Is Oda’s first year in Finland a good performance?

Image source: Oda

Oda has filed its financial statement for the first year of operation. The full launch of Oda’s service happened on 1.2.2022. Thus, the first year has 11 months of operation.

The first (almost) full year of operation resulted in 22 M€ revenues.

There probably were many kinds of expectations for Oda’s first-year revenues. The launch received a lot of press coverage, and the advertising campaigns were big and memorable. Can Oda’s performance in the Helsinki region be considered good?

Is 22M€ good for the first year?

It all depends. If one compares that to bricks-and-mortar players, it is naturally a small start. But that is totally wrong way to compare.

One should compare Oda’s performance to its peer companies. There are three main groups of peers for Oda:

grocery home delivery companies

online grocery challengers

other online grocery launches in other European countries

Other home delivery companies

When one compares Oda to the online arms of the Finnish grocery giants, Oda is still trailing them significantly. S-Group, with 244 M€, and Kesko, with 236 M€, offer their services nationwide. However, in 2022 Oda operated only in the Helsinki region.

The Helsinki region co-operative of the S-Group, HOK-Elanto, has more than 100 M€ in online revenues in the Helsinki region. Most probably, Kesko’s online revenues in the Helsinki region are roughly at the same level. Of the two players, HOK-Elanto probably has a higher share of Click & Collect than Kesko. Kesko has informed that home delivery represented 86% of online orders in the Helsinki region.

If home delivery represents 40-50% of the online revenues for HOK Elanto, it would put their home delivery revenues around 50 M€ in 2022. This is after several years of operation. For Kesko home delivery revenues are significantly higher.

Compared to 50 M€ of HOK Elanto, Oda’s 22 M€ from the first 11 months isn’t bad.

Other online grocery challengers

The most relevant comparisons in Finland are Fiksuruoka, Ruokaboksi, and Wolt. Fiksuruoka has published its 2021 numbers (13,7 M€) and said in an interview (for Kauppalehti, 17.5.2023) that revenues for 2022 were above 16 M€. This includes newly launched operations in the Netherlands and Belgium. So one could assume that their revenues in Finland would be around the same level as the previous year.

Ruokaboksi, on the other hand, has reported revenues for their 2022 fiscal year (ending 6/2022). Ruokaboksi sold meal kits for 20,9 M€. One could assume that the year 2022 for Ruokaboksi is not bigger than the fiscal year revenues. Fiksruoka and Ruokaboksi operate in the whole country, compared to the Helsinki region for Oda.

Wolt, unfortunately, does not publish any numbers from its online grocery operation in Finland. It is reasonable to assume that Wolt K-market is already operating at significant sales volumes. However, they should be included in the online grocery revenues of Kesko. The standalone Wolt Market operation is most probably significantly smaller than Oda.

Thus, Oda’s first year would be bigger than any of the online grocery challengers. The challengers have all operated for several years and serve the whole country.

Other online grocery launches in Europe

The final comparison for Oda’s launch is to compare to other online grocers in Europe. The most relevant comparisons are recent launches by Picnic and Knuspr (owned by the Rohlik group).

Picnic launched in Germany in the Nordrhein-Westfalen region already in 2017. The launch was a gradual rollout from the Netherlands, and 2018 was their first full year of operation. That year ended up with revenues of 23 M€ according to Exciting Commerce blog in Germany.

Knuspr, with the slightly faster delivery proposal, launched in the Munich region in August 2021. In May 2022, after nine months of operations, the company reported revenues of 23 M€. This is two months more than Oda operated in the Helsinki region.

Nordrhein-Westfalen and Munich, where Picnic and Knuspr operate, are very different types of regions to the Helsinki region. Nordrhein-Westfalen has more than ten times the population of the Helsinki region, with a significantly higher population density. This makes it much easier to launch an online grocery operation. Conversely, Munich has a population similar to the larger Helsinki region but ten times the density. Again, a bit easier to launch and scale.

However, somewhat more than 20 M€ seems to be a normal revenue level for the first of operations for a pure-play online grocer.

There are two more examples. Picnic’s two other launches seem to land around the same 20 to 30 M€ ballpark. In its second year of operation in the Netherlands, Picnic recorded a revenue of 30 M€. In its latest launch in France, there are estimates that Picnic’s revenue would end up at around 28 M€.

To summarise: a good start for a longer journey

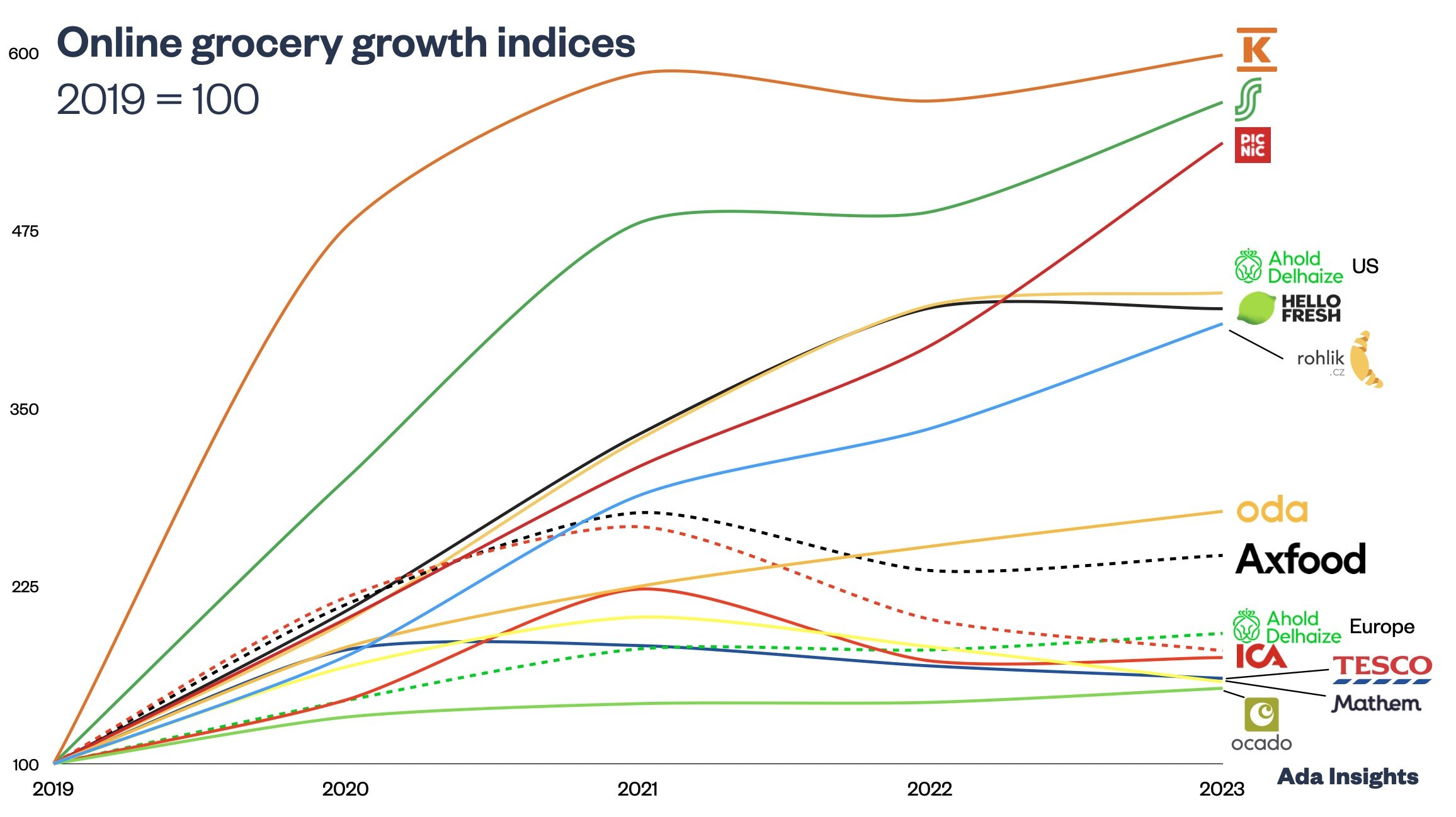

Oda’s first year can be regarded as a good performance. In the bigger picture, the only relevant thing is the growth trajectory that the company can maintain. For Oda to become a big player, it needs to maintain good growth despite the headwinds the online grocery market is facing. Even though Picnic started in Germany with 23 M€ in revenues, after the fourth year, the revenues are estimated to have reached 280 M€.

Change takes time

We, humans, are impatient by nature. We expect change to be fast, but it is always slow initially. Almost all major changes have arisen, first slowly and then at an accelerated. For some, the slow part has been shorter, but most of the time, the slow part has taken years before the acceleration started.

Some legendary retailers are great examples of this:

Lidl (Schwarz group): founded in 1973, expansions and the first international market in 1989 (18 years later)

IKEA: founded in 1943, started selling furniture in 1948; the first store opened in 1958, the first international market in 1963, Denmark 1969, but real expansion in 1973 (15 years after the first store)

H&M: founded in 1947, Norway in 1964, expansion out of Scandinavia in 1976 (London) (29 years after founding)