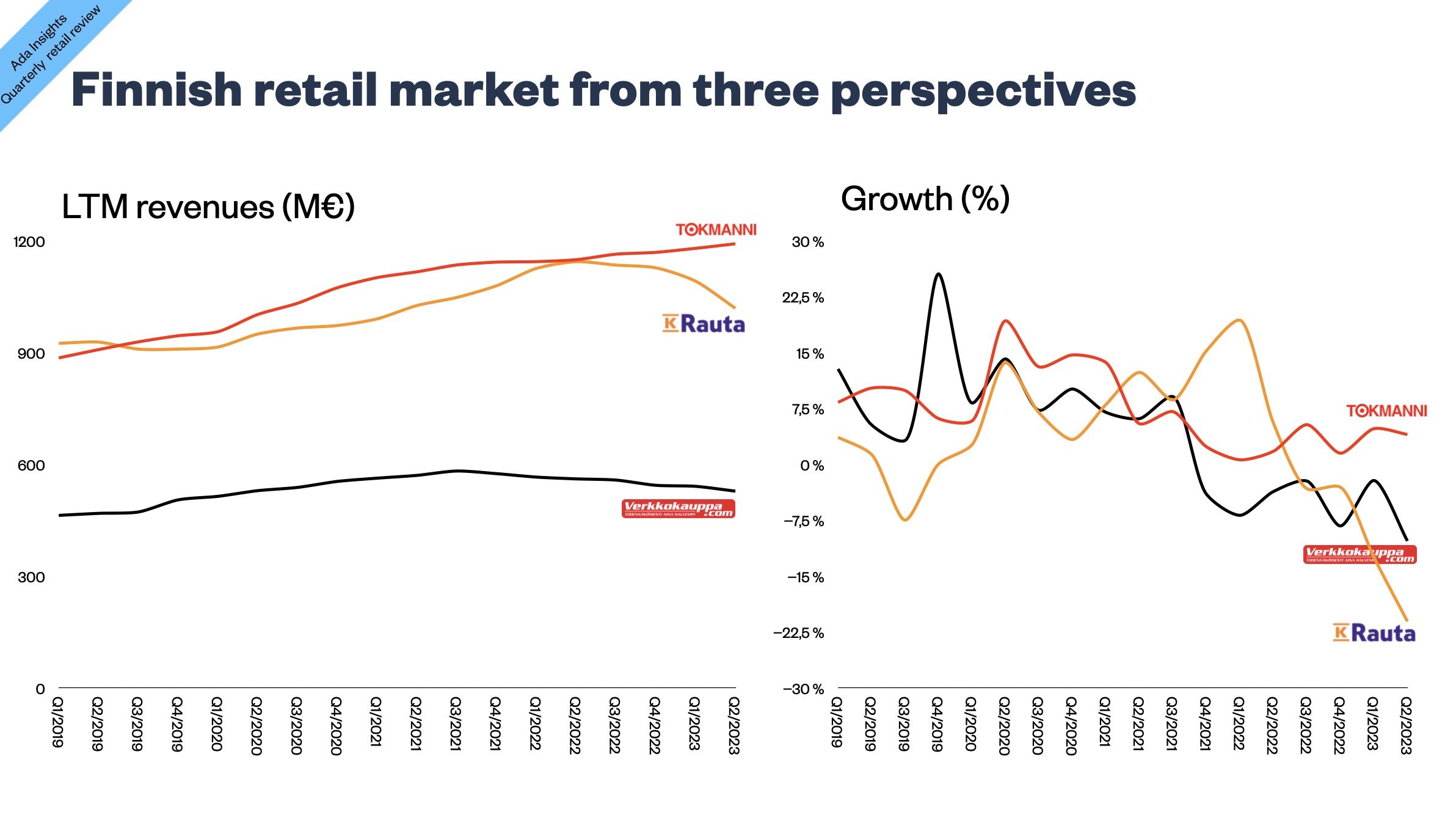

Kesko continuing to lose market share in groceries

Kesko reported a 3,4% sales increase in Q2/2023 (including all sales from Kesko and the entrepreneurs). The sales growth has accelerated, now for four straight quarters. However, the sales growth came in an inflationary market which has grown even more rapidly than Kesko. The market leader S-Group reported an almost three times higher sales growth: 9,4%.

Similarly to the four previous quarters, the growth has been driven by hypermarkets, especially Prisma of S-Group. Prisma and Lidl seem to be grabbing market share, with price perception still significantly influencing the market. However, lately, Kesko has been able to claw back the difference to overall market growth (as seen in the image in the middle).

Can Kesko ride through the turmoil by relying on its competitive strengths of quality and assortment?

Despite losing market share, Kesko has been able to maintain high profitability by relying on its core competitive strengths. In Q2/2023, Kesko Grocery reported a 7,3% profit margin (down from 8% last year). The robust profitability illustrates that Kesko has been able to resist not going into a costly price war with its main competitors. In Sweden, ICA was forced to start a price war as its market share slipped too far from the competition, especially Axfood’s Willy’s. It remains to be seen if Kesko needs to follows suit.

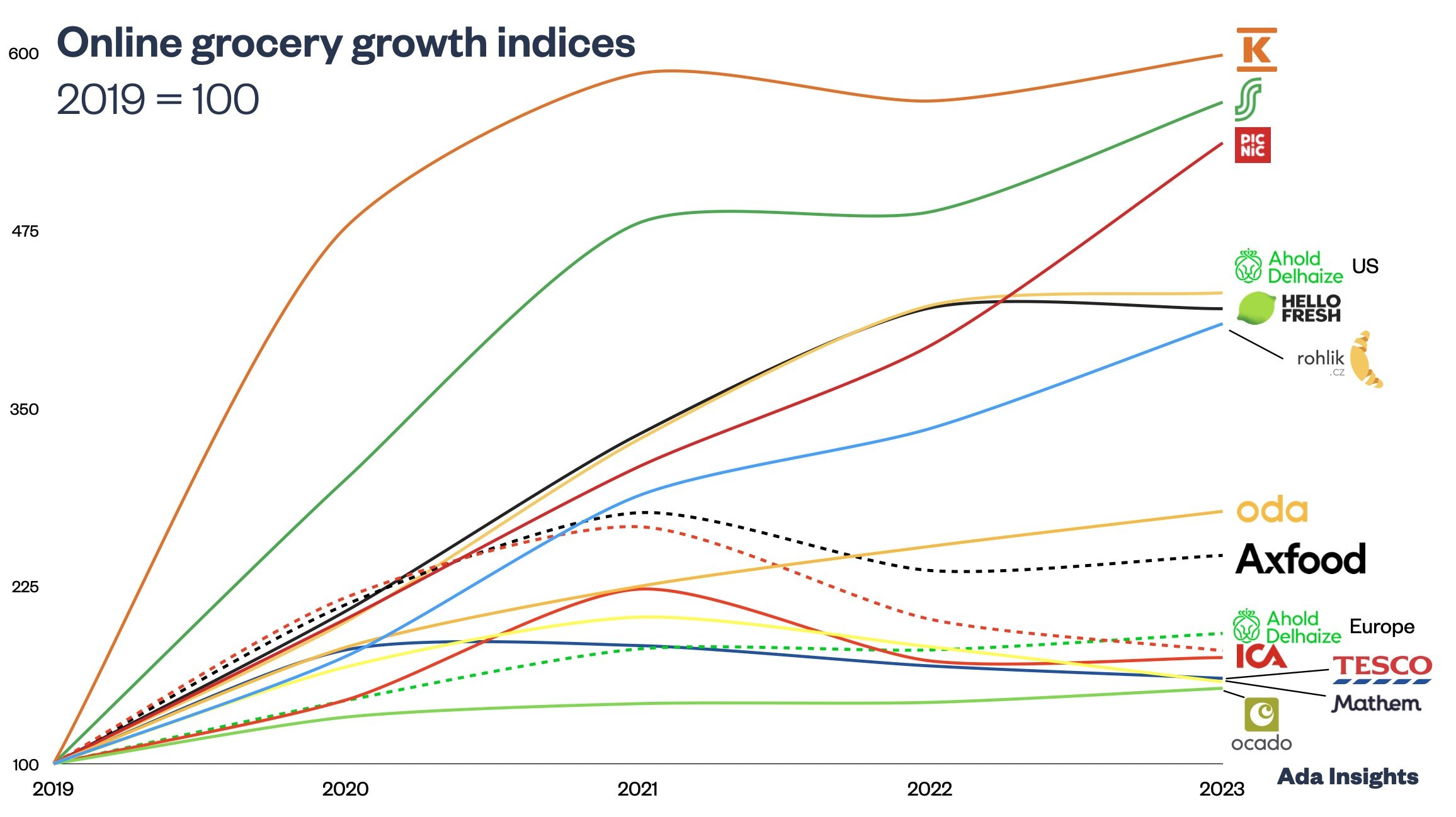

Online sales grew slightly less than the overall business, by 3,8%. Online growth was probably mainly driven by the rapid growth of the Kesko-Wolt partnership. The traditional online grocery probably saw a slight decline in revenue.

Kespro continuing to drive growth despite a slowing market

Similarly to two previous years, Kespro has been driving growth for Kesko Grocery. Kespro grew more rapidly than the Kesko Grocery business for the ninth consecutive quarter. However, the rapid growth of Kespro over the previous two years is slowing down. For the first time since Q3/2021, Kespro’s growth dipped to single digits. During those two years, Kespro has surpassed one billion euros in revenues.

With such growth, Kespro has increased its already dominant market share of the overall Foodservice market in Finland. The growth has also increased Kespro’s share of the Kesko Grocery business. In Q2/2023, Kespro represented 16% of Kesko's grocery revenues.