Amazon the non-profit cathing up on Walmart’s profits

For years, Amazon was considered a business not profitable enough for traditional retailers. For years, Jeff Bezos explained to investors how the company could generate cash. Contrary to many traditional businesses, these profits were reinvested long-term. Turns out, the long term is here.

Amazon has been profitable for a long time. However, much of that profitability has come from the lucrative AWS business segment, which has an operating margin of 35%. In contrast, the North American retail segment operates at a 5,9% operating margin. Thus, it is natural that AWS has dominated the headlines about the company's increased operating profits.

In the background, the profits from the retail business have also increased. Amazon is said to operate with a cyclical model where it either grows revenue rapidly or harvests profits. Lately, the company has been in a harvest mode.

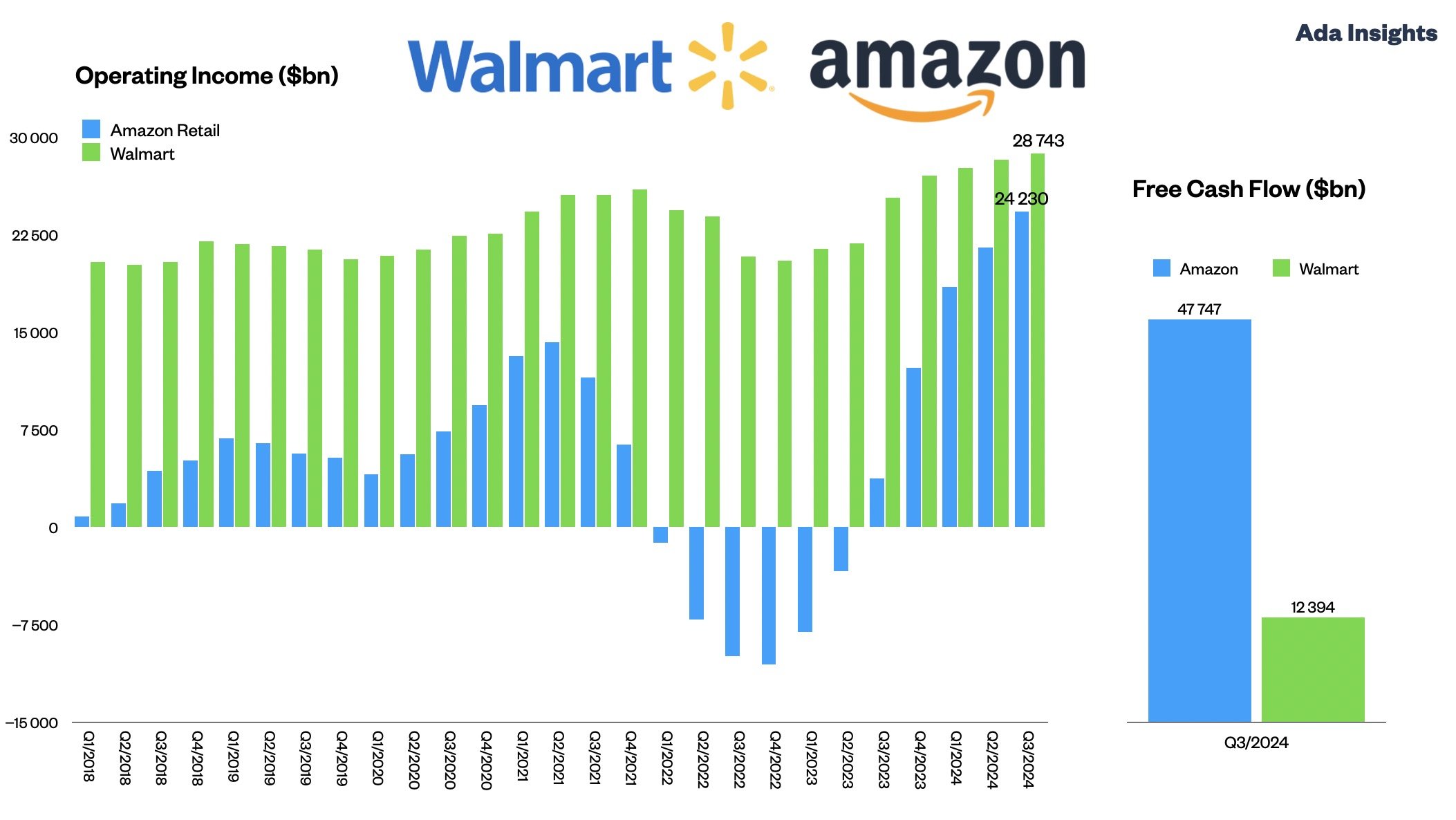

To put in context the profitability of Amazon Retail (North America and International), it is good to measure the biggest company in the retail industry: Walmart.

Before the pandemic, Walmart generated three to four times bigger operating income than Amazon’s retail businesses. After the pandemic, as Amazon began to harvest profits, it rapidly gained in on Walmart.

Currently, Walmart’s operating income for the last twelve months (LTM) is only 18 % higher than that of Amazon. In terms of free cash flow (measured for the entire Amazon, not only retail), Amazon generates more than three times the free cash flow of Walmart.

One can say that the thought of Amazon’s retail business not generating profits is no longer valid. It has not been for a long time.