Oda continues to grow revenues - in Norway

Norwegian online grocery pure player Oda reported continued growth in Kinnevik’s Q3/2023 reporting. The aggressive price war that the company went through in Norway seems to be paying off.

However, the continued growth has come from a changed base as Oda’s figures have been cleaned from the numbers of abandoned German and Finnish operations. Therefore, the revised numbers for Q1/2023 are 10 % lower than the previously reported numbers.

The short-term hit from the abandoned Finnish and German businesses seems surprisingly low.

The Kinnevik figures also show that Oda Norway has continued to grow for the last four quarters, reaching 242,5 M€, even with the poor currency ratio between the NOK and the euro.

“Oda has had a very turbulent time behind them. … What’s happened now really is that we see them regaining their footing. The price war in Norway has abated. They’re back to healthy 20% growth rates. They’re showing positive EBITDA certain months thanks again to their world leading fulfillment efficiency. And it’s these developments that we believe warrants what’s a pretty significant markup in percentage terms this quarter.”

Mathem continues to struggle

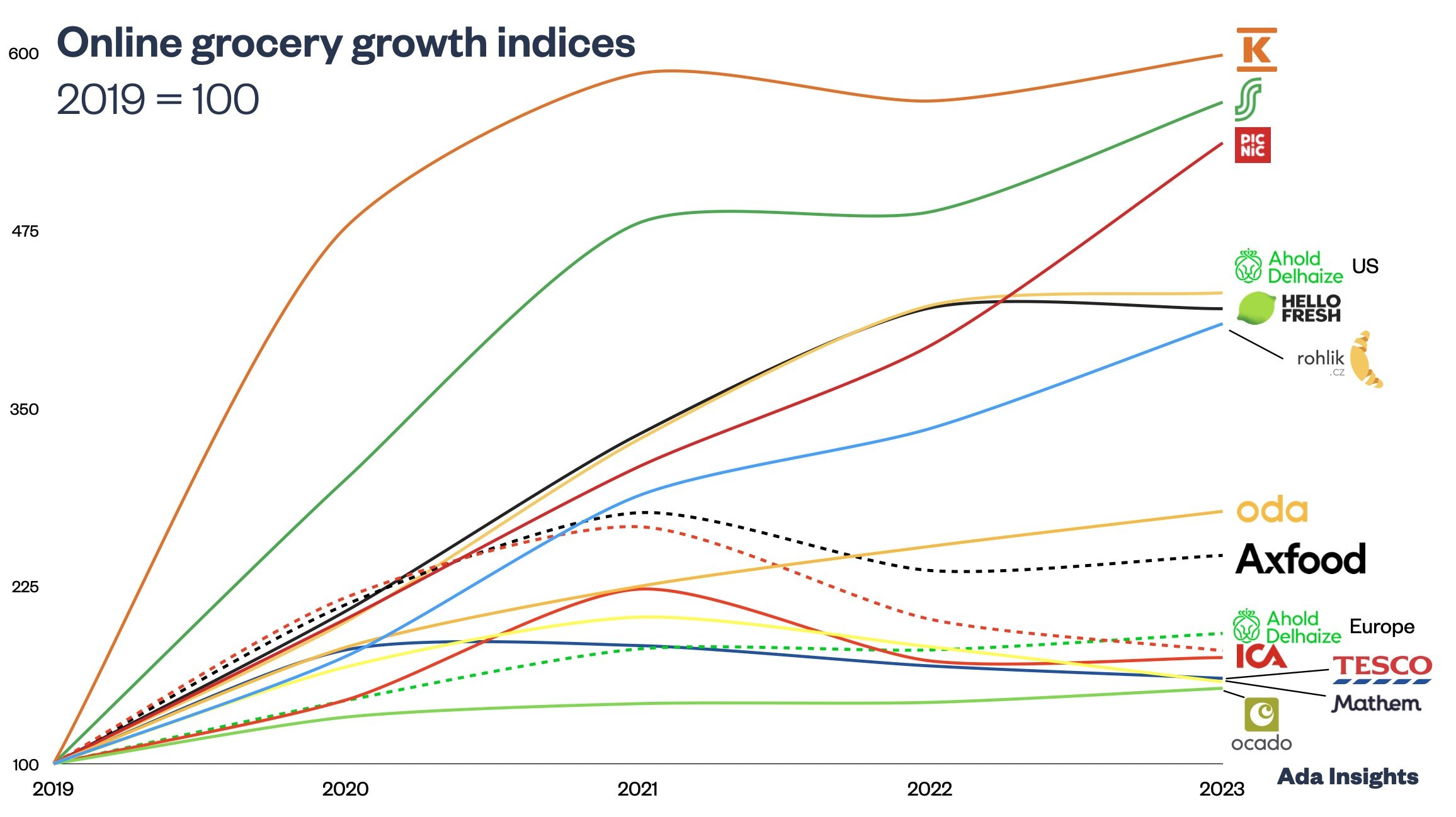

The other Kinnevik-owned pure-play online grocer, the Swedish Mathem, has struggled for the past few years. This has led Mathem revenues to decline to the levels previously seen during the early pandemic.

This is somewhat surprising as the home delivery part of the online grocery market has started to recover to growth. In Q2/2023, the home delivery market grew by 2,1%. Mathem offers only a home delivery option for the customer.

The recovery of the overall market is encouraging for Mathem in the future.

The malaise for the company has resulted in a rapid decline in the valuation of the company. Currently, Mathem is valued at one billion SEK. At the same time, Kinnevik reported that Oda’s valuation increased after a rapid decrease to 1,6 billion SEK. Currently, the company is at 2,1 billion SEK.