct is almost as big as all revenues by the main rival, Adidas ($24,5 billion).

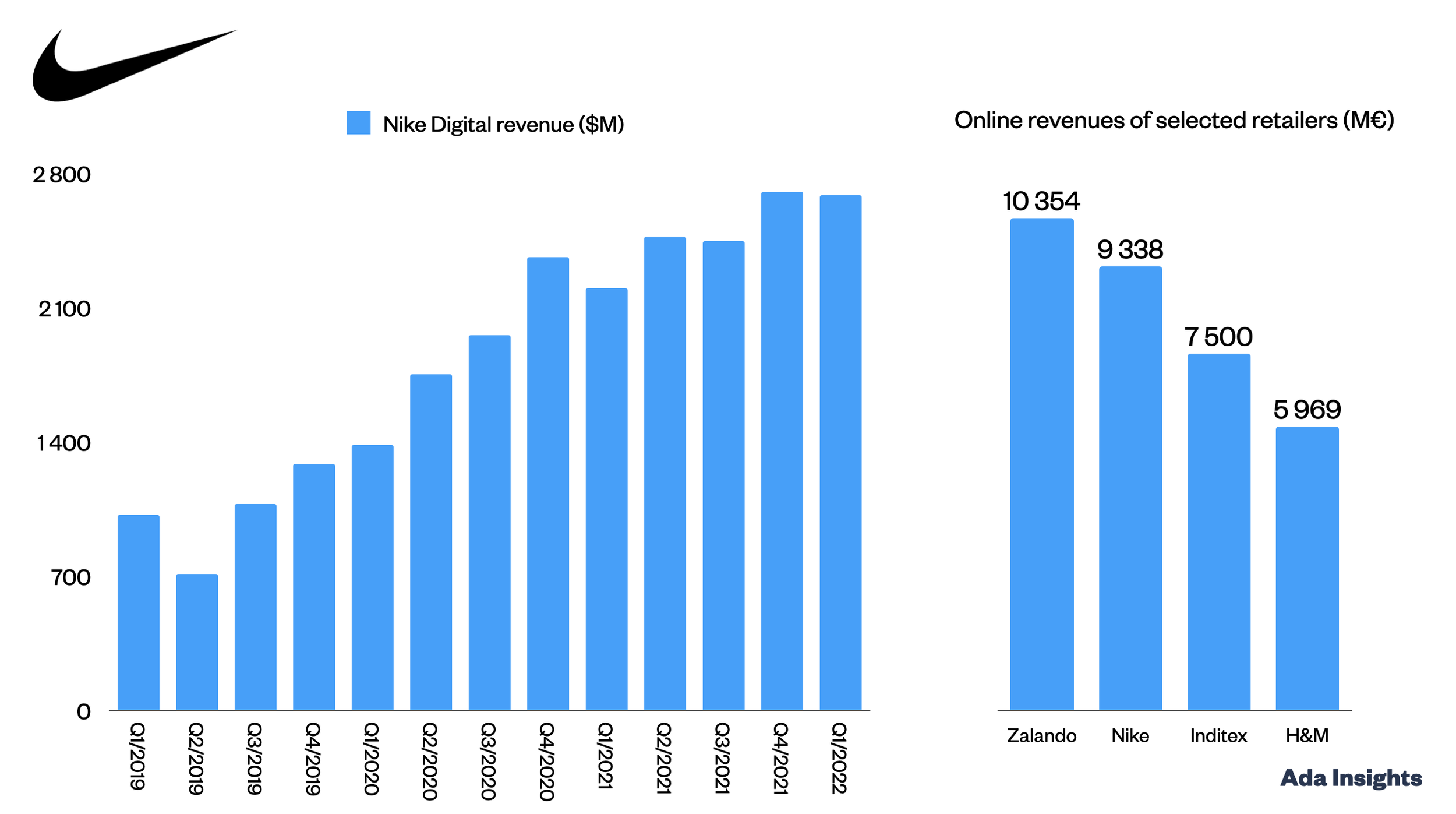

#3: Digital outpacing stores in the Direct channel

Within the Direct channel, digital sales have outgrown the Nike Store sales. Since pre-pandemic Q4/2019, Nike Digital sales have grown by 133%, whereas the store sales increased by 6,6%.

During that time, digital has gone from 41,5% of Direct sales to 60,8%. Already 26% of all Nike sales go through Nike's website and apps.

The long-term work done by the company is paying off in the form of more advanced qualitative and quantitive insight for the product development. As Nike's CEO John Donahoe pointed out in the company's latest quarterly earning release:

“Air Max also exemplifies how we brief new product by leveraging qualitative and quantitative member data science to have a sharper and more targeted focus. We’re able to ask ourselves, who are the consumers we want to serve and what are they looking for?

...

With just a year from conception to delivery, we relied on our Express Lane capabilities to make and deliver the product in such a short turnaround. Members who participated will be the first targeted for the shoe, creating Nike’s first full-circle insights-to-shopping experience.”