Three big retailers as a sample of the bigger picture of retailing

The three retailing juggernauts, Walmart, Target, and Home Depot, are illustrative examples of where the US retail market has been headed lately. During the post-pandemic and inflation-driven market, the non-food giants that fared exceptionally well previously, Target & Home Depot, have seen problems with revenues and inventories.

The general merchandise nature (no single dominant category) of the Target assortment was an advantage during the pandemic but has dragged the company lately. Target reported its first revenue decline since Q4/2016, when the company also announced significant investments to reinforce the long-term growth of the company. This paved the way for the tremendous growth that the company has enjoyed ever since. This year, the company has pledged to continue this substantial investment into the business.

On the other hand, Home Depot has been riding the wave of increased home building and renovation. As the trend has started to turn downwards, the company’s revenue growth has stalled (-2%). However, the biggest competitor to Home Depot, Lowe’s, saw revenues much faster, by -9,2%.

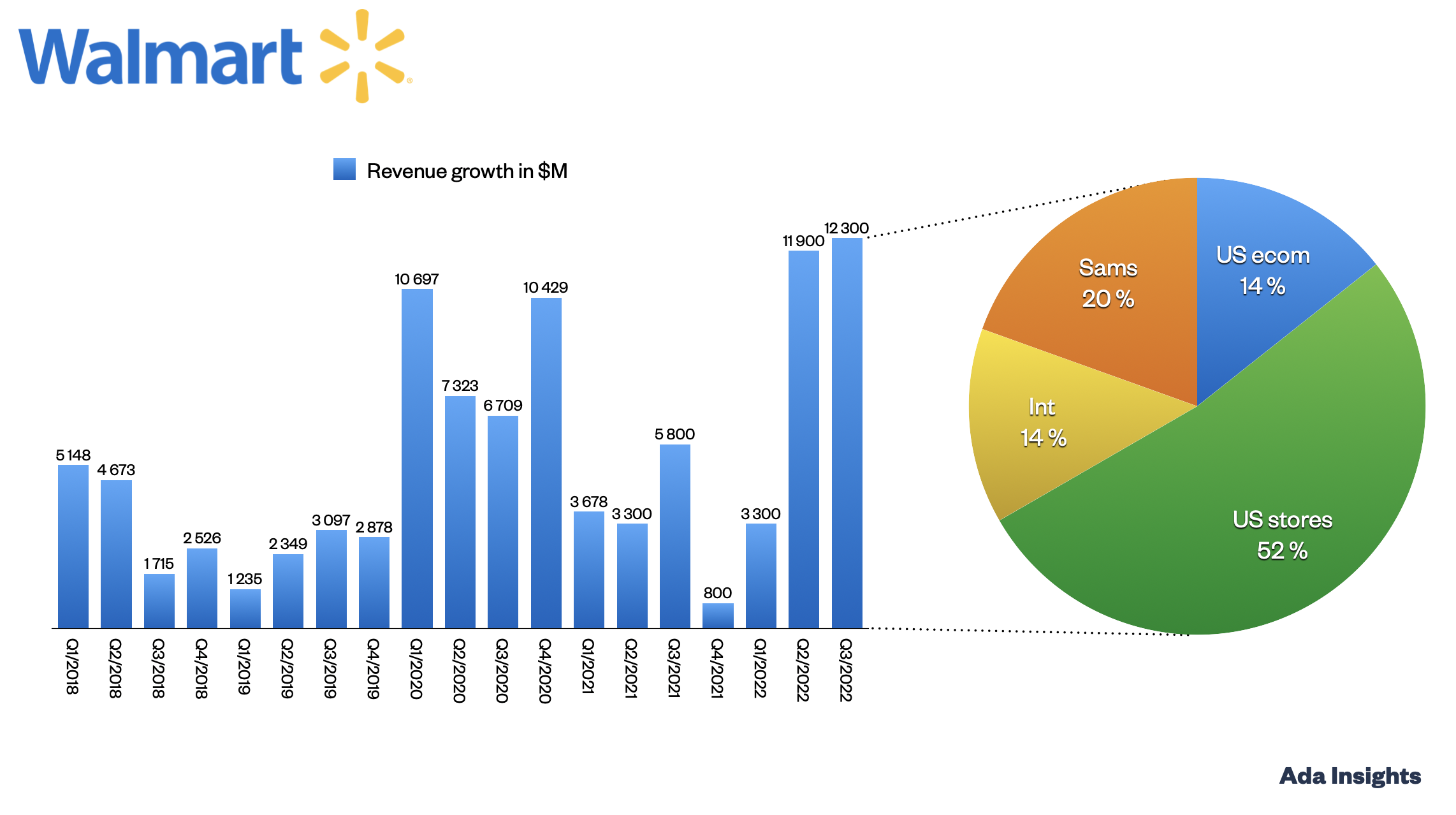

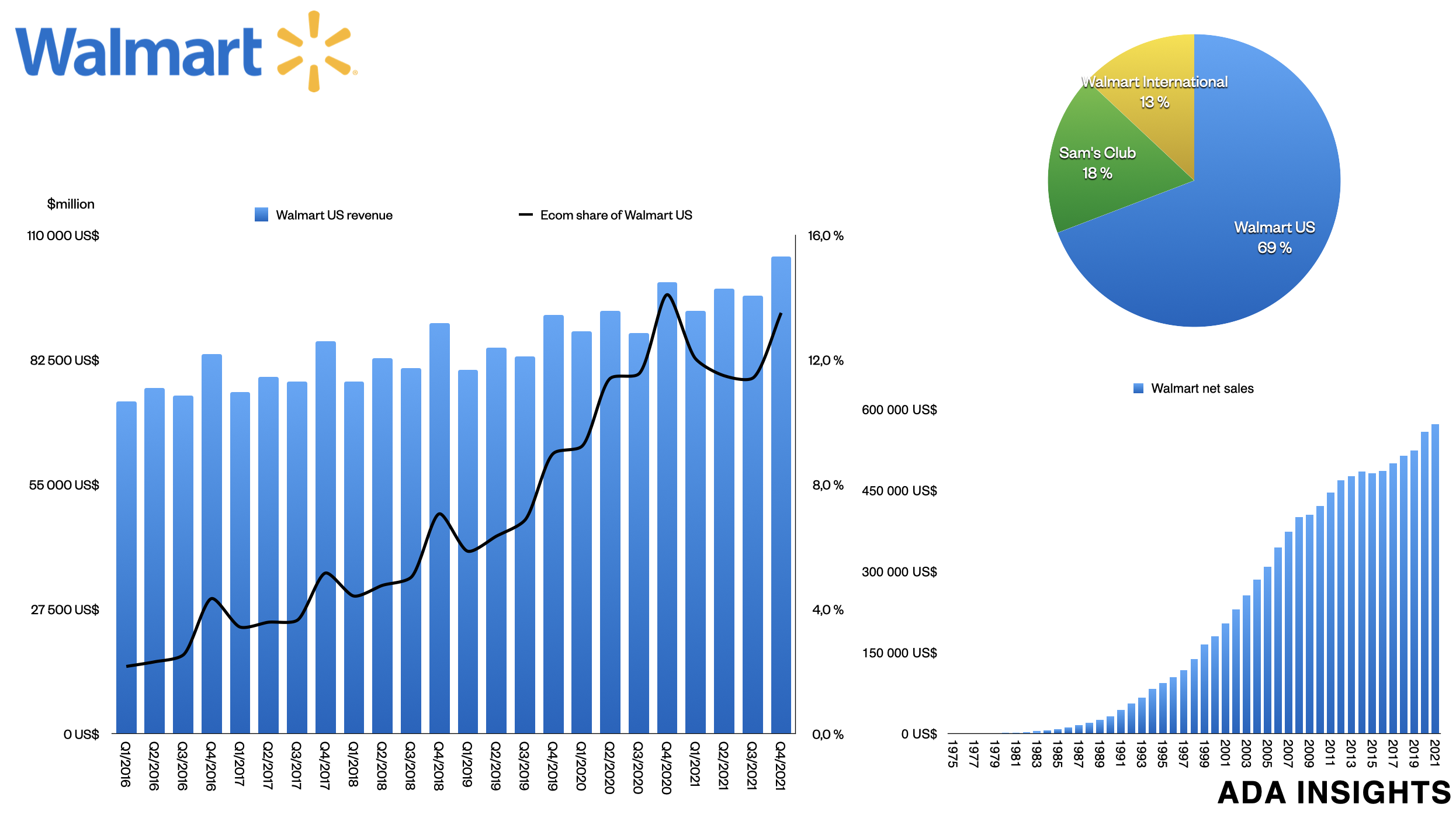

E-commerce driving Walmart’s growth

As the two other giants have seen declining revenues, Walmart has continued to grow strongly, driven by US e-commerce and International. E-commerce grew by +24%. For the last two quarters, Walmart has accelerated e-commerce back to 20+% growth after some slower growth quarters. The US business grew at a decreased rate of 5,5%, significantly better than the two peers.

More than half of the overall growth in the US business came from e-commerce. Last time, e-commerce was more than half of the US growth; we were living in the middle of the pandemic (Q1/2021).

On the other hand, Target has seen digital orders decline for the third quarter. The business’s digital share decreased from 17,9% a year ago to 16,9%.

Inventory problems easing up

One of the most significant topics around these two companies has been the rapid growth of the inventories and the drastic actions taken to reduce the inventories. All three companies have been able to cut down the inventory levels over the last five quarters. This has also been reflected in their profitability.

With the most drastic actions, Target saw Gross and Operating margins being slashed. The most challenging quarter was Q2/2022. Thus, for this quarter, the company was able to report significantly improved profitability levels. One could say Target has reached a normal level of inventories relative to revenues.