Amazon with strong growth in revenues and profits

The online giant reported double-digit growth of +12,6%. This was the third consecutive quarter with accelerated growth after more sluggish post-pandemic growth. With the growth, Amazon’s revenues of $550+ billion are fast approaching Walmart’s $630 billion.

The traditional retail side of Amazon, i.e. product sales, has grown less rapidly: +6,5%. With product revenues of $250 billion, Amazon is slightly bigger than Costco as a retailer.

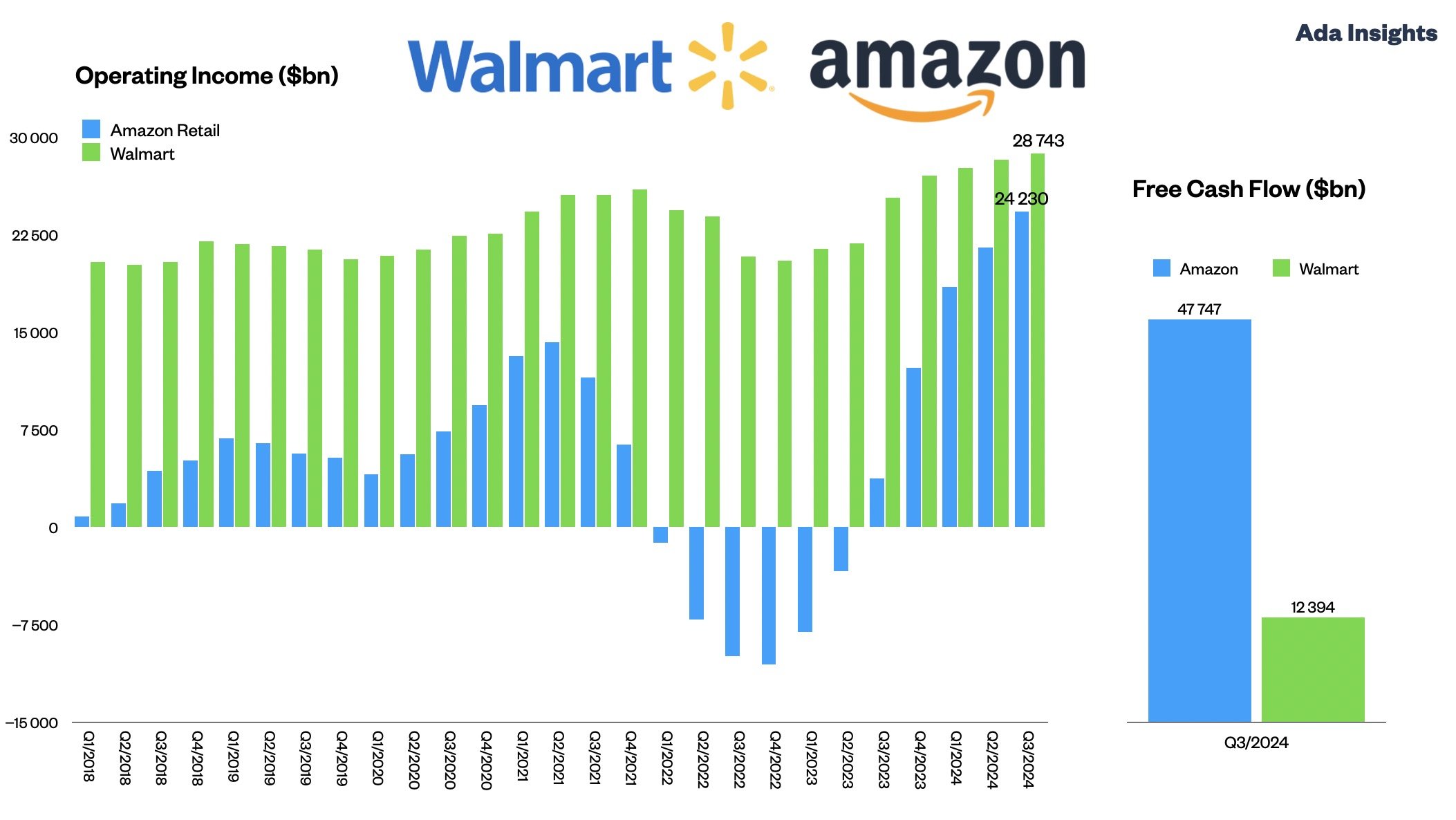

Alongside the service revenue growth, Amazon also reports significant improvements in operating income. The profits increased by more than 300%, driven by the firm return to profitability of the North American business (from -$412 million to +$4,3 billion). Also, AWS reported a strong improvement in the Operating margin. Even the International segment is approaching profitability.

Growth is once more driven by services

The service sales handsomely outgrew the product sales (+6,5% vs +17,9%). Services now represent 56% of all revenues for the company. This is probably one of the main reasons why the North American segment was able to return to profitability.

All major service categories of Amazon grew rapidly and were even able to accelerate the growth.

The most substantial revenue growth came from the Ads business, which grew by +26,3%. For the first time, the Ads business represented more than 8% of all Amazon revenues. With $43,8 billion in the Last Twelve Months (LTM) revenues. With its flush profit margins, the Ads business must be close to AWS's $22,7 billion in LTM Operating margin.

Even more impressive was the growth for the 3rd party services, which is already $130+ billion LTM revenue business for Amazon. Despite the huge size, the 3rd party services grew by almost +20%.

The Subscription (Prime mainly) service segment also accelerated growth, reporting a first $10+ billion quarter.

At the same time as the services grew, the fulfillment and shipping costs have continued to, albeit much slower than the income part.

Fulfillment and Shipping costs grew by 9,3% and 8,4%, respectively. The combined costs of these two were $44 billion, representing 30% of total revenues. Interestingly, the combined income of the 3rd party services and Subscriptions, both more or less covering the logistics costs, were $44,5 billion during Q3/2023. Thus, Amazon earned more from the logistics operations than it had to pay for them.

Amazon is facing challenges from multiple fronts. From the FTC legal actions to the Chinese online players (Temu, Shein, Tiktok), all are challenging Amazon’s dominance in the US online retail space. These challenges don’t seem to influence Amazon, at least not currently. It will be interesting to see whether that will change in the future.