Make it convenient, and it will grow - case Kesko and Wolt

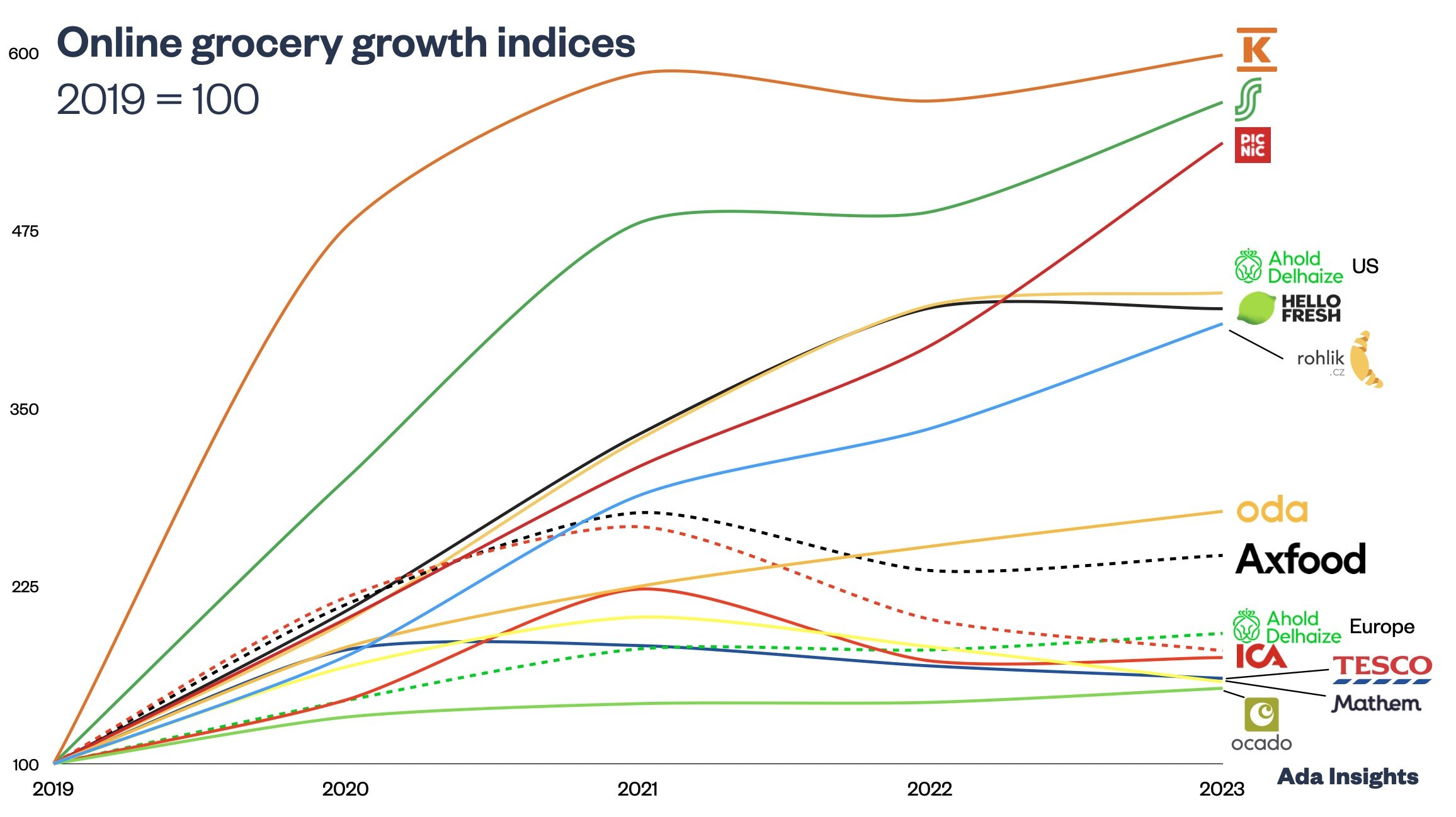

Online grocery has seen difficult times over the last year. Especially the quick commerce sector has nearly disappeared. Companies like Gorillaz, Flink and Fridge No More rose rapidly during the pandemic. During 2022 they struggled with the changing market and financing environment. Eventually, the industry consolidated around a handful of more prominent players. Even big companies such as Getir and GoPuff are struggling to survive.

However, some examples of quick delivery have succeeded over the last year.

Kesko and Wolt showing the way

The collaboration between Kesko and Wolt in Finland is an excellent example of successful quick delivery. The partnership started back in 2021 and was expanded in late 2021. However, the service began to grow in 2022.

Since then the number of Wolt deliveries has multiplied. Cumulatively they have reached one million deliveries. The image shows that most deliveries have come between 2022 and 2023.

This is an excellent example of how customers will flock in to buy by making something more convenient (fast delivery) and easy (low delivery fee).

Customers still want to have their groceries delivered but need to find the best customer experience. If it is easy and cheap enough, then customers will buy.

For Kesko Wolt is a great way to keep the online grocery channel on a growth path. Last year Kesko saw online grocery revenues decline, even though Wolt grew rapidly. This means that the traditional online grocery channel has been falling. Therefore, Wolt is an essential element for Kesko to remain competitive online.

Attracting younger consumers

The collaboration with Wolt is also intelligent for Kesko in another way. Fast deliveries cater to a different customer segment than traditional online grocery does.

Traditionally online grocery services, especially for families with children with big weekly purchases. The other group using online grocery are the older people who cannot go to the store anymore.

On the other hand, Wolt is used by young customer groups. Singles and young couples are digitally savvy but have yet to use traditional online groceries due to the high delivery fees.

They are an important customer group, as many will eventually become families with children. The sooner Kesko can start building loyalty among these customers, the better.

Interestingly, families with children are an essential group in fast deliveries also. They just are even more critical for traditional online grocery.

Different buying occasions from Wolt

The third interesting aspect of the fast delivery model is the products sold. The differences between traditional online grocery and fast delivery should be understood by comparing hypermarkets versus convenience stores.

The traditional online grocery caters to the weekly shop (like the one from a hypermarket), whereas fast delivery is a much more convenience store type of service.

The product categories sold in each channel illustrate the distinction. The traditional online grocery sells the classic product categories sold in a hypermarket. However, fast delivery caters to a more convenient type of top-up shopping. On that occasion, soft drinks, sweets and snacks are essential categories.

There has been an age-old discussion about whether customers will buy impulse products (i.e. sweets and snacks) from online channels. The categorisation by Kesko illustrates that sweets and snacks are not so much about the channel; they are more about the buying occasion, the convenience and the price of the delivery.

It is interesting to follow how the quick commerce or fast delivery category develops as the pure-play standalone companies struggle and fade into the background. At the same time, the collaboration between Wolt and Kesko shows very encouraging seeds for the future.

The source for the images is a media event organised by Kesko on 14.3.2023.