Grocery drives robust growth for Walmart

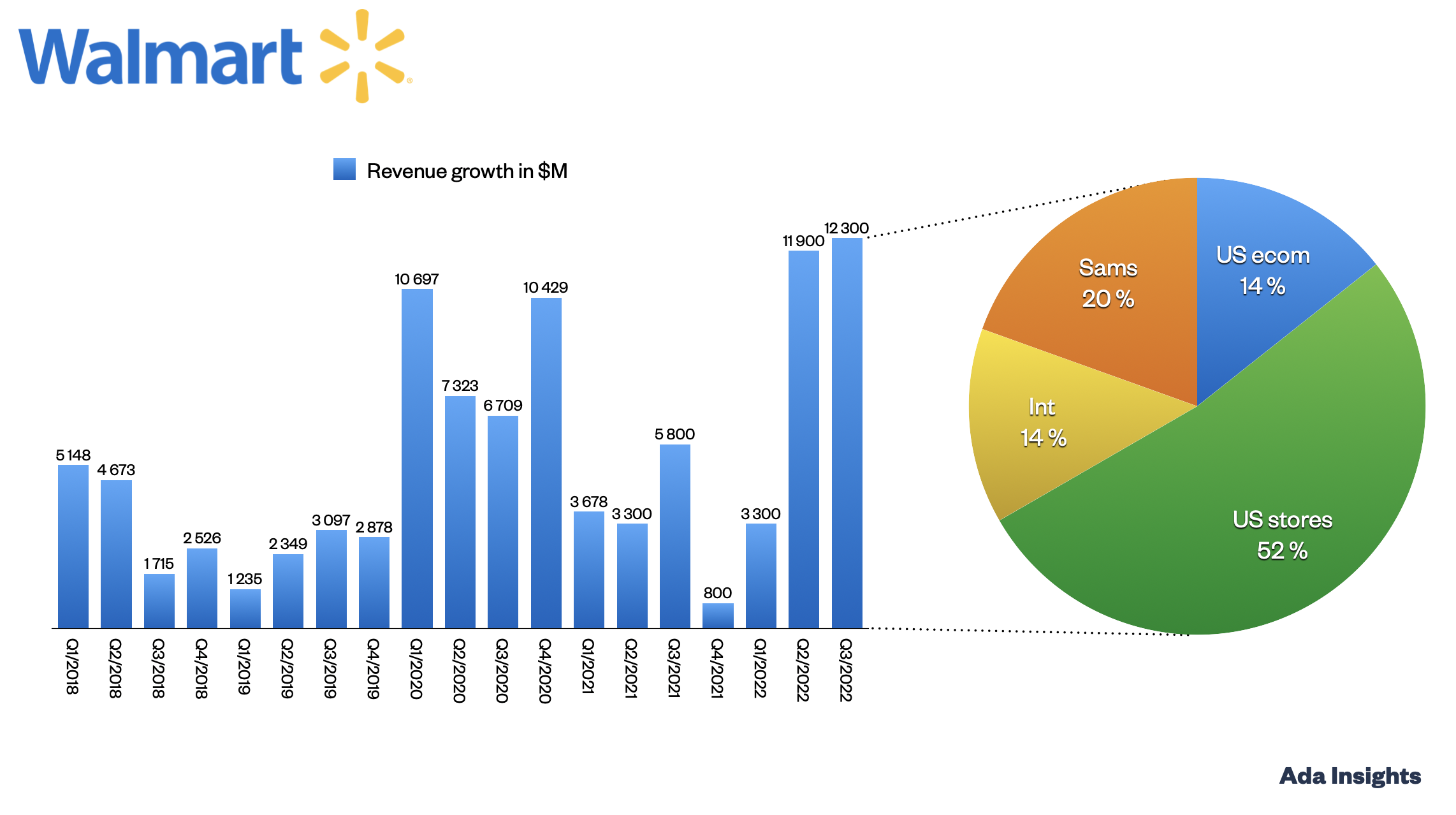

World’s biggest retailer reported strong growth of +7,6% for Q1/2023. The growth was driven by the International segment, with 11,8% growth. However, the 7,2% growth for the US segment with over $100 billion in revenues is a great performance also.

Walmart's growth was driven by grocery, which grew by low double digits. According to the company, health (a significantly smaller segment) grew by high teens. Walmart's strength is emphasized when the company’s performance is compared to the other American retail giants, Target (+0,7% growth) and Home Depot (-4,2%).

Grocery is a kind of safe harbour for retailers as the customers are cutting down on discretionary spending. The same happened during the pandemic.

While Walmart was able to grow strongly, the company was also able to clean out inventories. This time last year investors punished Walmart & Target for clogging up inventories. During Q1/2023, Walmart reduced inventories by -7%. This resulted in slightly reduced gross margins (24,5% -> 24,3%).

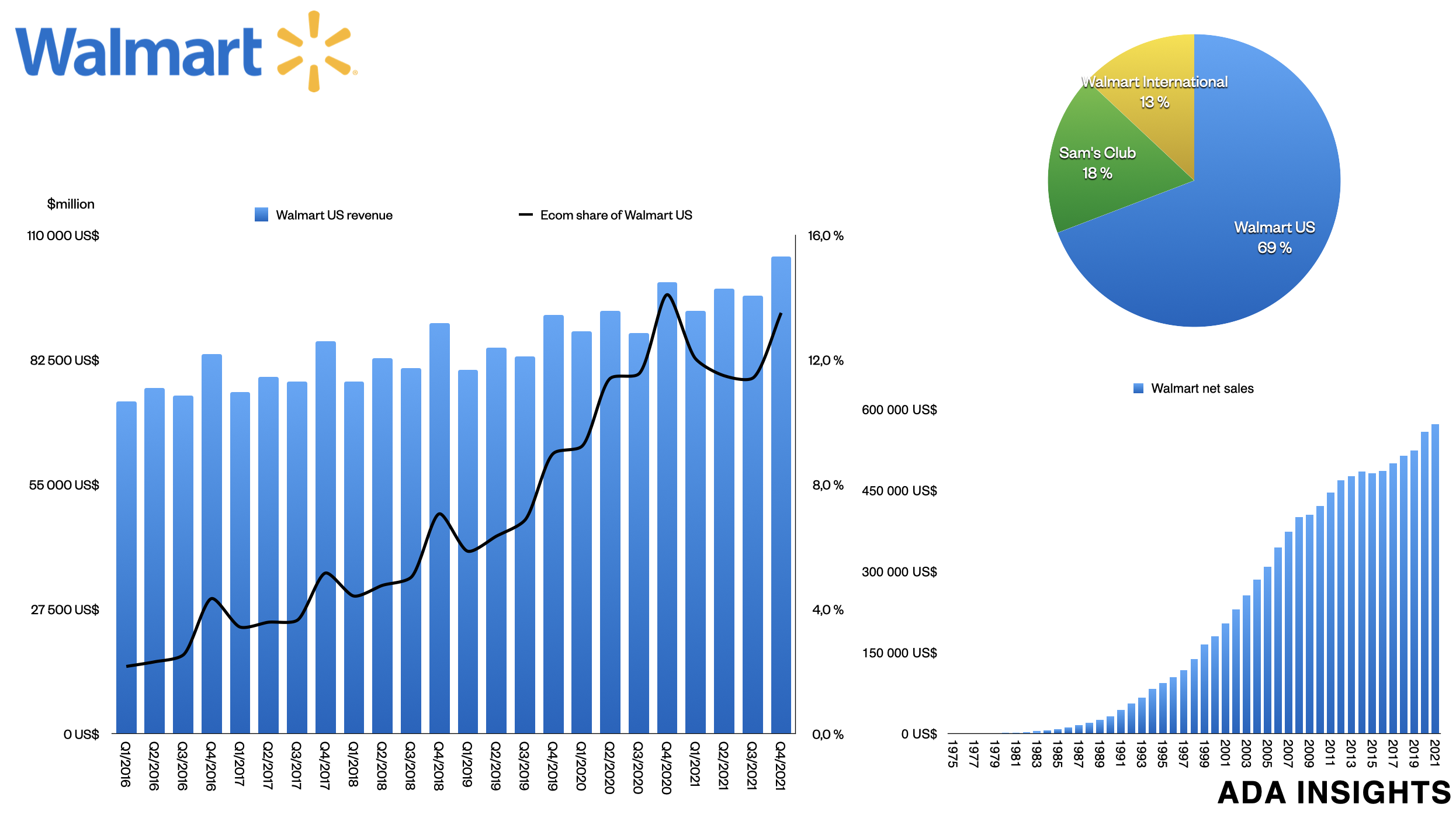

The online revenues of Walmart US saw a fourth straight quarter of growth with +27% revenue growth. Currently, online represents 13,8% of Walmart's US revenues (up from 11,7% in Q1/2022). The LTM (last twelve months) online revenue is almost $60 billion.

The Walmart US online business alone would be a top 25 retailer.