How Willy's aims to stay big?

The Swedish grocery giant Axfood held its Capital Markets Day (CMD) (https://www.axfood.com/investors/capital-markets-day/capital-markets-day-2023/) on 24.11.2023 in their new logistics centre in Bålsta. A big part of the CMD concentrated on the crown jewel of the Axfood family of brands, Willy's.

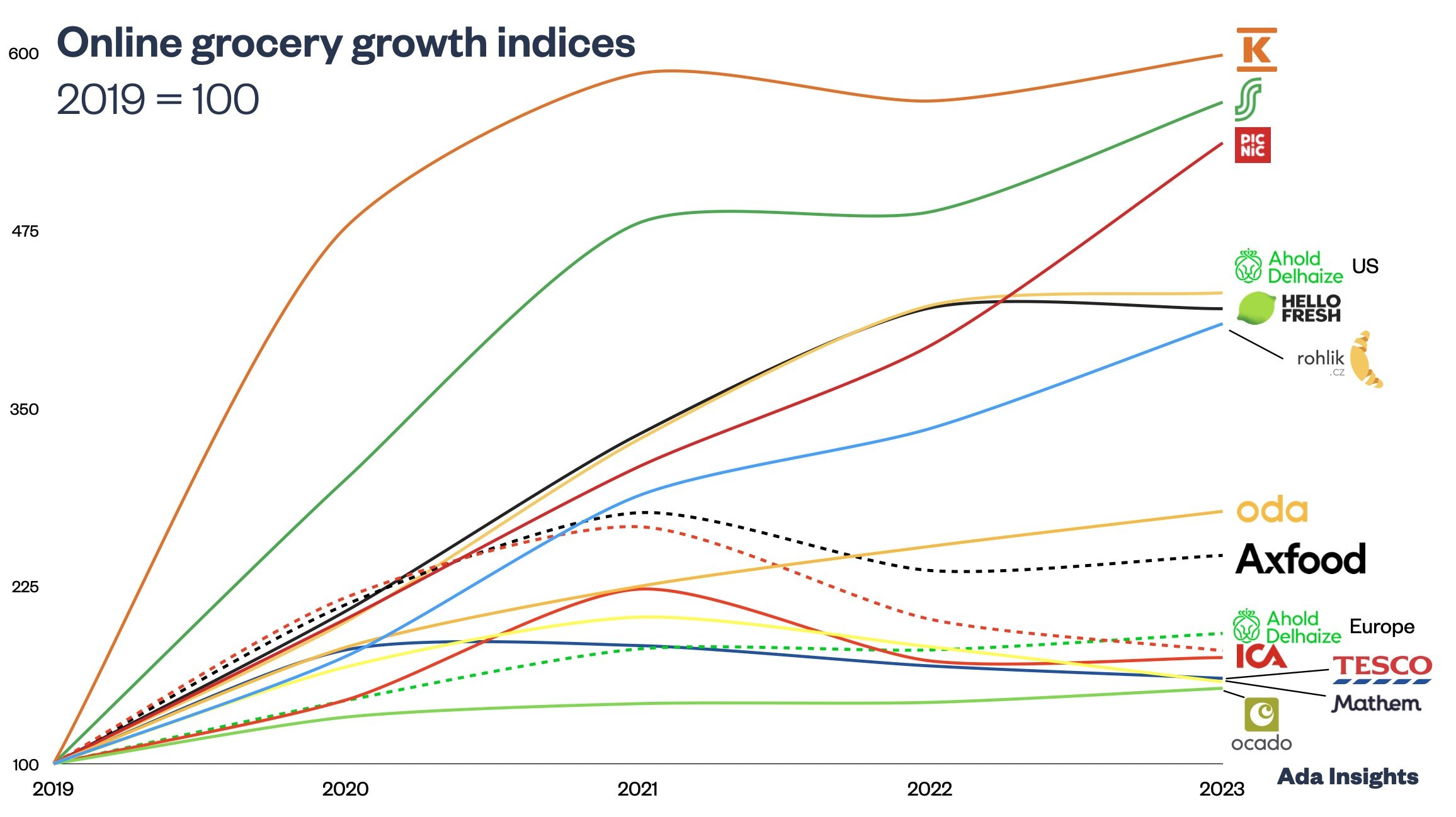

The growth of Willy's has been spectacular. Not many grocers have been able to outgrow the market (and inflation) as rapidly over the recent years as Willy's. This has naturally led to significant market share gains.

A big part of the growth is differentiation with the soft discounter concept. The discount nature of the business has led to solid growth during the inflationary times. Discounting has also differentiated Willy's from the traditional supermarkets and hypermarkets.

One could say that the soft discount concept is somewhat different to Lidl. In the CMD, Willy's management emphasised that they do not have directly comparable companies. However, Lidl has moved from the hard discounter towards the soft discounter model.

“There aren’t that many players that Willys can compare itself with in Europe. The combination that we have with the broad assortment to some 10,000 articles and also, at the same time, kind of a tough aggressive pricing.”

As the image below illustrates, the soft discount model of Willy's differentiates quite significantly from Lidl. One of the biggest competitive advantages of Lidl is its narrow assortment. The assortment in Willy's is significantly bigger than in Lidl. Still, Willy's keeps the assortment low enough to get efficiency gains compared to the traditional competitors, which carry two to three times the assortment.

“We look at hypermarkets and we try to be as close as possible to Lidl and we’re trying to be cheaper than the other hypermarkets so that consumers feel that it’s better to shop with us.”

"we look at hypermarkets and we try to be as close as possible to Lidl and we're trying to be cheaper than the other hypermarkets so that consumers feel that it's better to shop with us." Thomas Evertsson, Managing Director of Willy's

Similarly to Lidl, Private Label (PL) products have become essential for Willy's. During the inflationary times the revenue share of PL products has grown significantly. In Q3/2021, PL products represented 20% of revenue, whereas it had grown to 25% two years later. At the same time, the total revenues have grown rapidly. This means that PL sales in Willy's have grown fast.

Willy's has a significantly bigger market share online than offline (14% vs 25)

The German discounter does not offer e-commerce either, while Willy's has actively developed their e-commerce offering.

The value proposition of Willy's resonates both in-store and online. This has led Willy's to grow (maybe even more strongly) in the online channel. During the last few years, Axfood (especially Willy's) has been narrowing the lead of ICA, which was almost 50% of the market. The majority of Willy's online orders are Click & Collect.

“80% or so of e-commerce is click-and-collect.”

”if you (customer) start to do e-commerce, you will not stop completely with going to physical store, you will do less, but you will not stop going to the store, which is good because this means that we can, so to say, steal customers, and we can make our customers more profitable for us. So which means that e-commerce has been very important for us”

Is the change permanent, or will we revert to "normal"?

The big question is whether this strong growth of the discounters is a more permanent shift or just momentary during the inflationary times. Willy's seems to think that it will continue. One of their arguments is that "Value for money" would have overtaken "Location" as the most important selection criteria for a grocery store.

This might be true, but it would be a significant change in the grocery retail dynamics as the location has ruled the grocery market dynamics for decades.

On the other hand, the UK market saw a permanent shift towards discounting after the financial crisis 2008. Since then, the market share of Aldi and Lidl has continued to grow at a rapid pace.

Some other material

Loyalty and preference fuelling the growth

"new members they become loyal quickly, quicker than what we would used to do with the new customers because we like our old habits, we try something out and usually successively depending on how much you like the supplier, you build loyalty." Thomas Evertsson, Managing Director of Willy's