Tesco: improving profitability while growing with online

Tesco reported a strong first half for the fiscal year 2023/2024. Despite the declining food inflation, the emphasis on prices (value) and the German discounters is highlighted throughout the Tesco earnings report.

An interesting side note about the way Tesco talks about the market is how the market is divided between full-line grocers (”normal supermarkets”) and limited-range discounters (i.e., discounters).

Tesco wants to compare itself to other traditional supermarkets. This makes the results seem better as the two companies growing fastest and grabbing market share are taken out of the comparison. To the credit of Tesco, out of the traditional supermarkets, they seem to be succeeding best against the discounters.

Tesco reported a healthy 8,4 % growth in its core UK market. More impressive is the growth in profits as the company reported a 17,2 % growth in operating profits. The profit growth was driven by “accelerated cost savings and a resilient volume performance offsetting significant cost pressures”.

The increased profitability also gives Tesco extra firepower to ensure that they are able to win during the most important trading season of the year, Christmas.

“As we go into the second half, what we’re trying to make sure is that we remain competitive. We continue to invest in quality and we protect the flexibility and the firepower so that we can react to whatever we face into the second half. It is really, really important that we have all we need to continue to win Christmas.”

That is driven by the startegic priorities of value, loyalty (Clubcard) and convenience (breadth of ways to shop with Tesco).

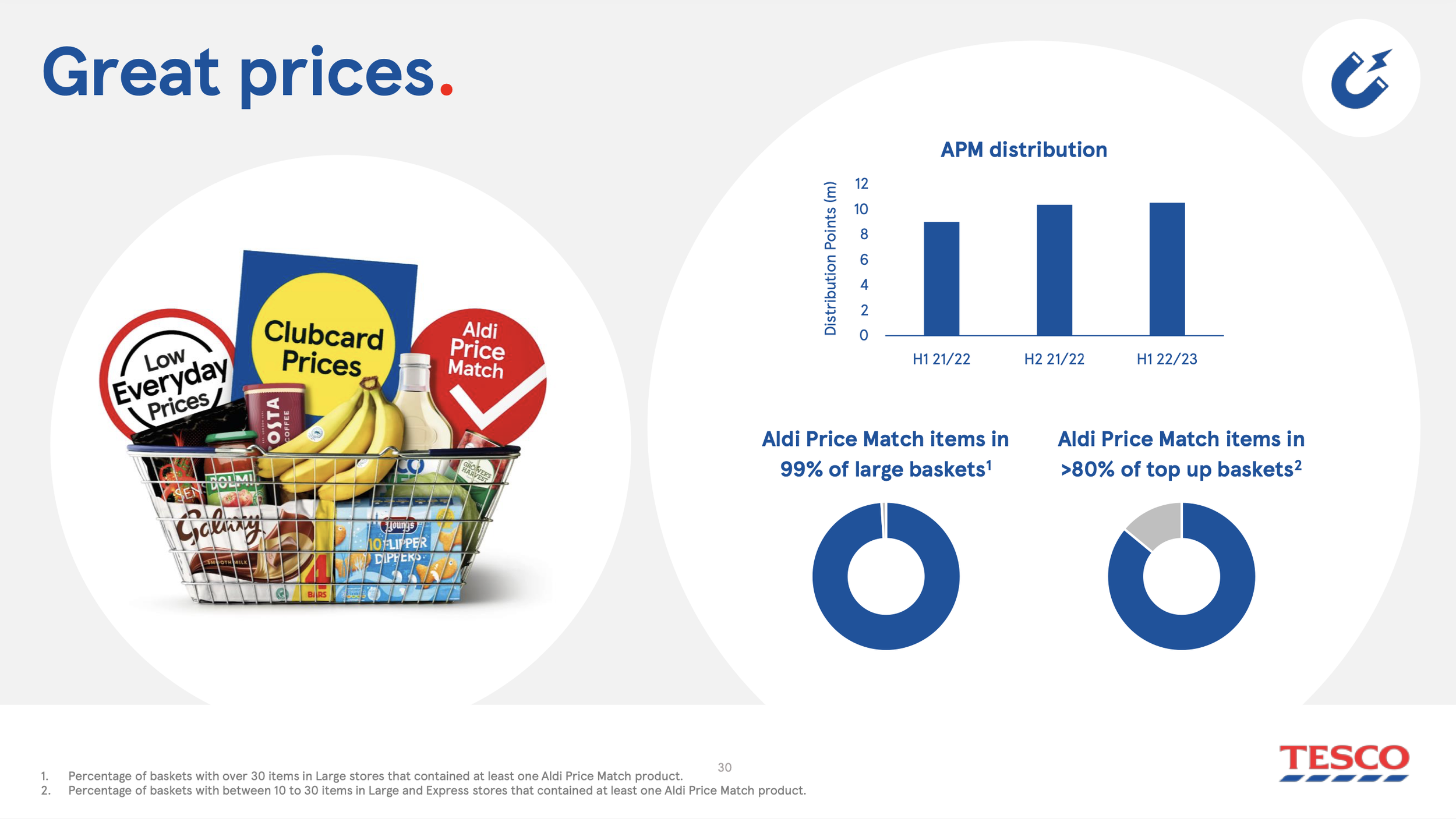

Tesco has also invested heavily in guaranteeing low prices. The company has continuously increased the amount of Aldi price match products and locked several products’ prices. Tesco claims to be the cheapest among the traditional supermarkets. The company also touted that it has consistently shrunk the price difference to the discounters.

Tesco seems to follow the retail strategy against the discounters as Albert Heijn in the Netherlands. Both have expanded the price-match product assortment to include almost the same amount of products the discounters have.

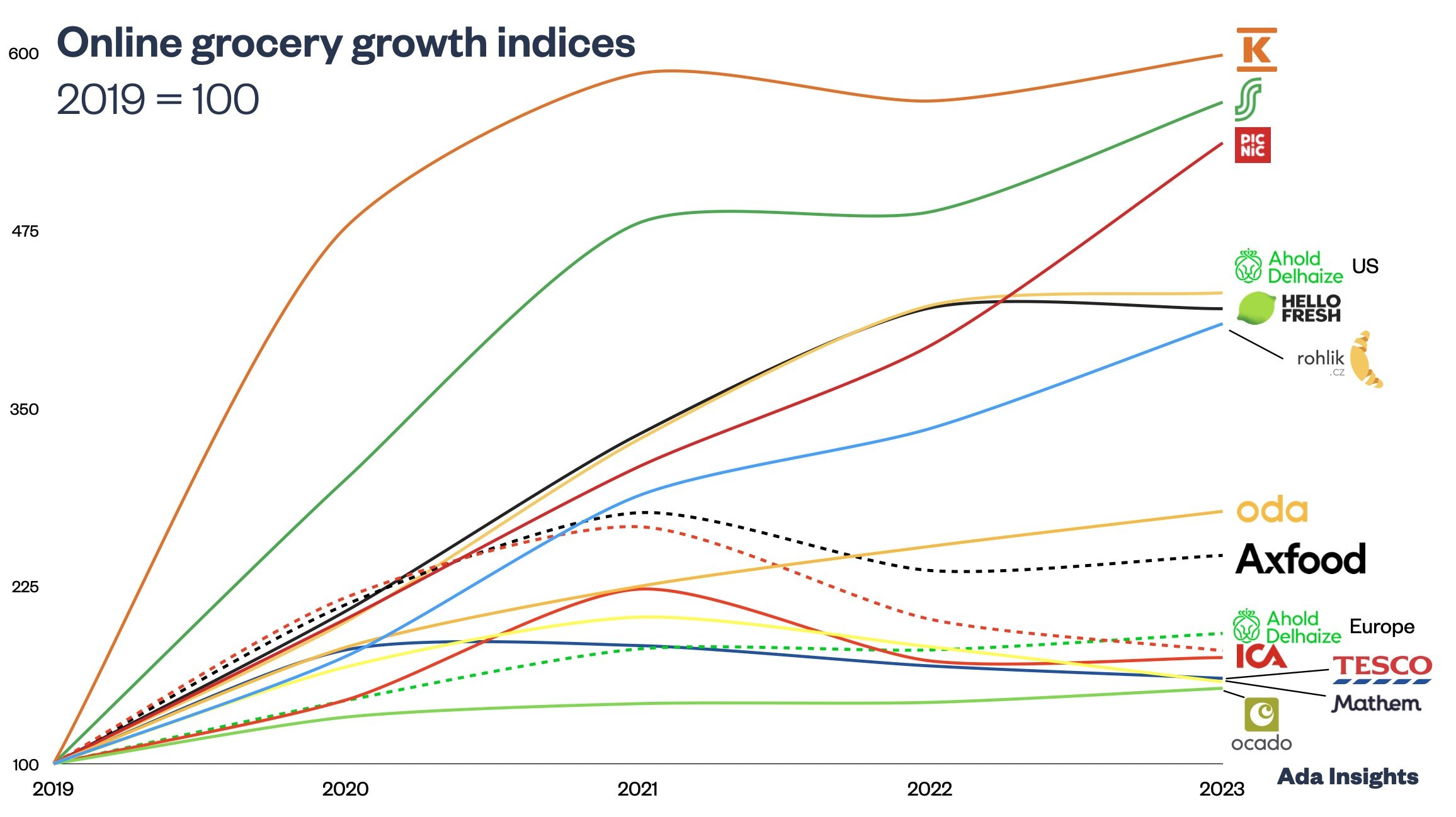

Online is the fastest-growth channel

Online was the fastest growing part of the Tesco UK business, with 10% growth from the previous year. After the pandemic, online share seems to have stabilized around 13% (against ~9% pre-pandemic) of all Tesco UK revenue.

The online growth seems to have picked up during the second quarter of the fiscal 2023/2024. This has enabled Tesco to increase its online market share to 36%, a significantly higher share than the around 27% total market share.

In online fulfillment, Tesco reported opening three new Urban Fulfillment Centers (UFC). This will put the total number of UFCs for Tesco to nine centers. The new UFCs will allow Tesco to increase its online capacity by one million orders annually. This is a surprisingly small increase, considering that Tesco currently fulfills 1,1 million orders per week.

Tesco has always been the market leader for online grocery in the UK. With the early start and continuous incremental development, the company has maintained outsized market share in the most developed online grocery market.